Microsoft (NASDAQ: MSFT) has become one of the most profound success stories in stock market history. Since its March 1986 initial public offering, the stock has risen nearly 4,500-fold.

That growth would not have occurred had the company not redefined itself over time. When Satya Nadella took over as CEO in 2014, its Windows-driven dominance had weakened amid the rise of the smartphone and competition from Apple on the PC side. So Nadella redefined Microsoft as a cloud company, ushering in a new era of prosperity and making it the company with Wall Street's largest market capitalization.

Here's how the company got there -- and where it could go from here.

Microsoft's growth in the Satya Nadella era

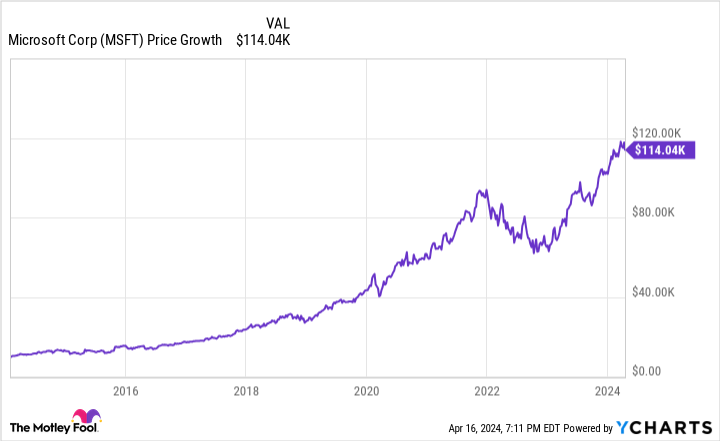

Nadella took the helm at Microsoft on Feb. 4, 2014. During his tenure, the stock rose dramatically, so much so that its market value now exceeds $3.1 trillion. That dethroned Apple, the longtime leader in this regard. This move rewarded shareholders handsomely, and a $10,000 investment made on Nadella's first day as CEO would now be worth about $114,000.

Microsoft before Nadella

Nadella joined Microsoft in 1992 and had most recently served as executive vice president of the cloud and enterprise group. In that role, he took the company into cloud infrastructure and services.

When he became CEO, he took over from longtime CEO Steve Ballmer, a confidant of co-founder Bill Gates. Microsoft stagnated under Ballmer's leadership. During that time, the release of the smartphone caught the company entirely off guard.

Consequently, a $10,000 investment made when Ballmer became CEO in 2000 would be worth just over $6,700 when he stepped down in 2014, leaving many investors pessimistic about the company.

Nadella's approach

Under Nadella, the paradigm shifted in a positive direction. He redefined Microsoft's lead business around the Azure cloud platform. He was enormously successful, and Azure eventually became the second most-popular cloud platform after Amazon Web Services, which pioneered this industry.

Image source: Statista.

That ranking in the cloud means the company plays a crucial role in supporting AI. It partnered with OpenAI, and thanks to improvements in ChatGPT, Microsoft's Bing search engine poses the first real challenge in decades for Alphabet's Google Search, which has long dominated that field.

This stands in contrast to Apple, which has not released a game-changing product in years and hasn't stood out in the cloud or AI despite its vast resources. Nadella has capitalized on the situation, allowing Microsoft to become one of the "Fab 4" companies, emerging as the largest and arguably most important tech giant.

Amid its successes, the stock is up almost 50% in the last year alone. However, that takes its price-to-earnings (P/E) ratio to 37, a level near five-year highs. While that does not necessarily derail the long-term growth story, it could discourage interest in the stock over the near term.

Where Microsoft goes from here

Despite the valuation, investor returns under Nadella's leadership likely are not finished. Thanks to his guidance, Microsoft is again a leading company among the largest tech stocks.

As the company leverages its cloud competitiveness and OpenAI partnership, long-term growth should continue even if the stock price is modestly ahead of fundamentals. Hence, those who invested in Nadella's leadership should probably continue to hold -- and possibly consider adding shares should the stock experience a bear market pullback.

Where to invest $1,000 right now

When our analyst team has a stock tip, it can pay to listen. After all, the newsletter they have run for two decades, Motley Fool Stock Advisor, has more than tripled the market.*

They just revealed what they believe are the 10 best stocks for investors to buy right now… and Microsoft made the list -- but there are 9 other stocks you may be overlooking.

*Stock Advisor returns as of April 15, 2024

Suzanne Frey, an executive at Alphabet, is a member of The Motley Fool’s board of directors. John Mackey, former CEO of Whole Foods Market, an Amazon subsidiary, is a member of The Motley Fool’s board of directors. Will Healy has no position in any of the stocks mentioned. The Motley Fool has positions in and recommends Alphabet, Amazon, Apple, Microsoft, Oracle, Salesforce, and Tencent. The Motley Fool recommends Alibaba Group and International Business Machines and recommends the following options: long January 2026 $395 calls on Microsoft and short January 2026 $405 calls on Microsoft. The Motley Fool has a disclosure policy.