Adobe Systems Inc(ADBE-Q)NASDAQ

Q4 Earnings Outperformers: Adobe (NASDAQ:ADBE) And The Rest Of The Design Software Stocks

The end of the earnings season is always a good time to take a step back and see who shined (and who not so much). Let’s take a look at how design software stocks fared in Q4, starting with Adobe (NASDAQ:ADBE).

The demand for rich, interactive 2D, 3D, VR and AR experiences is growing, and while the ubiquitous metaverse might still be more of a buzzword than a real thing, what is real is the demand for the tools to create these experiences, whether they are games, 3D tours or interactive movies.

The 8 design software stocks we track reported a mixed Q4; on average, revenues beat analyst consensus estimates by 1.9%. while next quarter's revenue guidance was 5.8% below consensus. Stocks--especially those trading at higher multiples--had a strong end of 2023, but 2024 has seen periods of volatility. Mixed signals about inflation have led to uncertainty around rate cuts, and design software stocks have had a rough stretch, with share prices down 5.5% on average since the previous earnings results.

Adobe (NASDAQ:ADBE)

One of the most well-known Silicon Valley software companies around, Adobe (NASDAQ:ADBE) is a leading provider of software as service in the digital design and document management space.

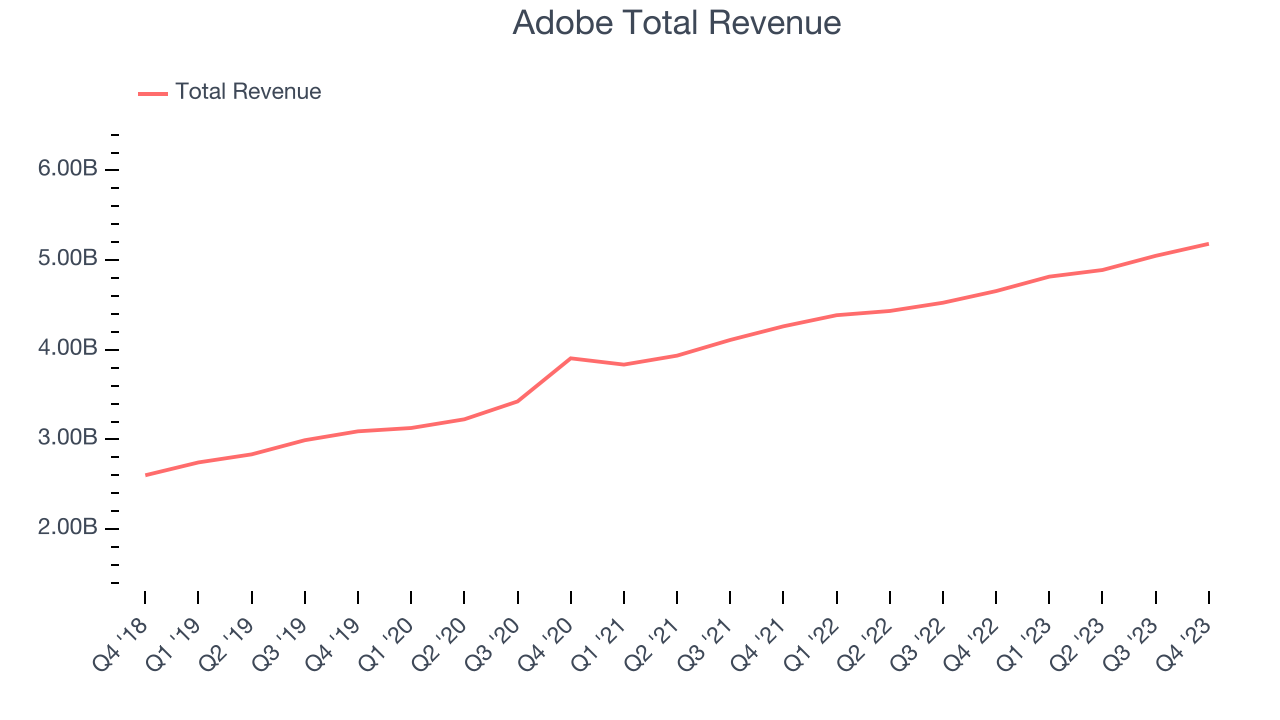

Adobe reported revenues of $5.18 billion, up 11.3% year on year, in line with analyst expectations. It was a mixed quarter for the company, with billings exceeding analysts' expectations. Its net new digital media ARR of $432 million beat estimates of $415 million, enabling the company to top Wall Street's revenue and EPS projections. On the other hand, its revenue guidance for next quarter missed analysts' expectations as its net new digital media ARR guidance of $440 million fell short of analysts' $468 million forecast.

“Adobe drove record Q1 revenue demonstrating strong momentum across Creative Cloud, Document Cloud and Experience Cloud,” said Shantanu Narayen, chair and CEO, Adobe.

The stock is down 15.1% since the results and currently trades at $485.51.

Is now the time to buy Adobe? Access our full analysis of the earnings results here, it's free.

