Jobless rate up

Canada’s economy churned out 12,000 new jobs in September, but it’s far from stellar news and is sure to be on the radar of the political parties as the election campaign enters its final days.

First, the unemployment rate inched up to 7.1 per cent as more people joined the work force, Statistics Canada said today.

That marks the highest since February of last year, The Globe and Mail's Rachelle Younglai reports. And, as BMO Nesbitt Burns pointed out, it’s the first time since 2009 that the jobless rate has topped the levels of a year earlier.

Note, too, that the net figure of 12,000 masks the fact that 62,000 full-time jobs were lost, eclipsed by the rise of 74,000 part-time positions.

Yet again, those hefty numbers have raised questions about the Statistics Canada survey.

“Probably the single truest measure in this report is the slow upward grind in the unemployment rate - with the economy only managing to grow about 1 per cent in real terms over the past year, it’s no shock that the jobless rate is nudging higher (sprinting higher, in the case of hard-hit Alberta,” said BMO chief economist Douglas Porter.

Alberta’s jobless rate, for the record, now stands at 6.5 per cent, up from 6 per cent in August.

Here’s what economists are saying today:

“Employers aren’t doing much employing these days, since paid jobs dropped this month and are up only 0.6 per cent from a year ago. That’s been offset by a 2.5-per-cent rise in ‘self-employment’ over that period, sometimes a sign of a job market that’s forcing people to hang up their own shingle.” Avery Shenfeld, Canadian Imperial Bank of Commerce

“Canada’s economy cranked out jobs for a third consecutive month in September following a six-month period of more volatile readings. That said, the increases record in the first half of the year solidly outpaced the declines, resulting in the average monthly job gain running close to 16,000 over that period. In the third quarter, job gains were more consistent but smaller, resulting in the average monthly increase slowing to 10,200.” Dawn Desjardins, Royal Bank of Canada

“Today’s employment numbers add more paint to the generally positive picture of the Canadian economy in the third quarter. The quarterly gains in hours worked are supportive of growth, which is currently tracking at about 2.5 per cent annualized for Q3.” Brian DePratto, Toronto-Dominion Bank

“While no doubt it is significantly weaker than the decent headline result would suggest, it’s also probably not as bad as the steep drop in full-time jobs would indicate. The plunge in education employment looks plain weird, and is likely to partly reverse next month.” BMO’s Mr. Porter

“This isn’t a disaster, but it’s not a stellar performance either. Going forward, we’ll need to see further gains in cyclical sectors such as manufacturing and construction to assuage concerns of an economic relapse.” Krishen Rangasamy, National Bank of Canada

Loonie surges

The Canadian dollar is well above the 77-cent mark today, driven higher by commodities and a fizzle in the greenback.

The loonie got to about 77.5 cents U.S., though eased somewhat after the Canadian jobs report.

“Employment data, baseball and the Thanksgiving long weekend” is how Shaun Osborne sees it.

“The CAD is at the upper end of the performance league this morning,” Bank of Nova Scotia’s chief foreign exchange strategist said, citing the rise in oil prices.

Resource-linked currencies are generally doing well as certain commodity price climb higher, said London Capital Group chief analyst Brenda Kelly.

But along with that is a dip in the U.S. dollar, pulled lower as investors bet against the possibility of a rate hike by the Federal Reserve this year.

Yesterday’s release of minutes from the last meeting of the Federal Open Market Committee, the U.S. central bank’s policy-making group, helped fuel that speculation.

“With the dollar basket posting a second week in decline, with additional downside likely bolstered by a less-than-hawkish FOMC, the reverse is taking place in the commodity complex,” Ms. Kelly said.

The loonie is now up almost 4 per cent from its Sept. 29 close of about 74.5 cents and, said chief economist Sal Guatieri of BMO Nesbitt Burns, the currency “could extend its winning streak if today’s jobs report surprises to the upside.”

Some analysts are betting on a continued short-term bump in the loonie, though they do see it tumbling again.

Corporate malaise

Canada’s first half economic slump is taking a toll on business confidence, particularly in the regions and industries affected by the oil price collapse, The Globe and Mail's Barrie McKenna reports.

“The outlook remains weak for firms in the energy sector and supply chain, as well as those exposed to slowing household spending and diminished confidence in the affected regions,” the Bank of Canada said in its latest quarterly business outlook survey, released today.

And that is affecting the mood of businesses right across the country, which “remains tepid overall,” the central bank said.

