Briefing highlights

- Outlook for the loonie (lame)

- Outlook for interest rates (pain)

- How NAFTA could change it all

- Markets at a glance

- Euro zone factory growth surges

- BP takes $1.5-billion U.S. tax change charge

- What to watch for this week

Expect a still-lame Canadian dollar whose fortunes may improve as 2018 rolls on, and higher interest rates that will no doubt cause pain for many.

But playing into both forecasts is the acrimony at the NAFTA bargaining table: Depending on how talks for a new North American free-trade agreement play out, the loonie could end up far weaker, and interest rates less painful, were the economy to take a hit.

"We remain of the view that the market is complacent in pricing in NAFTA termination risk," Bipan Rai, executive director of macro strategy at CIBC World Markets, and his colleague Jeremy Stretch, head of G10 foreign-exchange strategy, warned in a 2018 forecast.

- Part 1, Monday: Stocks: A risky mechanical bull

- Part 3, Wednesday: Housing, mortgages and banks

- Part 4, Thursday: Eroding wealth, frightful finances

- Part 5, Friday: The economy, oil and NAFTA

Of course, a full 10 years after the financial crisis, we're still in a low-rate environment, having suffered, too, through a crude price shock that devastated the oil patch.

The Bank of Canada is now on tenterhooks for other reasons, including the NAFTA uncertainty and the fact that we didn't let something like a crisis stand in the way of borrowing to the point of where many of us are now living under the threat of higher rates.

Currency analysts believe the value of the loonie would plunge if NAFTA dies. The Trump administration has oft threatened to kill it if the President doesn't get what he considers a fair deal, so forecasts for the Canadian dollar tend to come with a caveat.

Observers generally believe Canada, the U.S. and Mexico will strike a deal in the end. So for now, and absent the death of NAFTA, interest rates will factor heavily into the fortunes of the loonie, which has been bounced around on the outlooks for the Bank of Canada and Federal Reserve, its U.S. counterpart.

The dollar ended the year at 80.3 cents (U.S.). Amid the many forecasts for 2018, currency, here are six:

CIBC's Mr. Rai and Mr. Stretch project a loonie worth just over 78 cents through the first half of the year.

"The BoC has indicated a few times now that potential growth is expected to expand - which means that near-term growth won't be inflationary," they said.

"Still, the uptrend in the common core measure of inflation suggests that pressures are building, though the bank is likely to wait until Q4 data is released in early March. That should be enough to keep the loonie supported though an important caveat will rear its ugly head again in January - NAFTA negotiations."

Société Générale, in turn, is on the higher side, calling for a Canadian dollar that tops 83 cents through the year.

Bank of Montreal's longer-term outlook forecasts the currency at above or about 76.5 cents through the first three quarters of the year, pulling closer toward the 77-cent mark late in 2018 and actually hitting it in the second quarter of 2019, then picking up further.

Laurentian Bank Securities expects the trading range to shift to about 77 to 87 cents. But the "complete derailment" of NAFTA talks would drive it to between about 71.5 and 74 cents, said chief strategist Luc Vallée and senior economist Eric Corbeil.

Royal Bank of Canada sees a weaker loonie to start with, at just above 75 cents in the first quarter and just shy of 77 cents in the second.

After that, said RBC technical strategist George Davis, the currency should perk up to almost 79 cents in the third quarter and about 80.5 cents in the fourth.

"We continue to see topside risks for USD/CAD in Q1 2018 as the cautious tone that has emanated from the Bank of Canada since October is expected to remain in place," Mr. Davis said, using their symbols to refer to the U.S. dollar versus the loonie.

"New mortgage regulations that come into effect in the new year, as well, as another more contentious round of NAFTA renegotiations in January present upside risks to USD/CAD in Q1," he added, which in reverse, of course, means downside for the loonie.

"In addition, the BoC will want to evaluate the impact of their two recent rate hikes on the Canadian consumer - now carrying record levels of debt."

David Rosenberg, chief economist at Gluskin Sheff + Associates, also cited "increased odds" of a weaker currency, which, given the circumstances, could help buoy the economy and Canadian companies.

"Let's face it, the economy here is going to need another dose of some currency-related stimulus," Mr. Rosenberg said, citing the cocktail of NAFTA uncertainty, new mortgage rules and a "clouded fiscal picture" because of the outlook for taxation.

"In any event, the resultant weakening in the loonie is a positive underpinning for many of our sectors, and, again, that includes energy," he added.

"There are a host of other Canadian companies in our portfolio that have U.S.-dollar revenue streams in areas like real estate, banks, insurers and forest products, that are going to benefit from this renewed period of Canadian dollar weakness."

Of course, it is winter so a lame loonie's not going to help our snowbirds any.

Which brings us to what to actually expect from Bank of Canada Governor Stephen Poloz, senior deputy Carolyn Wilkins and their colleagues.