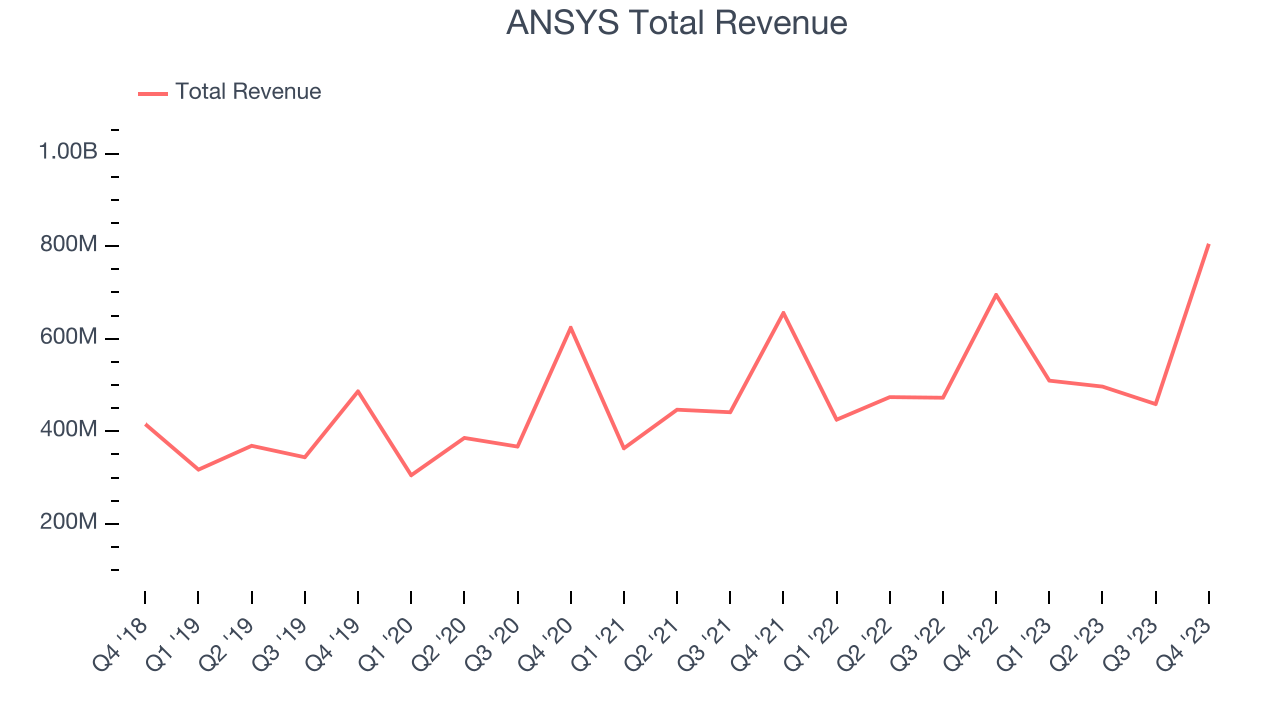

Best Q4: ANSYS (NASDAQ:ANSS)

Used to help design the Mars Rover, Ansys (NASDAQ:ANSS) offers a software-as-a-service platform that enables simulation for engineering and design.

ANSYS reported revenues of $805.1 million, up 15.9% year on year, outperforming analyst expectations by 1.2%. It was a very strong quarter for the company, with revenue and EPS exceeding analysts' estimates.

The stock is up 1% since the results and currently trades at $332.01.

Is now the time to buy ANSYS? Access our full analysis of the earnings results here, it's free.

Unity (NYSE:U)

Started as a game studio by three friends in a Copenhagen apartment, Unity (NYSE:U) is a software as a service platform that makes it easier to develop and monetize new games and other visual digital experiences.

Unity reported revenues of $609.3 million, up 35.1% year on year, exceeding analyst expectations by 4.1%. It was a weak quarter for the company, with full-year revenue guidance missing analysts' expectations and management forecasting growth to slow.

Unity delivered the fastest revenue growth but had the weakest full-year guidance update in the group. The stock is up 2.5% since the results and currently trades at $25.87.

Read our full analysis of Unity's results here.

PTC (NASDAQ:PTC)

Used to design the Airbus A380 and Boeing 787 Dreamliner commercial airplanes, PTC’s (NASDAQ:PTC) software-as-service platform helps engineers and designers create and test products before manufacturing.

PTC reported revenues of $550.2 million, up 18.1% year on year, surpassing analyst expectations by 2.3%. It was a decent quarter for the company, with a solid beat of analysts' ARR (annual recurring revenue) estimates but full-year revenue guidance missing analysts' expectations.

The stock is up 0.5% since the results and currently trades at $181.56.

Read our full, actionable report on PTC here, it's free.

Procore Technologies (NYSE:PCOR)

Used to manage the multi-year expansion of the Panama Canal that began in 2007, Procore Technologies (NYSE:PCOR) offers a software-as-service project, finance and quality management platform for the construction industry.

Procore Technologies reported revenues of $260 million, up 28.7% year on year, surpassing analyst expectations by 4.7%. It was a strong quarter for the company, with revenue and EPS exceeding expectations.

Procore Technologies achieved the biggest analyst estimates beat and highest full-year guidance raise among its peers. The company added 300 customers to reach a total of 16,367. The stock is up 1.3% since the results and currently trades at $75.52.

Read our full, actionable report on Procore Technologies here, it's free.

Join Paid Stock Investor Research

Help us make StockStory more helpful to investors like yourself. Join our paid user research session and receive a $50 Amazon gift card for your opinions. Sign up here.