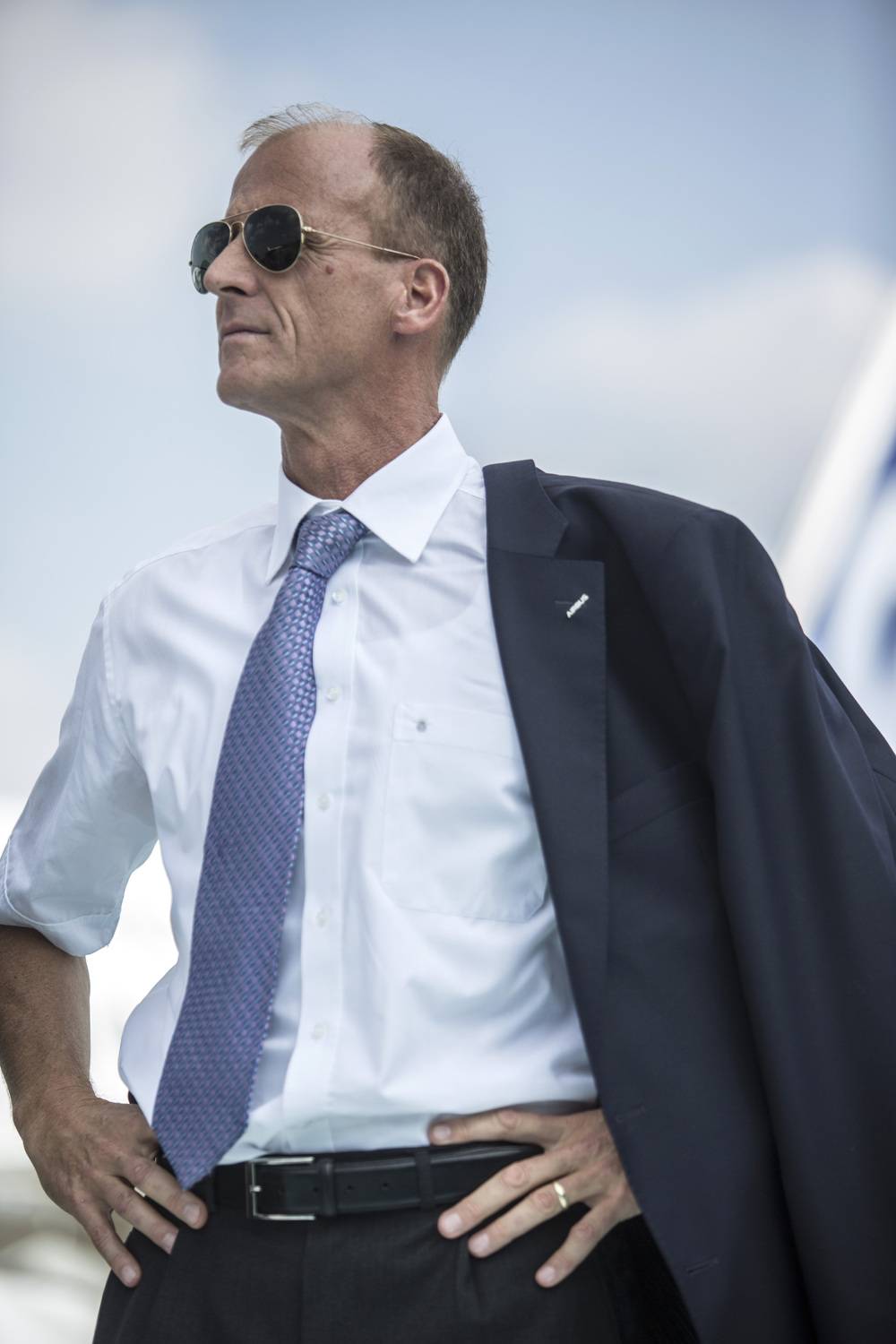

Tom Enders fixes a piercing stare and leans forward to explain what finally made him decide to agree to take control of Bombardier Inc.'s flagging C Series program.

