After a series of disappointing assessments, Canada’s money laundering enforcement system is up once again in front of an international third party, with experts hinting that it may be Canada’s toughest review yet.

Every year, billions of criminal-fueled dollars are made difficult to trace as they get funneled through legitimate businesses, despite the fact that companies spend millions themselves to comply with Canadian regulations against money laundering and other illegal activities.

In its 2008 report on Canada, the Paris-based Financial Action Task Force (FATF) cited problems with the country’s anti-money laundering and anti-terrorist financing systems. While there had been a “reasonable number” of charges laid under Section 462.31 of Canada’s Criminal Code, which deals with proceeds of laundering money, it noted convictions were “very limited.”

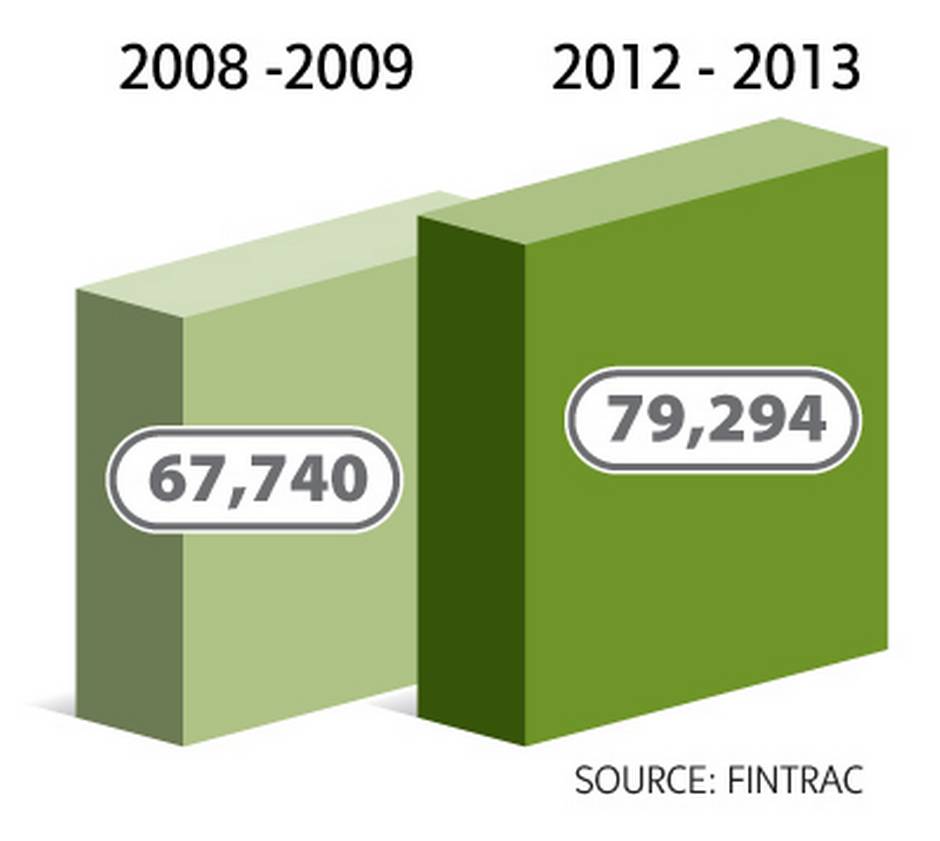

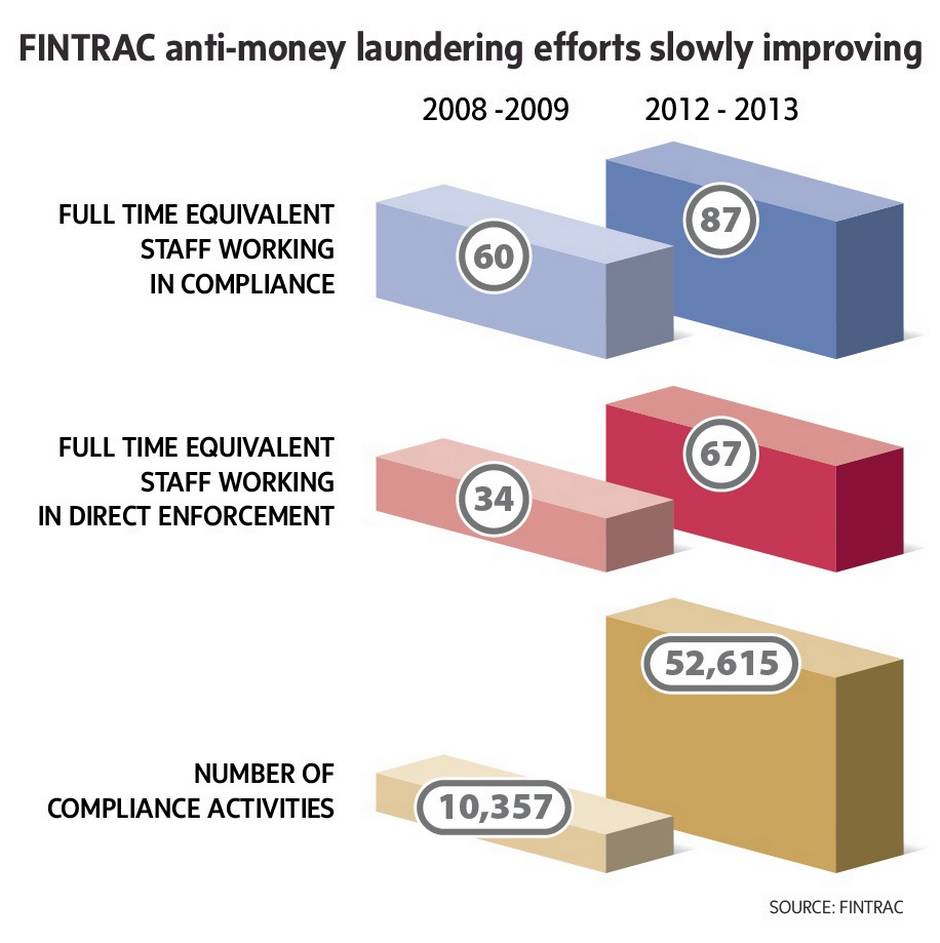

In a follow-up report published in February 2014, the FATF said Canada had made progress in some areas, including more staffing and resources at the Financial Transactions and Reports Analysis Centre of Canada (FINTRAC), Canada’s financial intelligence unit.

However, the report said its scope was too limited to draw final conclusions on FINTRAC’s ability to generate cases.

"A national anti-money laundering regime can be judged in part by the number of prosecutions and convictions it produces,” said Daniel Seleanu, a regulatory intelligence reporter and Canada commissioning editor for Thomson Reuters.

“In Canada, those numbers are very low, and it's not because money laundering doesn't happen here,” Seleanu said. “In fact, money laundering is a serious problem in Canada, due to the presence of significant organized criminal activity. This is especially true of drug trafficking, which generates enormous amounts of cash that must be laundered and introduced into the legitimate financial system.”

Experts say it’s difficult to pinpoint how much money is laundered each year in Canada, and estimates vary widely. In a 2009 report from Statistics Canada, the amount was estimated to be somewhere between $5 and $15 billion on an annual basis.

Canada’s latest review will also certainly face even tougher scrutiny, especially in light of remarks made by FATF vice president Je-Yoon Shin at the Thomson Reuters 2nd Annual Japanese Regulatory Summit in Tokyo.

“This new round of evaluations is by no means easy,” he said in his March 10 speech. “Indeed, the FATF has now strengthened significantly the assessment of effectiveness over and above the previous technical compliance assessment. Put it simply, it is not enough to pass laws and set up agencies and institutions – they also need to work effectively to get right results on the ground.”

Seleanu expects the FATF will acknowledge Canada’s legislative and bureaucratic reforms since 2008, but that he would be “very surprised if the FATF concludes that those reforms have significantly improved the actual effectiveness of Canada’s anti-money laundering framework.”