Bank of Canada senior deputy governor Carolyn Wilkins and Governor Stephen Poloz

Globe and Mail Update

The central bank raised rates twice in 2017 as Canada's economy improved markedly before slowing later in the year. As Mr. Davis noted, Mr. Poloz is gauging the impact, given the rise in borrowing costs being so painful to many stretched families.

They'll be even more stretched if, as expected, the Bank of Canada raises rates again this year, possibly up to three times to bring its benchmark overnight rate to 1.75 per cent from its current 1 per cent.

"Early 2018 brings a trio of factors - NAFTA renegotiations, new housing regulations and Ontario's minimum wage legislation - which could temporarily restrain the economy and keep the central bank on the sideline for a period," said Mark Chandler, head of Canadian rates strategy at RBC Dominion Securities, and rates strategist Simon Deeley.

"Ultimately, though, the re-normalization process should get back under way and, cumulatively, we see 75 basis points of rate increases in 2018."

The Bank of Canada's delay in this initially uncertain climate means the currency could be "under some pressure" early this year, Mr. Chandler and Mr. Deeley said, given that its lag, as the Fed tightens, would not be loonie-friendly.

But "some recovery is anticipated once the BoC begins to match the pace of Fed tightening with [West Texas intermediate] oil prices expected to average U.S. $58/barrel for the year."

Some observers don't think the Bank of Canada will move that forcefully.

"Even though we perceive the risks of an economic slowdown to be increasing, unless very unfavourable developments regarding NAFTA negotiations fail to be compensated by a lower CAD we don't expect a recession [in 2018]," said Laurentian's Mr. Vallée and Mr. Corbeil.

"We now see, at best, the Bank of Canada raising its policy rate once by 25 basis points in 2018, later during the year," they added.

"However, Canadian long-term rates will continue to face some upward pressures because of increasing long-term interest rates on the U.S. bond market."

David Rosenberg, chief economist at Gluskin Sheff + Associates, cited the latest weak reading on gross domestic product, which showed manufacturing activity notably soft.

Which, in turn, "makes you wonder why markets had seemed so convinced lately that the BoC would want to raise rates and have the Canadian dollar jump, which is exactly what we don't need at the present time," Mr. Rosenberg said.

"If the U.S. government is going to play hardball with Canada on trade, the only way we can combat the negative shocks from the blatant protectionism from the Trump team will be through the currency."

All bets are off if NAFTA dies. Were that to happen, analysts believe the central bank would roll back last year's rate hikes and possibly cut further.

And it's not just the death of NAFTA, but other possible scenarios, as well, that could change the outlook.

"We now judge the odds of an unfavourable outcome, either an abrogated NAFTA or a zombie NAFTA (with talks failing but abrogation held up, say, by legal actions), are better than even," said economists at Bank of Montreal.

"Reflecting the increased economic risk, we now judge there are net downside risks to our 2018 forecast (rate hikes in March, July and October)."

- Barrie McKenna: Bank of Canada stays cautious, keeps rates on hold

- Things that go slump in the night: What keeps the Bank of Canada governor awake

- Canadian dollar could plunge to 72.5¢ on NAFTA ‘crash-out’

- Get your loons in a row: ‘Investors should protect themselves against NAFTA termination risk’

- ’Buckle up’: It would take $100 oil to stop the Canadian dollar from skidding to 75¢

- Threat of Canadian financial crisis eases (but don’t take that to the bank)

- 2018 consumer math: 2% inflation + 1.4% pay raise = you’re screwed

Markets at a glance

Read more

How we closed out 2017: The week ahead

We're about to get our first look at how we closed out 2017 in some key areas, notably jobs.

It's a slow week to start with, at least where scheduled events are concerned, but we'll be back in the thick of it in no time.

Tuesday: Markets up and running

We kick off the trading week with some purchasing managers index (PMI) readings around the world as markets get back to business.

Wednesday: Fed questions

Investors get to see what Federal Reserve policy makers were thinking and saying when they raised their benchmark lending rate in December.

The minutes from that meeting of the Federal Open Market Committee, the U.S. central bank's policy-setting group, will be released in the afternoon.

"The minutes from the Dec. 12-13 FOMC meeting will be scoured for clues to Fed policy in 2018," Bank of Montreal deputy chief economist Michael Gregory and senior economist Sal Guatieri said in a lookahead to Wednesday.

"Specifically, we'll be looking for answers to three questions."

Question 1: Fed policy makers, in their individual projections at the December meeting, were looking for three rate hikes in 2018. But "with the economy now essentially at full employment and no longer sporting an output gap, is there a sense among FOMC participants that, unlike the other rate-hike years (2015-2017), the balance of risks now weigh on the side of more rate hikes, not less?"

Question 2: Those projections also included a stronger economic outlook and lower unemployment but little change in the inflation outlook. "Is the Fed betting that current secular disinflationary trends (owing to the likes of technology-enabled disruption and globalization) will continue to counter cyclical inflation pressures, and that tax cuts will spur more capacity growth?" said Mr. Gregory and Mr. Guatieri.