The chief executive officer of Airbus SE had spent weeks last summer watching teams from Bombardier and Airbus try to hammer out a partnership deal, using the code name Selene, the Greek goddess of the moon, to keep everything secret. But as the discussions dragged on, Mr. Enders knew something had to be done. So he arranged to meet Bombardier CEO Alain Bellemare and a small group of senior executives at a law office in London during the last week of September. Over the next few days, and after a final face-to-face meeting in Munich, they reached an agreement that will see Airbus take majority control of the C Series and roll the $6-billion aircraft program into the French giant's global operation.

Two weeks later, the announcement sent shock waves through the aerospace world and left Canadian taxpayers wondering what they'd got for their $1-billion-plus investment in Bombardier. Why would Airbus take over an aircraft program the company's chief salesman mocked as doomed and that Mr. Enders once dismissed as too risky? For Mr. Enders the answer was simple: gut instinct.

"Always in life, human interaction is so important," he said in an interview at Airbus's offices in Munich this week. "It can convince you to make the last step and say, okay, now I'm really convinced. It can also work the other way around. And you say somehow my gut feeling says I don't trust these people."

With Mr. Bellemare, there was immediate trust and "no bullshitting, no trying to manoeuvre around each other."

Instincts and a strong sense of fearlessness have driven Mr. Enders in business and in life. After all, he's a former paratrooper who holds the rank of major in the German Army reserve. He flies military helicopters for fun. And he still skydives regularly at the age of 58 and likes to recite the skydivers' code: "Once you leave an airplane, you are dead – until you do something about it."

During a lunch of salmon, steak and Bavarian beer at Airbus's defence and space centre, Mr. Enders talks at length about his high hopes for the C Series and his dream of building a closer relationship with Canada. But he's also blunt about the challenges facing the aircraft and his expectations from the Canadian government in return for his company's rescue of the C Series and 12,500 direct and indirect jobs in Canada.

Mr. Enders doesn't mince words or put on airs. Dressed in blue jeans, a green sports jacket and a casual shirt, he arrives only slightly late and apologized for cancelling an earlier telephone interview. The blunt talk, plain wardrobe and polite manners stem from his no-nonsense upbringing in rural Germany as the son of a shepherd. He also craves action. Without the challenge of running a company with 134,000 employees, $100-billion in annual revenue and thousands of aircraft flying in and out of almost every country, he says he just might get restless. "I've never been good at being bored," he says solemnly. He's slow to engage but after 45 minutes or so he begins to unload, offering thoughts on Munich architecture, bemoaning London house prices and quoting the Rolling Stones. But there's one theme he keeps coming back to: the C Series and its new-found importance to Airbus.

This partnership "is good for Canada, it's good for us, it's good for America because we will create additional jobs, and it's very good for airlines," he says. The two C Series models, the CS100, which has 100 seats, and the CS300 with up to 160 seats, fill a hole in the Airbus lineup of single-aisle aircraft and give the company an unparalleled breadth of offerings from small regional jets to 500-seat superjumbos. It also opens new opportunities for Bombardier, as it taps into Airbus's global supply chain, and the Canadian government as it seeks to modernize the military.

And then comes the cautious pragmatism.

"But we have considerable hurdles that we have to take before we can really take off," Mr. Enders says. "And I have no doubt that the bad guys will throw at us whatever they can think."

The "bad guys" are Boeing Co., Airbus's perennial rival and a bogeyman for Bombardier. The Chicago-based plane maker has been locked in a bitter trade dispute with Bombardier, alleging its government assistance has been unfair and that the Montreal manufacturer is selling the C Series in the United States at "absurdly low" prices. For now, the U.S. Department of Commerce has agreed, proposing slapping 300-per-cent tariffs on C Series imports, effectively shutting the Bombardier plane out of its largest market. The Airbus deal could solve all of that in one fell swoop and Mr. Enders is ready to help.