“It would not be the first time that an advanced jurisdiction received harsh FATF criticism for failing to translate on-paper reforms into real progress against money laundering,” he said. “It will be interesting to see what they say about the adequacy of financial, technical, and human resources available to FINTRAC and law enforcement agencies.”

In its latest annual report filed in November, FINTRAC shows an increase in efforts and results over the past five years. For example, it highlighted 1,143 disclosures in 2013-14, up from 919 the year before, of what it calls “actionable financial intelligence” provided to police and national security partners to assist in money laundering and terrorist financing investigations. Of those, 845 were related to money laundering, up from 719 the year before.

In a speech at the University of Calgary on March 5, FINTRAC director Gerald Cossette also said that more than 400 criminal charges related to money laundering had been laid in the past five years, with more than 140 convictions. He also said the RCMP had seized more than $80 million in suspected criminal assets.

According to FINTRAC, the “single most important factor” in deterring and detecting money laundering is whether reporting companies fulfil their compliance duties.

Some sectors and companies, such as financial services firms, casinos, securities dealers and dealers in precious metals and stones, are also required to report suspicious transactions to FINTRAC.

Matthew McGuire, national anti-money laundering practice leader at MNP, said many companies are willing to report to FINTRAC but would like to see more results from their time and resources.

According to McGuire, thousands of complex intelligence disclosures from FINTRAC are going to authorities that may not have the resources or training to deal with complex financial crimes.

“We’re talking about a fire hose being fed into a garden hose,” McGuire said. “The result is a handful of jail sentences and little money detained or forfeited. It is far easier to go after the predicate offence - the one that generated the money... but that only impacts one small and replaceable piece of a large and profitable network.”

He said resources should be put towards specialized prosecution and civil remedies “so that we can actually benefit from the billions we've spent on gathering data and disseminating intelligence.”

“Seldom do you find a business that doesn’t believe in the cause,” said McGuire. “They all want to do the right thing … The question still remains: What have we achieved?”

To read more about how Canada attempts to prevent the financing of crime in the country, click here.

Numbers are step one. Capitalize applies context to data – helping professionals leverage powerful information to make confident decisions. For more information, go to www.thomsonreuters.ca

Now experience Thomson Reuters Exchange. A new digital publication for fresh ideas and insights in a dynamic, interactive format. Download the free App from the App Store, Google Play and Amazon Appstore.

This content was produced by The Globe and Mail's advertising department, in consultation with Thomson Reuters. The Globe's editorial department was not involved in its creation.