The TSX ticker is shown in Toronto on May 10, 2013. THE CANADIAN PRESS/Frank GunnFrank Gunn/The Canadian Press

The S&P/TSX Composite was flat for the trading week ending with Thursday’s close – lower by less than 0.04 per cent. The benchmark stands 2.7 per cent lower for 2018.

In terms of technical analysis, the index’s Relative Strength Index (RSI) of 58.9 leaves it much close to the overbought sell signal of 70 than the oversold RSI buy signal of 30.

There are only two officially oversold, technically attractive index constituents this week in Cineplex Inc. and Chorus Aviation Inc.

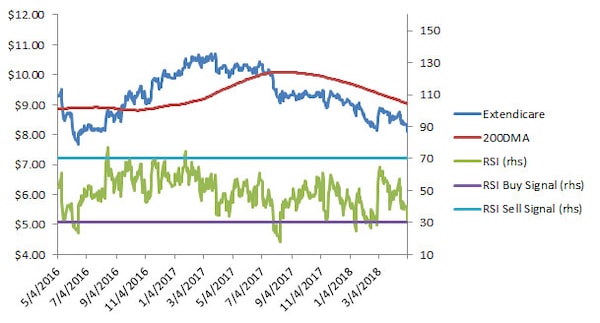

I picked senior care provider Extendicare Inc. as the focus chart even though, with an RSI of 30.6, it’s not quite below the buy signal of 30. The stock has been trading in a narrow-ish band between $7.00 and $10.50 over the past two years.

RSI buy signals have a mixed-to-mediocre record in uncovering profitable buying opportunities for Extendicare. A buy signal in June 2016 worked extremely well as the stock rallied almost 40 per cent to March 2017. Another buy signal in August 2017 marked a slowdown in selling pressure but the price refused to rally.

In November of 2017, the stock did respond to a buy signal but only very briefly before resuming its path lower. A January 2018 buy signal was followed by a similar non-result. At the end of February, a buy signal was followed by a significant rally but the price is now re-testing the recent lows.

The next few trading sessions will be interesting even if past history makes the RSI buy signal unreliable. If the re-test of the end of February low of $8.12 doesn’t end up with price going below that level, there could be a short-term bounce in store.

As always, investors should complete fundamental research before making any market transactions.

There are eight overbought, technically vulnerable index stocks according to RSI this week. Baxtex Energy Corp. is the most overbought stock in the S&P/TSX Composite, followed by Mitel Networks Corp, Celestica inc., Parex Resources Inc., MEG Energy Corp., Parkland Fuel Corp. and Kelt Exploration Ltd.

Scott Barlow

Scott Barlow