Genesco Inc(GCO-N)NYSE

Genesco (NYSE:GCO) Beats Q2 Sales Targets

Footwear, apparel, and accessories retailer Genesco (NYSE:GCO) reported Q2 FY2024 results topping analysts' expectations, with revenue down 2.3% year on year to $523 million. The company didn’t provide any forward revenue guidance. Turning to EPS, Genesco made a non-GAAP loss of $0.85 per share, down from its profit of $0.59 per share in the same quarter last year.

Is now the time to buy Genesco? Find out by accessing our full research report, it's free.

Genesco (GCO) Q2 FY2024 Highlights:

- Revenue: $523 million vs analyst estimates of $497.3 million (5.18% beat)

- EPS (non-GAAP): -$0.85 vs analyst estimates of -$1.23

- Gross Margin (GAAP): 47.7%, in line with the same quarter last year

- Same-Store Sales were down 2% year on year (beat vs. expectations of down 5.7% year on year)

- Store Locations: 1,375 at quarter end, decreasing by 37 over the last 12 months

Mimi E. Vaughn, Genesco’s Board Chair, President and Chief Executive Officer, said, “As we expected, the operating environment remained challenging in the second quarter. However, relative to earlier this year, we were encouraged to see some improvement in the trend within our Journeys business as the quarter progressed, leading us to deliver results ahead of our prior expectations. In the meantime, Schuh and Johnston & Murphy continue to outperform, each delivering another quarter of record sales despite the challenging backdrop, and we continued to make progress on our plans to close roughly 100 Journeys stores and reduce costs by $40 million. Moving forward, I remain confident that we are implementing the right strategic initiatives to weather the current environment, including specific actions to elevate and accelerate Journeys performance and evolve it for the longer term to drive value in an even stronger competitive position.”

Spanning a broad range of styles, brands, and prices, Genesco (NYSE:GCO) sells footwear, apparel, and accessories through multiple brands and banners.

Footwear sales–like their apparel counterparts–are driven by seasons, trends, and innovation more so than absolute need and similarly face the bigger-picture secular trend of e-commerce penetration. Footwear plays a part in societal belonging, personal expression, and occasion, and retailers selling shoes recognize this. They therefore aim to balance selection, competitive prices, and the latest trends to attract consumers. Unlike their apparel counterparts, footwear retailers most sell popular third-party brands (as opposed to their own exclusive brands), which could mean less exclusivity of product but more nimbleness to pivot to what’s hot.