His plan is to open a C Series assembly line at an Airbus plant in Mobile, Ala., thereby doing an end run around the tariffs by ensuring the plane is American-made. It's a risky proposition. There's no guarantee U.S. officials will buy the idea and Boeing isn't letting up, arguing the Alabama assembly line is a ruse. Airbus has also hurt its cause with recent revelations that the company provided inaccurate information to the U.S. State Department about its arms sales practices. The company is already under investigation in Europe over allegations it used intermediaries to pay bribes and the U.S. misstep could lead to another probe, and hand ammunition to Boeing.

"It's not pretty. It's not going to help," Mr. Enders says. "But it's a different issue."

He's counting on political allies in Alabama to make the company's case and he's banking on the "America first" attitude of U.S. President Donald Trump, who would be hard pressed to balk at job creation in a jurisdiction where he is still popular. "We're quite confident. Otherwise, we wouldn't have taken [the partnership]," he says. "But it's not like 95 per cent. I think that the probability is lower but we have a good chance to pull this off and we'll try hard."

Costs are another matter. Airbus has promised to keep Bombardier's C Series assembly facilities in Canada and protect jobs at its Northern Ireland location, where about 1,000 workers make wings for the aircraft. But cost overruns have already plagued the C Series program and adding another assembly line in Mobile, which could cost $300-million (U.S.), would add to the expense. Mr. Enders acknowledges that costs have to come down "considerably," although he won't put a figure on it. The real key, he says, is boosting sales.

"It's an easy calculation. We're quite confident that we can sell the C Series much better than Bombardier was able to do so far because we do it under Airbus with our global sales network, our global supply chain network. So, if we sell many more of these aircraft, obviously, that's good news for the jobs wherever they are."

Maybe, but will he guarantee jobs won't be lost?

"We're not in the business of guaranteeing each and every job. Obviously, sometimes you have also synergies and stuff like that but, [job cuts] aren't part of the plan," he says. "Part of the plan is to drive down the cost and to sell the C Series, hopefully by the thousands, and that will create a lot of value in Canada; that will keep the jobs in Northern Ireland."

He's less enthusiastic about the sales outlook for the C Series than Bombardier. The Canadian plane maker has predicted there will be sufficient demand for 6,000 similar-sized airplanes over the next 20 years, a figure some analysts say is too optimistic. Mr. Enders said his outlook is in the range of 4,000 to 6,000 planes, but he insisted that even 4,000 would be an enormous number and that there was no reason the C Series couldn't supply half the total.

This isn't the first time Airbus has considered taking on the C Series. There have been two other attempts, one in 2005 and the other in 2015. Mr. Enders wasn't involved the first time around, but as a senior manager at the company he knew discussions had taken place. By 2015, he was CEO and led the talks. He spent weeks poring over the C Series, but his gut wasn't convinced. The risks were too high. "Basically, the aircraft was not certified yet," he recalls. "So there was some uncertainty around the product and the further development."

He dropped the idea altogether and Airbus generally lost interest in the plane. So, when Mr. Bellemare came calling in early August, along with officials from the Canadian government, Mr. Enders was caught off guard. He didn't know at the time that Bombardier and Boeing had ended negotiations about a similar partnership as a way of resolving Boeing's trade complaint. And he didn't know that the Canadian government had steered Bombardier toward Airbus and away from a possible deal with Chinese plane makers. Nonetheless, the message from the Canadians to Mr. Enders was clear: Would you mind taking another look?

The CEOs shake on it: Bombardier’s Alain Bellemare, left, and Airbus’s Tom Enders visit the Bombardier plant in Mirabel, Que. in October.

Christinne Muschi/REUTERS

"We said yeah, okay, let's look into that, let's look at our files from the last discussion and let's see what's new." Times had changed. The C Series was now in commercial use, albeit on a limited basis, and it was winning rave reviews from pilots who loved the technology and passengers who loved the spacious interior. "It was two years more advanced and that convinced us that it would make a lot of sense for us," Mr. Enders says.

