Illustrations by Wenting Li

Welcome to the Newcomer’s Guide to Finances in Canada newsletter. My name is Erica Alini, and I’m a personal finance reporter at The Globe and Mail, Canada’s largest national newspaper. (Not subscribed to the newsletter yet? Click here to sign up.)

When I moved to Canada from Italy in 2010, I remember getting culture shock from my bank account statement. My Canadian bank was charging around $10 a month for simply having a chequing account. It didn’t remain my bank for long.

Opening up a bank account is one of the first things you’ll have to do upon arrival, and I’m here to tell you you’ve got options. So let’s get to it. Below you’ll find a starter guide to choosing a bank account, and why you should start right away to build up your credit score, which you’ll need to borrow and get a mortgage. And don’t miss the survive-and-thrive tip at the bottom (spoiler alert: I spilled bagged milk so you don’t have to).

In the upcoming newsletters I’ll tackle how to find a place to live; what to know about borrowing; the ins and outs of Canadian taxes and government benefits; and how to save and invest in Canada. For this newsletter course, The Globe has partnered with Savvy New Canadians, a popular personal finance platform for newcomers run by Enoch Omololu, a money expert and veterinarian who moved to Canada in 2011.

FIRST THINGS FIRST: GET A SOCIAL INSURANCE NUMBER

A social insurance number, or SIN, is a nine-digit identifier, you’ll usually need to open a bank account, as well as to work and receive government benefits in Canada. Keep your SIN safe and confidential.

Here’s how to apply for a SIN.

NOW, LET’S TALK ABOUT BANKING IN CANADA

One of the first things you’ll see when you land at the airport are ads from Canada’s largest banks. “Welcome to Canada! Come sign up for a bank account and credit card with us!” Don’t let those friendly posters distract you from what matters: Getting the best deal that suits your needs.

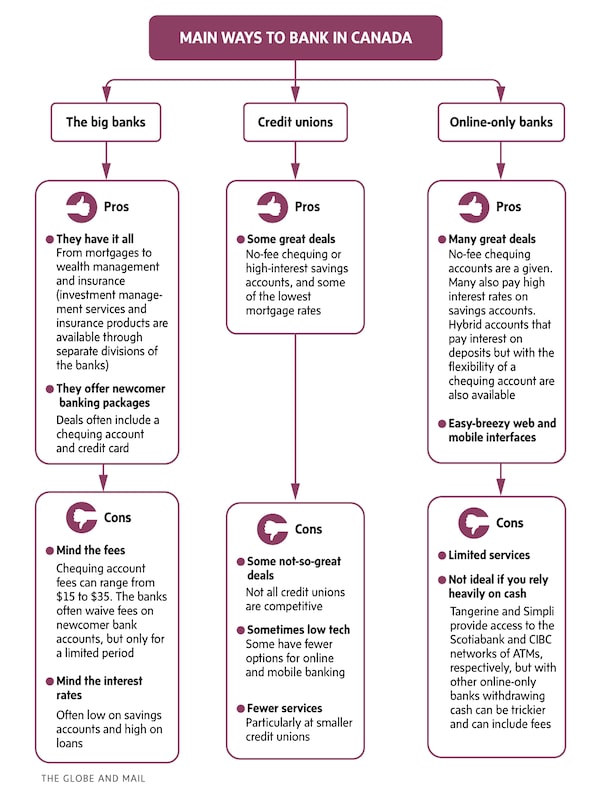

There are three main banking options:

- Traditional banks. Canada has five large banks known literally as “the Big Banks” or “the Big Five.” They are: Royal Bank of Canada (RBC); Toronto-Dominion Bank (TD); Bank of Nova Scotia (better known as Scotiabank); Bank of Montreal (BMO, pronounced BEE-mo); and Canadian Imperial Bank of Commerce (CIBC). Not in the Big Five, but still quite large, is National Bank of Canada. There are also a number of smaller banks.

- Credit unions or caisses populaires. They offer all the typical banking services but are run as financial co-operatives. When you open an account, you become a part-owner (known as “member”) and get to do things like vote for the board of directors. While the banks are regulated by the federal government, most credit unions – which are especially popular in Quebec and Western Canada – are provincially regulated. Some of the biggest ones include: Desjardins (a co-operative financial group), Vancity and Meridian Credit Union.