Mixed outlook

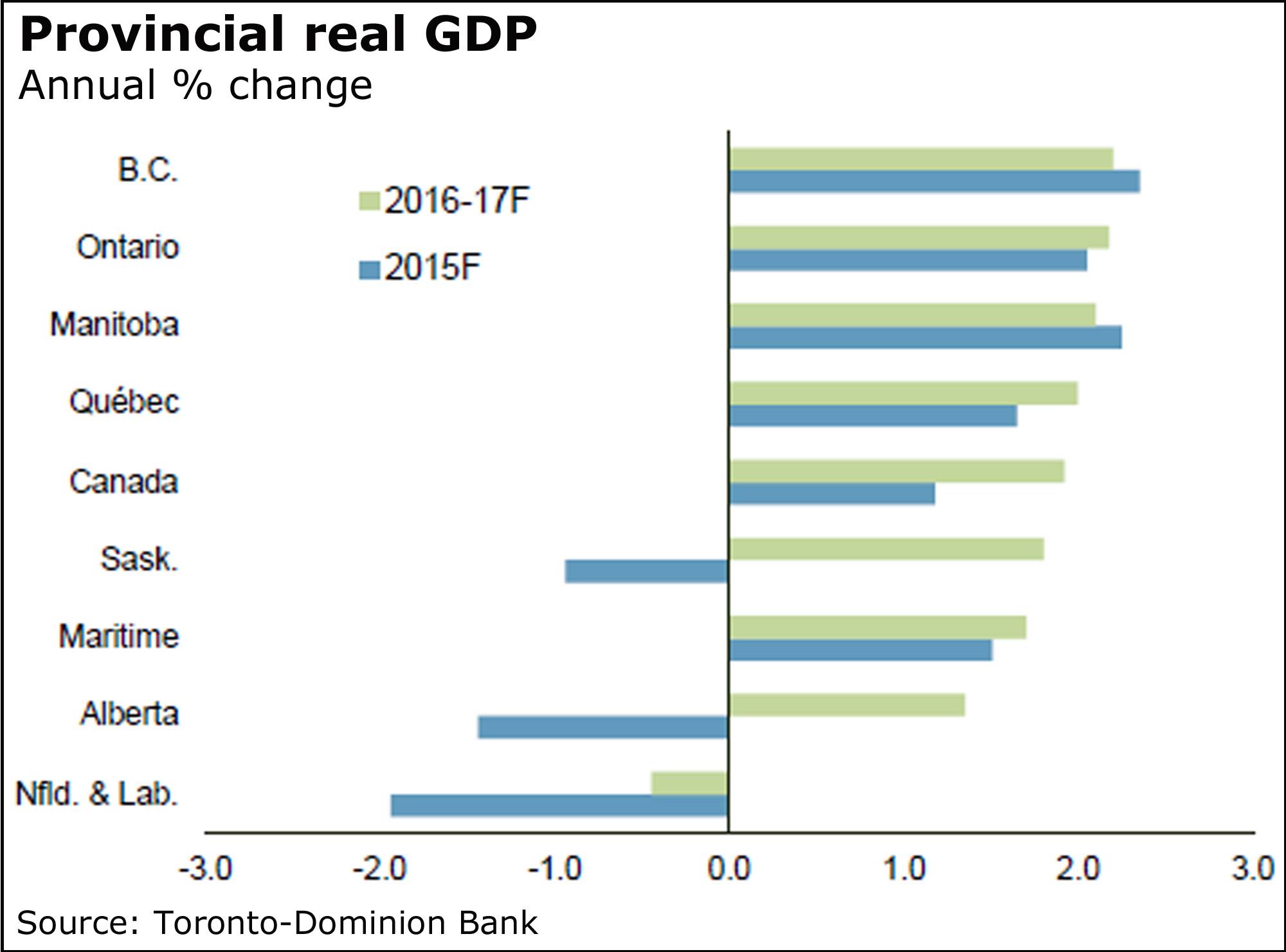

Toronto-Dominion Bank is painting a bleak picture of Canada’s oil-dependent provinces, and a “respectable” but not stellar showing for the rest.

Alberta, Saskatchewan and Newfoundland and Labrador will all be in recession this year in the wake of the oil price collapse, TD economists said in a new forecast this week.

Alberta and Saskatchewan will rebound only modestly in 2016-17, while Newfoundland and Labrador is hit again next year before some stability sets in, said deputy chief economist Derek Burleton and economist Jonathan Bendiner.

“Looking ahead, the tough times are likely to endure in commodity markets and in provinces that rely on resource-driven activity,” they said.

“Elsewhere, the medium-term picture can be characterized as continued moderate and steady growth, led by British Columbia, Ontario and Manitoba,” they added.

The economies of the oil regions will collectively contract by 1.4 per cent, while the rest of the provinces see 2-per-cent growth, which “is not booming but respectable,” the economists said.