Whither the loonie

Some currency watchers expect the Canadian dollar to tumble to well below 80 cents U.S., lending a helping hand to exporters but causing some issues for others.

It was hovering just below 80.5 cents today.

Recent forecasts may range, but they’re all below the 80-cent mark.

Royal Bank of Canada projects the loonie will tumble to just above 76 cents by the third quarter, from its year-to-date average of 81 cents.

Canadian Imperial Bank of Commerce forecasts a 79-cent currency by the end of this year, and Bank of Nova Scotia is close to that at about 79.5 cents.

Société Générale projects it will be somewhere between 77 cents and just below 78 cents any day now.

“The crude export trajectory is crucial as, over the medium term, the Canadian dollar is 93 per cent correlated with its terms of trade, which, in turn, is highly correlated with the price of WTI - the CAD is very much a dog on a leash,” Kevin Hebner, chief foreign exchange strategist at JPMorgan Chase & Co., said in a new report.

He was referring to the loonie by its symbol, and to West Texas Intermediate, the U.S. crude benchmark that he projects will end next year at $67 a barrel.

That, in turn, would be “consistent” with an 87-cent dollar, which is higher than some other forecasts, but it's also 18 months from now.

The loonie tumbled along with the crash in oil prices, a surprise January interest rate cut by the Bank of Canada, and a strong U.S. dollar. It has had its ups and downs that move with oil, interest rate expectations and the fortunes of the greenback.

A lower loonie should help exporters and those in the Canadian tourism business, just as examples.

Of course, it’s troublesome for Canadian travellers headed south, companies that don’t hedge and somehow have to plan amid the turmoil, and consumer who pay more via rising import prices.

Here are a handful of recent observations:

CIBC: “As the Canadian dollar trades at a discount for a longer period, and remains rangebound even as oil prices rally further, business leaders may see Canada as a more competitive location to increase capacity for the longer term.”

RBC: “We anticipate Canadian exporters to benefit from stable U.S. demand in the second half of 2015. The Canadian dollar is also likely to provide support with the currency forecasted to weaken against the U.S. dollar once the U.S. Federal Reserve raises the policy rate.”

Toronto-Dominion Bank: “The collapse in oil prices since mid-2014 and the surprise rate cut by the Bank of Canada has hastened its decline. However, the loonie has actually held up well over the past 12 months compared to many other global global currencies.”

What the next Greek cabinet meeting might look like

Stalemate

Anyone who didn’t see this coming shouldn’t be a gambler: Greece and its creditors are deadlocked a day before a key payment is due from Athens.

Prime Minister Alexis Tsipras, elected on an anti-austerity platform, returned late yesterday from a meeting with European officials with no deal in sight, having refused to meet the terms demanded by lenders.

“The Greece negotiations were held at the heads of state level, in order to speed up the process,” said Société Générale.

“Press reports suggest that an agreement may be found on the primary surplus targets. Yet, concerns remain that the discussions on the pension reform notably remains more problematic - given the stark opposition from within the Greek ruling party.”

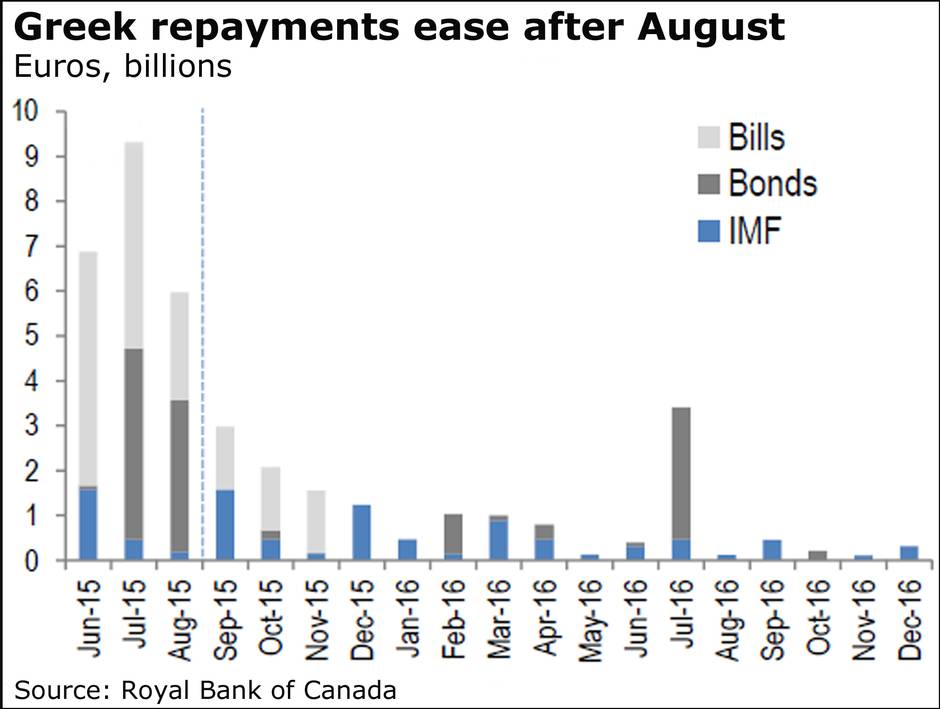

Mr. Tsipras did suggest, however, that tomorrow’s payment of €300-million to the International Monetary Fund wouldn’t be a problem.

“Greece’s day of reckoning is nearly upon us and traders can’t get out of the market fast enough,” said market analyst David Madden of IG in London.

“We are back to the bad old days of the euro zone debt crisis, when equity markets around Europe are selling off hard and fast. Only the brave stay long in the stock markets and it is difficult to keep your nerve when you are facing a sea of red trading screens.”

Phrase of the day

Goldilocks scenario

Not too hot, not too cold. As in, Capital Economics sees $60-$70 oil as “just right” for the global economy. (Greece has no Goldilocks, just bears.)

Wait, IMF says

The International Monetary Fund has substantially downgraded its U.S. economic growth forecasts and suggested the Federal Reserve should remain on hold with interest rates until the first half of 2016, even though it described the U.S. economy’s troubles so far this year as “temporary” setbacks.

The global financial agency forecast that U.S. gross domestic product growth would be 2.5 per cent in 2015, down from its previous estimate of 3.1 per cent. It trimmed its 2016 forecast to 3 per cent from 3.1 per cent, The Globe and Mail’s David Parkinson reports.

Quote of the week (so far)

“Like Toronto Maple Leafs fans, we are once again holding onto hopes that next year can only be better.”

Avery Shenfeld, CIBC, on the global economy

Bleak times

Canadian gas producers face grim prospects with lower-than-expected Asian demand, slower oil sands growth and increased competition in the U.S. market, the International Energy Agency said in a report today.

The Paris-based agency said Asia is not the Mecca for liquefied natural gas (LNG) that producers had hoped, The Globe and Mail’s Shawn McCarthy reports.

Deal brewing

Another big deal is said to be brewing in the U.S. media-telecom sector.

Dish Network Corp. is in discussions with T-Mobile US Inc. aimed at a merger, The Wall Street Journal reports.