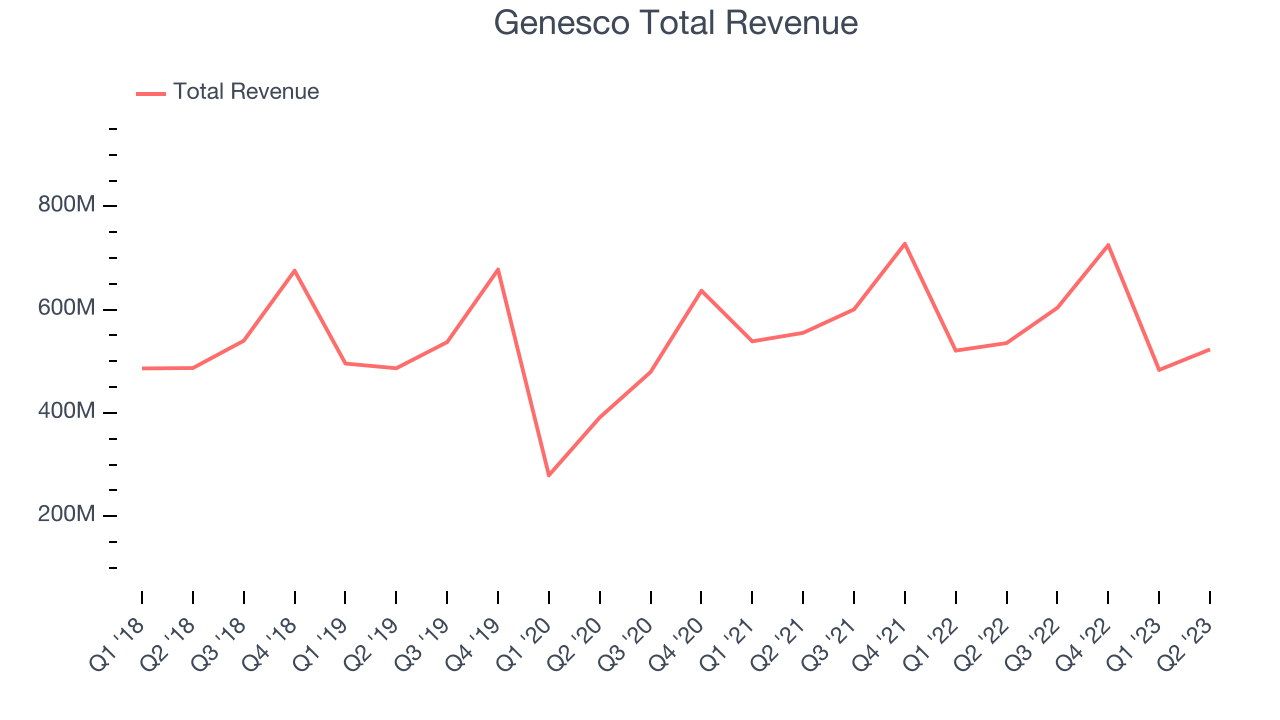

Sales Growth

Genesco is a small retailer, which sometimes brings disadvantages compared to larger competitors that benefit from economies of scale.

As you can see below, the company's annualized revenue growth rate of 1.53% over the last four years (we compare to 2019 to normalize for COVID-19 impacts) was weak as its store count dropped, signaling that growth was driven by more sales at existing, established stores.

This quarter, Genesco's revenue fell 2.3% year on year to $523 million but beat Wall Street's estimates by 5.18%. Looking ahead, Wall Street expects revenue to decline 1.74% over the next 12 months.

The pandemic fundamentally changed several consumer habits. There is a founder-led company that is massively benefiting from this shift. The business has grown astonishingly fast, with 40%+ free cash flow margins. Its fundamentals are undoubtedly best-in-class. Still, the total addressable market is so big that the company has room to grow many times in size. You can find it on our platform for free.