The final deal has been controversial. Airbus isn't paying any cash for the majority position while Bombardier will see its stake fall to 31 per cent while the Quebec government will drop to 19 per cent ownership from 49-per-cent, despite sinking $1-billion (Canadian) into the airplane. There's a buyout clause that lets either side prompt a sale to Airbus at "fair market value" in seven years, but to many Canadian observers this smacked of Airbus pulling a fast one and taking advantage of Bombardier's desperation. Mr. Enders demurs and says Bombardier and Quebec weren't desperate. They were realistic.

"I think Bombardier and the Quebec government made a very smart decision by betting and assuming, and I think rightly assuming, that this activity will be worth far more once we have been able to really sell these aircrafts by the hundreds or more than today," he says. "It's one thing to develop a great aircraft. The engineering power at Bombardier is amazing. The other thing is to sell it worldwide and to have sufficient leverage with all these suppliers. … I think it speaks very much about the realism of the top management at Bombardier and also the second shareholder, the government of Quebec, they realized that weakness and said we need to compensate for that."

He won't commit to buying out the others in seven years, saying it's too early for that kind of discussion. But he wants it known that Airbus sees this deal as just the start of a lasting relationship with Canada. And that includes the Canadian government.

Airbus has made Canada its fifth home country, ranking it alongside Airbus co-founders France, Germany, Spain and Britain.

For Mr. Enders, that designation carries real meaning and expectation. "You expect your home country to at least take a very fair view of your own industry, and if that industry's competitive with what it's offering for your needs, that you favour your industry. That is what home country is about," he says.

It's a not-too-subtle message to Canadian politicians that Airbus expects to be considered whenever the government thinks about buying airplanes, jet fighters, military transport planes or even satellites.

Already, Airbus is preparing plans to submit a proposal for its Typhoon fighter jet now that the Canadian government has signalled it won't buy fighters from Boeing as long as the trade dispute continues. "There is a broad array of topics where I think we can engage," he says. "I'm sure we can do more if the will on both sides is there, and on the Airbus side, clearly that is the case."

Canadian and Quebec politicians would do well to heed Mr. Enders. He's used to dealing with politicians and doesn't shy away from a fight. Lately, he's been the focus of rumours that French President Emmanuel Macron doesn't like him and wants him fired. When asked about the controversy, Mr. Enders gives a wry smile. "Look, I've seen enough crisis and battles in my career," he says rhyming off his 26 years in the business, including 17 at Airbus. A fight with the President of France? Bring it on.

Mr. Enders is the one who pushed to overhaul Airbus's corporate structure, transforming it from a state-founded entity and eliminating government interference in the operations, which included having two CEOs, one from France and one from Germany. He also moved the head office to France from Germany, incurring the wrath of local politicians, and he took on angry unions in Europe when Airbus dared to open an assembly line in China.

He finds the current rumours amusing and chalks it up to the emotional nature of the industry. "So that government X, Y, or Z likes me or dislikes me is one thing, but much more important is that I have the confidence of the board," he says. "I take it as a positive sign that governments are still interested in our well-being. But that's about it."

The bribery allegations do hurt and Mr. Enders has gone to great lengths to introduce sweeping changes at Airbus. He's launched an internal probe, brought in experts to train managers and made it clear that from the top down, ethical behaviour is mandatory. He also hopes to bring more diversity to the company, adding that, while most of Airbus's business is now in Asia, the company has no Asian managers or directors. It's also lacking women in senior roles and is failing to attract enough young people to replace the 55,000 staff who are expected to retire over the next five years. "If you have only white, middle-aged men who think more or less the same way, that's a much bigger risk than having a diverse set of people with different nationalities, different agendas, and different races looking at stuff from slightly different angles," he says.

The Bombardier deal is part of that effort and he sees Canadians helping add to Airbus's diversity.