- Online-only banks. Just like the banks, but without physical branches. Their big selling point: because they save on overhead costs, they’re able to offer products like no-fee chequing accounts and higher interest on deposits. Two of them, Tangerine and Simplii Financial, are actually subsidiaries of big banks (Scotiabank and CIBC, respectively). Another popular one is EQ Bank.

Each of these options has its pros and cons:

The Globe and Mail/The Globe and Mail

Keep in mind: You don’t have to do all your business at the same institution. I use an online bank for daily banking, keep my short-term savings at another online bank as well as a credit union and get my auto and home insurance through a big-bank subsidiary.

Take note that banks rarely reward loyal customers with better interest rates, Mr. Omololu said. “I initially stuck with the first bank account I opened for all my banking needs until I needed a loan and asked around. My bank had the highest rate by far of the three financial institutions I received a quote from. The same thing happened when we took out a mortgage, and a credit union had a much better offer.”

Bonus tip: Overwhelmed by choice? You can use this tool to help you compare bank accounts based on the criteria that matter to you. For comparing financial products beyond bank accounts you can rely on websites like Ratehub.ca and Rates.ca.

HOW SAFE IS MY MONEY AT THE BANK?

Short answer: very safe. Bank deposits are backed by the Canada Deposit Insurance Corporation, and those at credit unions have provincial deposit insurance.

WHAT IS A CREDIT SCORE AND WHY DO I NEED ONE?

- A credit score is a three-digit number between 300 and 900 that helps lenders rate the likelihood that you’ll repay your debts. Scores in the mid-600s to low-700s are considered good, and the higher the better. A credit score affects whether a lender will give you credit, how much you’ll be able to borrow and at what cost. Landlords also increasingly ask for credit scores in rental applications.

- More than one score. Your score is based on information about your borrowing behaviour, which forms your credit report. Equifax and TransUnion are the two main credit bureaus in Canada, which compile credit reports based on information creditors send them about your debts and payments. They each then formulate a credit score using complex algorithms. Lenders may also have their own scores. Contrary to popular belief, there isn’t a single credit score.

- Unknown quantity. That’s what you are to lenders when you don’t have a borrowing history in Canada. That’s why it’s important to start using credit – for example, borrowing with a credit card –shortly after you arrive.

- To build a score from scratch, a credit card offered as part of a newcomer banking package is one way to go. Another is a secured credit card. Here’s more about the borrowing habits that lead to a good score.

Bonus tip: If you already have an American Express card you can easily apply for a new card in Canada. Amex will take into consideration your account history when assigning a credit limit to your Canadian card.

🍁 SURVIVE AND THRIVE TIP

Milk in parts of Canada (Ontario, for example) comes in plastic bags. Here’s the history of it. And here’s the correct serving technique (pouring the milk into the jug is not socially acceptable – I’m not joking).

I must emphasize: Don’t forget to tap the jug onto the kitchen counter a couple of times to make sure the bag sinks to the bottom. Then, and only then, may you cut a small corner off the bag. Forget to tap or cut too big a corner and disaster might ensue. Don’t say I didn’t warn you.

Dive deeper with Savvy New Canadians

Run by Enoch Omololu, a money expert and veterinarian who moved to Canada in 2011, the website Savvy New Canadians has become a destination for newcomers seeking personal finance information.

For more on banking, money transfers and credit cards:

10 Best Bank Accounts for Newcomers to Canada

16 Best Credit Cards for Newcomers to Canada

The best ways to transfer money internationally

How to transfer money within Canada

Keep going with Globe personal finance columnist Rob Carrick

Rob Carrick, the Globe’s personal finance columnist, has helped Canadians make sense of investing, the housing market, retirement planning and every money-related topic under the sun for more than 30 years. He is one of Canada’s best-known and most-trusted sources on anything that might affect your wallet.

You can read Rob’s latest articles here.

Sign up for Rob’s twice-weekly newsletter here.

Listen to Stress Test, the Globe’s personal finance podcast hosted by Rob and Globe personal finance editor Roma Luciw, here.

Are you a young Canadian with money on your mind? To set yourself up for success and steer clear of costly mistakes, listen to our award-winning Stress Test podcast.

Erica Alini

Erica Alini