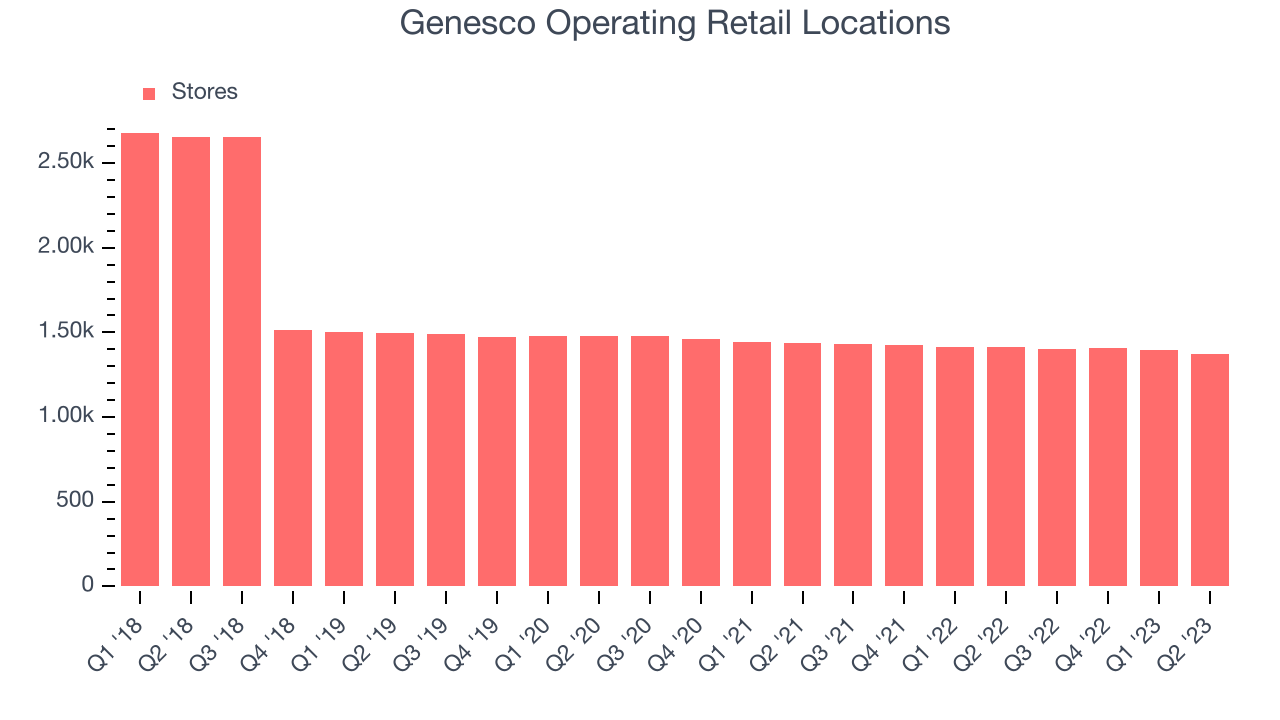

Number of Stores

A retailer's store count often determines on how much revenue it can generate.

When a retailer like Genesco is shuttering stores, it usually means that brick-and-mortar demand is less than supply, and the company is responding by closing underperforming locations and possibly shifting sales online. Since last year, Genesco's store count shrank by 37 locations, or 2.62%, to 1,375 total retail locations in the most recently reported quarter.

Taking a step back, the company has generally closed its stores over the last two years, averaging a 2.03% annual decline in its physical footprint. A smaller store base means that the company must rely on higher foot traffic and sales per customer at its remaining stores as well as e-commerce sales to fuel revenue growth.

Same-Store Sales

Same-store sales growth is an important metric that tracks demand for a retailer's established brick-and-mortar stores and e-commerce platform.

Genesco's demand within its existing stores has barely increased over the last eight quarters. On average, the company's same-store sales growth has been flat, or about 0.38% year on year.

In the latest quarter, Genesco's same-store sales fell 2% year on year. This performance was more or less in line with the same quarter last year.

Key Takeaways from Genesco's Q2 Results

Although Genesco, which has a market capitalization of $366.3 million, has been burning cash over the last 12 months, its more than $37.4 million in cash on hand gives it the flexibility to continue prioritizing growth over profitability.

Genesco beat on revenue and EPS. For the full year, the company increased its sales outlook while maintaining the EPS outlook. This is a welcome development as some retailers have been missing and/or lowering guidance. Management also made encouraging comments, saying "...relative to earlier this year, we were encouraged to see some improvement in the trend within our Journeys business as the quarter progressed, leading us to deliver results ahead of our prior expectations. In the meantime, Schuh and Johnston & Murphy continue to outperform, each delivering another quarter of record sales despite the challenging backdrop". The stock is up 2.88% after reporting and currently trades at $30 per share.

So should you invest in Genesco right now? When making that decision, it's important to consider its valuation, business qualities, as well as what has happened in the latest quarter. We cover that in our actionable full research report which you can read here, it's free.

One way to find opportunities in the market is to watch for generational shifts in the economy. Almost every company is slowly finding itself becoming a technology company and facing cybersecurity risks and as a result, the demand for cloud-native cybersecurity is skyrocketing. This company is leading a massive technological shift in the industry and with revenue growth of 50% year on year and best-in-class SaaS metrics it should definitely be on your radar.

The author has no position in any of the stocks mentioned in this report.