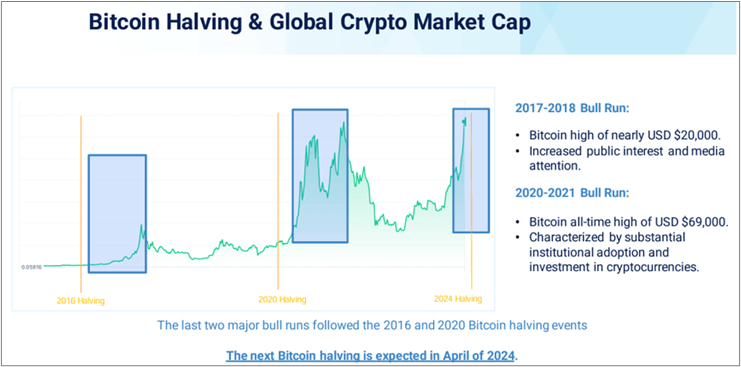

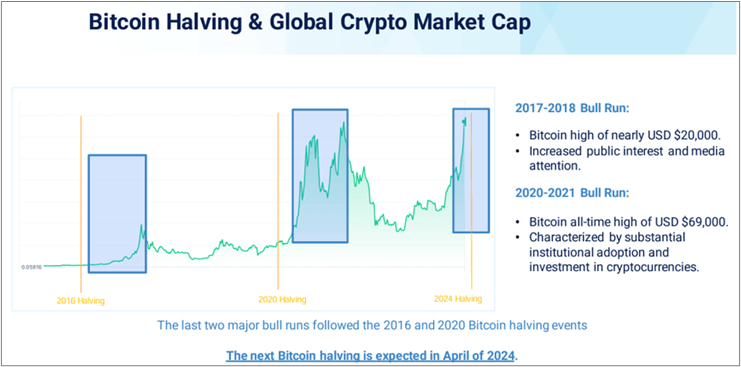

Every four years, a monumental event happens in the realm of cryptocurrencies, Bitcoin halves. But what exactly does this mean? In simple terms, Bitcoin miners who validate transactions on the Bitcoin blockchain will see their rewards cut in half, whereas if they used to get 6.25 Bitcoin for validating a transaction, they’ll get 3.125 Bitcoin. Now the rationale for these quadrennial halving events, which are written into Bitcoin’s original code, is to reduce the supply of Bitcoin entering circulation. The underlying basis is that it avoids inflation and keeps its value thanks to the invention of having the number of Bitcoins that will ever exist capped at 21 million.

A natural question to ask is: what are the investment implications of this Bitcoin halving event? This article will provide some insight into this market event and what impact it will have on Bitcoin ETFs.

The recent Bitcoin rally around the halving event is different

As has been well documented, Bitcoin has rallied significantly in recent months, attaining new highs. However, the rally that has recently occurred goes somewhat against historical precedence, as the halving event normally precedes the pricing increase. What has made this Bitcoin halving event distinctly different from previous occurrences is the launch of nearly a dozen spot Bitcoin exchange-traded funds in the U.S., with significant firms such as BlackRock, Fidelity, Franklin Templeton, VanEck, and WisdomTree being among the first offering access to bitcoin via an ETF.

How the current macroeconomic environment affects Bitcoin’s price

Another important consideration for this Bitcoin halving event is the macroeconomic environment. In previous instances, the interest rate environment was notably lower, whereas in the present, interest rates are elevated across major global economies. Specifically regarding the U.S., interest rates are above 5% and markets have recently priced out hopes of cuts this year in the light of sticky inflation and a resilient economy. As noted in a recent commentary from Goldman Sachs, today’s higher interest rate environment may make high-risk investments like crypto less attractive. Given the recent indication that the Federal Reserve may not be cutting rates in the near term, the anticipated liquidity that could have resulted from said news would have been a boon to all asset classes.