Question 3: The Fed dropped its reference to "the balance sheet normalization program." And, thus, "was this an overt attempt to downplay the on-auto-pilot program and a covert sign of Fed confidence in the conjecture that there's minuscule risk of collateral damage for financial markets from balance sheet shrinkage? We aren't so confident."

It gets interesting here because market players tend to scour these minutes for signs of what might come next.

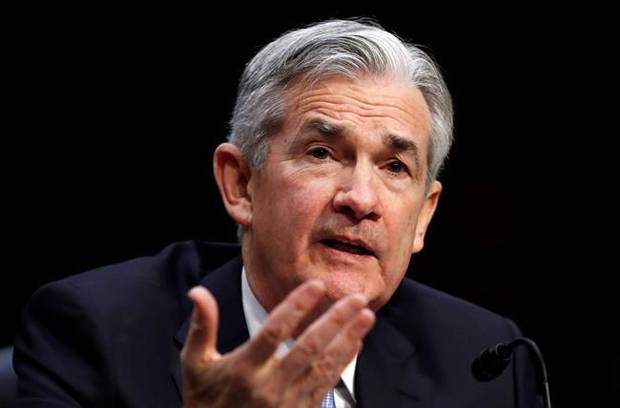

But up next is a new Fed, with U.S. President Donald Trump's choice for chairman, Jerome Powell, set to take over in February. Other fresh faces are also coming in.

New Fed chairman Jerome Powell

CAROLYN KASTER/THE ASSOCIATED PRESS

"If President Trump's Fed board nominee (Marvin Goodfriend) is confirmed soon, only four of nine members at the March, 2018, meeting will have also been a member in December, 2017," said Mr. Gregory and Mr. Guatieri.

"And, one of them, NY Fed president [William] Dudley, will depart mid-2018. Potentially, the Fed might sound and act much differently as 2018 unfolds."

Today also brings more PMIs, notably the widely watched ISM reading in the U.S., which economists generally expect to come in at about 58, the 50 mark being what separates contraction from expansion.

It stood at 58.2 in November, and "our expectation for the ISM is for it to move away from current extreme levels," said Andrew Grantham of CIBC World Markets.

"Even in the best expansionary periods historically, spikes close to and above the 60 mark have typically only lasted a few months," he added.

"Readings in the mid-50s are much more common. As such, even though our forecast for a drop to 57.1 is below the consensus, it would still be well in expansionary territory and consistent with solid growth in the sector."

Thursday: Jobs

There are a couple of less-important indicators, plus the ADP measure of the U.S. jobs market in December. Economists generally expect to see job creation of 190,000 positions.

There are also some quarterly earnings reports, from Monsanto Co. and Walgreens Boots Alliance Inc.

Friday: Jobs and trade

Here come the biggies: employment and trade reports in Canada and the U.S.

Employment has been on a roll, as measured by Statistics Canada's monthly labour force survey, so economists won't be surprised to see something slower than November's whopper of almost 80,000 job gains.

Keep in mind that these reports can be volatile, and often out of line with what economists expect. This time, some expect to see a gain in jobs, possibly up to 15,000 in December, while Toronto-Dominion Bank and IHS Markit project a loss of about 10,000.

The jobless rate is forecast to hold at 5.9 per cent or inch back up to 6 per cent.

The optimistic view, from CIBC's Nick Exarhos: "We're going to close out the year with relatively modest gains, but that won't change the fact that there's only one way to characterize [2017's] labour market: spectacular … We'll be particularly mindful of the mix of jobs, with full-time gaining recently. That's been part of the reason for a pickup in the average pay rate."

The not-so-optimistic view, from economists Arlene Kish and Chulwoo Hong at IHS: "There were outsized gains in a few industries in November (manufacturing, trade, education and construction) that helped lower the unemployment rate to a decade low. There has to be some payback given that anecdotal evidence were relaying job cuts related to changes within the retail sector."

The U.S. jobs report, in turn, is expected to show gains of 185,000 or more, with unemployment possibly dipping further to 4 per cent.

We'll get two trade reports at the same time.

Economists believe Canada's trade deficit narrowed marginally in November, to just below $1.5-billion.

"Trade bounced back strongly in October, with a gain in exports and drop in imports slashing the shortfall," said Benjamin Reitzes, BMO's Canadian rates and macro strategist.

"We look for a further modest improvement driven by higher oil prices," he added, citing "opposing forces" that included higher chemical exports but stronger imports for other reasons.

"The loonie's pullback from about two-year highs in September might have helped the trade balance, as well," Mr. Reitzes said.

"We'll be watching electronic and electrical equipment import volumes, which have a strong correlation with machinery and equipment investment, to see if the three-month slide continues. And, non-commodity export volumes are a key as usual, as they try to build on October's rebound from the lowest level since January, 2014."

Economists also generally expect to see a narrower trade gap of $47.7-billion (U.S.) south of the border.

More news

- Euro zone factory growth surges to record; more uneven in Asia

- BP takes $1.5-billion charge over U.S tax changes, joining Shell