Darden Restaurants(DRI-N)NYSE

Why This Activist Investor Has Honed In On Outback Steakhouse

Back in late 2013, activist investor Starboard Value had disclosed a significant equity stake in restaurant company, Darden Restaurants (NYSE: DRI). After a heated proxy fight, the activist ended up gaining complete control of Darden’s board. As a result of the change in leadership, Darden would go on to revamp its operations and increase profitability, driving share prices up by nearly 166% over the following 5 years.

One decade later, and now Starboard appears poised to revive its old playbook. This time, the target is Bloomin’ Brands (NASDAQ: BLMN), the restaurant holding company behind chains like Outback Steakhouse and Flemings. The activist fund led by Jeffrey Smith has recently built up a 9.9% stake in Bloomin’, although it has yet to announce its plan for the business.

So why has Starboard taken a stake in Bloomin’ at this time? What’s going wrong at the company and what might be the activist’s plan to turn things around? Finally, we’ll examine the path forward and how the company might respond to these developments.

Company Background

Bloomin’ Brands was founded in 1988 with the first Outback Steakhouse opening in Tampa, Florida. Over the years, the company has added additional restaurant chains to its portfolio and expanded internationally. Bloomin’s core theme is around casual dining, providing guests with a laid-back, family-friendly, and affordable experience. The company now has a presence in 13 countries with over 1,450 restaurant locations.