With so much going on at Airbus, it's not hard to imagine that the C Series will get lost in the shuffle. Just this week, the company announced a massive $50-billion (U.S.) deal for 430 jets with Indigo Partners, a U.S.-based firm that has interests in four airlines.

Where Bombardier fits in is a concern shared by some analysts, who say cost challenges and the U.S. trade dispute could result in the C Series partnership failing. Mr. Enders disagrees.

"It will not be lost. The single-aisle business is our bread-and-butter business and the C Series will be an important part at the lower end of our single-aisle business in the future, if we make this deal happen," he says. "I'm keen to develop a broad relationship with Canada and with, possibly, Bombardier when it comes to aeronautics in the future. … We have products to offer, we have services to offer. Canada has a lot to offer in terms of a skilled work force, in terms of new technologies, in terms of aeronautics. That's clear and we'll see where this goes."

With that, he's up and out the door, striding briskly across a sidewalk in the maze of Airbus buildings in a Munich suburb. He smiles as the afternoon sun beats down. He is comfortable here, amid the military hardware and in a part of Germany he adores. He has lived in Munich with his wife and four sons for more than 20 years, embracing the winter sports scene and spending summer days hiking in the nearby mountains. As he walks he checks his watch and asks about the time of sunset. About 4:30 p.m., he's told. Just enough time to take a spin in a helicopter.

The CV: Tom Enders

Born: Dec. 21, 1958, in Neuschlade, Germany. He is the oldest of four children, whose father was a shepherd and mother a homemaker.

Education: Studied economics, history and politics at the University of Bonn and the University of California at Los Angeles. Completed a doctorate in political science at Bonn by the age of 28.

Career: During his 20s, Mr. Enders worked as an assistant in the German parliament and served as a research assistant at various think tanks. From 1989 to 1991, he was a member of the planning staff at the defence ministry. He joined DaimlerChrysler Aerospace in 1991 and when DASA teamed up with aerospace companies in France and Spain to form the European Aeronautic Defence and Space Company (EADS), he became head of the defence division. In 2005, he was named co-CEO with France's Noël Forgeard. In 2007, EADS scrapped the dual-CEO jobs and Mr. Enders became head of the Airbus division, leaving Frenchman Louis Gallois as the only CEO. In 2012, he took over as CEO and renamed the company Airbus.

Personal: Mr. Enders is married and has four sons. He lives in Munich but travels frequently to Airbus's head office in Toulouse, France. He enjoys skydiving and flying helicopters.

Interview outtakes

On his lack of interest in Bombardier before being approached about a partnership in August: "It was not an idea that I had getting up at some point in the morning saying, 'Gee, let me call Bombardier, maybe it's the right time to do a deal.'"

On whether he can cut the C Series' costs by between 30 and 40 per cent, as some have estimated: "I don't know. I don't recognize that number."

On whether Bombardier was desperate to do a deal: "Well, it didn't occur to me in the negotiations that they were desperate. I think, realistic."

On Bombardier's approach: "I think these guys had figured out before they approached us what would be feasible or attractive for us and what wouldn't. They knew us."

On Airbus's failure to sell any A380s to Emirates during the recent Dubai Airshow and watching the airline turn to Boeing instead: "What I think is you can't always get what you want. Remember the Rolling Stones? Look, this is a long-term industry. What you don't get today, maybe you get tomorrow."

On the importance of Emirates to the A380 program: "Emirates is the largest customer for the 380s [the airline has bought around half of all 380s made]. To put it in harsher terms, without Emirates the program would be dead in the water so obviously we have an interest in the long-term survival of the program."

On changing corporate culture to cope with bribery allegations: "It takes a while; it's a marathon. That's the frustrating piece. You would like to get it done as soon as possible. But it usually takes a few years until the proceedings come to a conclusion."

On why Airbus now loves the C Series after chief salesman John Leahy mocked it as a "nice little plane" last year: "Our sales people play these tricks occasionally. There's nothing surprising about that … He would probably today say it's a terrific little plane … So that is something one shouldn't take too serious, but that was largely marketing talk."