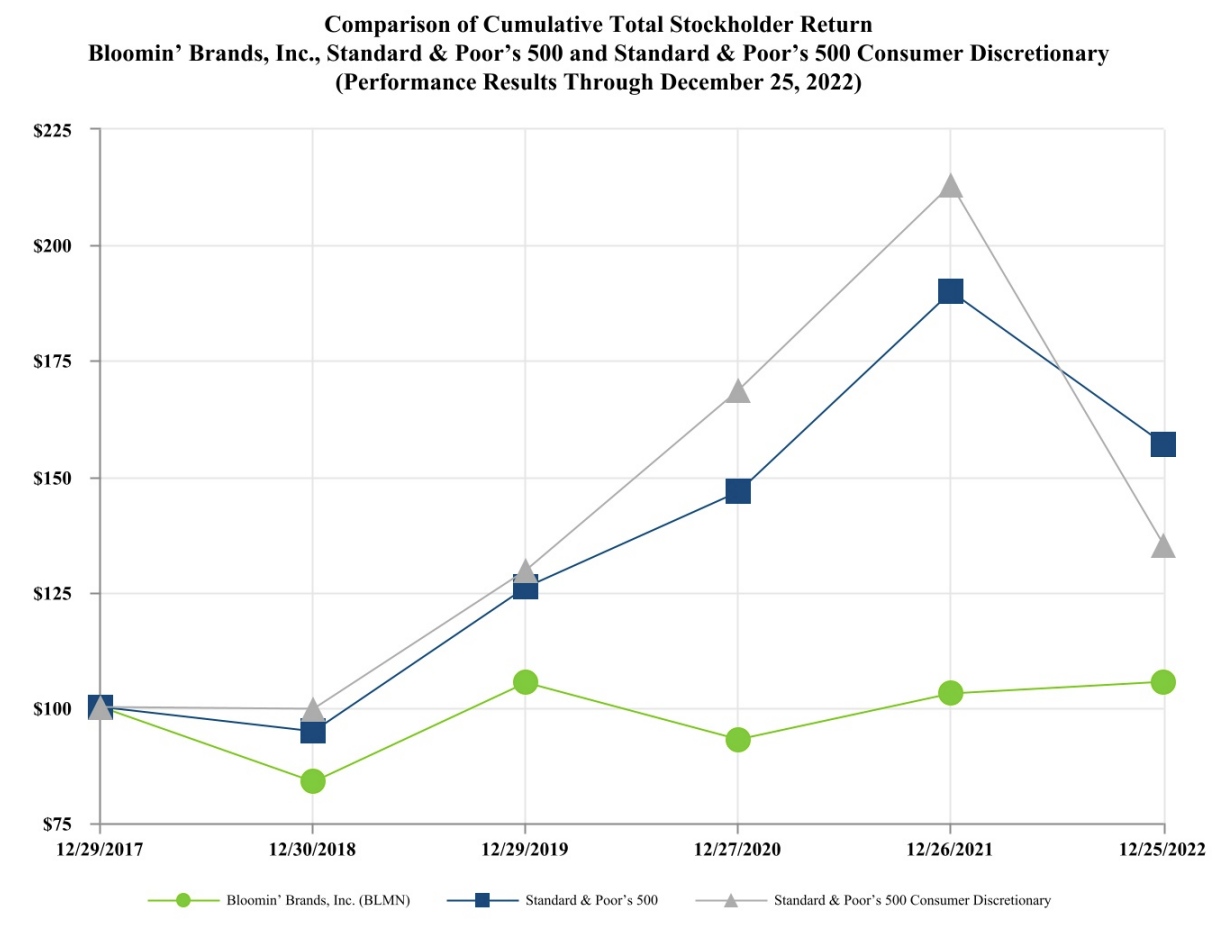

While Bloomin’ has continued to expand its operations and storefronts, share prices have generally remained stagnant.

Over the past 10 years, Bloomin’s shares have hardly appreciated, rising from $23.61 in September 2013 to just $27.15 today (September 2023), making for an average annual return of 1.4%. In fact, the stock is currently underwater relative to its peak in April 2021 during the COVID-19 pandemic.

What Is The Opportunity?

Activist investors typically unlock value in one of four ways: operations, governance, strategy, or financing.

In the Darden case, the activist’s proposal involved a few key priorities:

- Specific operational improvements around inventory management, facility maintenance, the dining experience, marketing efforts, etc.

- Developing a franchising program to accelerate growth and improve ROIC

- Freeing up additional capital by offloading Darden’s real estate assets through a spin-off

- Electing directors to the board who would execute these changes

Not all of these changes ended up being implemented once Starboard gained control, and new ideas emerged as well. Jeffrey Smith (the founder of Starboard) had himself and all the new directors work in a restaurant to understand the current experience first-hand. Famously, one of Starboard’s key issues in this campaign was that Olive Garden (a Darden subsidiary) had stopped salting the water in which it boils pasta.

In the current case with Bloomin, Starboard may seek to replicate its previous success in the restaurant business at Darden. According to a recent video by CNBC, Outback Steakhouse experienced minimal growth in its U.S. business, with same-store sales increasing just 0.5% over the past year.

According to the company’s latest 10K filing, combined traffic across the U.S. was down 5.3% over the past year.

Bloomin has also underperformed relative to peers. Over the past 5 years, share prices have significantly lagged behind the S&P 500 Consumer Discretionary Index.

The Path Forward

Bloomin’ recently declassified its board of directors, which means that all nominees will now serve one-year terms subject to annual elections. At the company’s 2023 AGM, shareholder turnout was a whopping 91.7%. The directors who were re-elected at the meeting garnered fairly strong support from shareholders, although three candidates each had over 1 million shares vote against their re-election (out of a total 80 million shares outstanding).

Another activist fund, JANA Partners, had previously settled with Bloomin' and appointed two directors to the board in 2020. The presence of directors already appointed from another activist may present challenges for Starboard. Even with the entire board subject to a vote at the 2024 AGM, Starboard may have a hard time successfully pushing through its own candidates. Rather than immediately propose a settlement, the company's board would likely court other shareholders in response to an announcement by Starboard.

For this reason, it appears somewhat unlikely that Starboard will go the distance via a proxy contest for seats on the board. However if the situation does indeed escalate further, Starboard’s key advantage is that it is a major shareholder, holding just under 10% of the company’s stock. Not only will Starboard be able to leverage its existing ownership to vote in favor for its nominees, but it may also acquire voting rights from other shareholders to ensure success.

In the coming months, we may expect to see Starboard publish a white paper on the situation at Bloomin’ Brands. This action may be accompanied by talks with current leadership and potential board nominees, as the activist formulates its plan to revitalize the company. The record date for this year’s AGM was February 24, 2023, so any additional moves by Starboard will likely be made over the coming 2-3 months.

More Food & Beverage News from Barchart

- Red Corn Trade through Midday

- 2c Gains for Midday Soybeans

- Wheat Dropping into Weekend

- Brazil Harvest Pressures Weigh on Coffee Prices

On the date of publication, Shareholder Vote Exchange did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

Provided Content: Content provided by Barchart. The Globe and Mail was not involved, and material was not reviewed prior to publication.