Briefing highlights

- Asian, European markets tumble

- New York poised for weaker open

- Loonie as low as 74.6 cents

- Will Ottawa ever balance its books?

- What to expect in Morneau budget

Stocks tumble

Trading screens around the world are screaming red as another rough-and-tumble morning takes shape.

Global markets are down so far after Tuesday’s rout, with Asian and European stocks all down and North America poised for a weaker open as the so-called Trump trade takes a big hit.

“A reverse in U.S. equity indices has proven contagious to all regions and all markets,” said Kit Juckes of Société Générale.

“Asian equities are down across the board, industrial metals prices, too, are weaker, while oil prices are trapped for now in a new lower range.”

Tokyo’s Nikkei shed 2.1 per cent, Hong Kong’s Hang Seng 1.1 per cent, and the Shanghai composite 0.5 per cent.

In Europe, London’s FTSE 100, Germany’s DAX and the Paris CAC 40 were down by between 0.4 and 0.8 per cent as North American markets were getting up and running, and easing, as well. The Canadian dollar tumbled to as low as 74.6 cents U.S.

“After the S&P 500 posted its biggest one-day fall since last October last year, the question being asked is whether the scales are starting to fall away from investors’ eyes as to whether President Trump will be able to deliver anything close to what has been priced into markets since his election last November,” said CMC Markets chief analyst Michael Hewson.

“Even the mistiest-eyed optimist appears to be coming to the realization that even on health care, where there is some form of consensus, that reforms are likely to take a lot longer than realized, and as such any other programs like tax and banking reform and infrastructure spending are likely to get pushed further out into the future.”

Oil prices will also be in focus with a fresh reading on inventories later in the day.

This could “provide another spike in volatility in this market, with another hefty boost to stockpiles expected, following hard on the heels of the [American Petroleum Institute] data yesterday,” said IG chief market analyst Chris Beauchamp.

“Without much else to drive markets, it will be interesting to see whether bargain hunters start to get active on Wall Street, or whether we are witnessing a pause before this slump turns into something bigger.”

Having said all this, European markets aren’t as bad as their lows, which means “there is clearly some appetite to move back in despite the atmosphere of caution that prevails,” Mr. Beauchamp added.

“Paradoxically, the very fact that the declines of the past 24 hours are already being talked about as a new long-term correction tends to reinforce the idea that we are just seeing a temporary blip.”

How markets ended Tuesday

Budget day

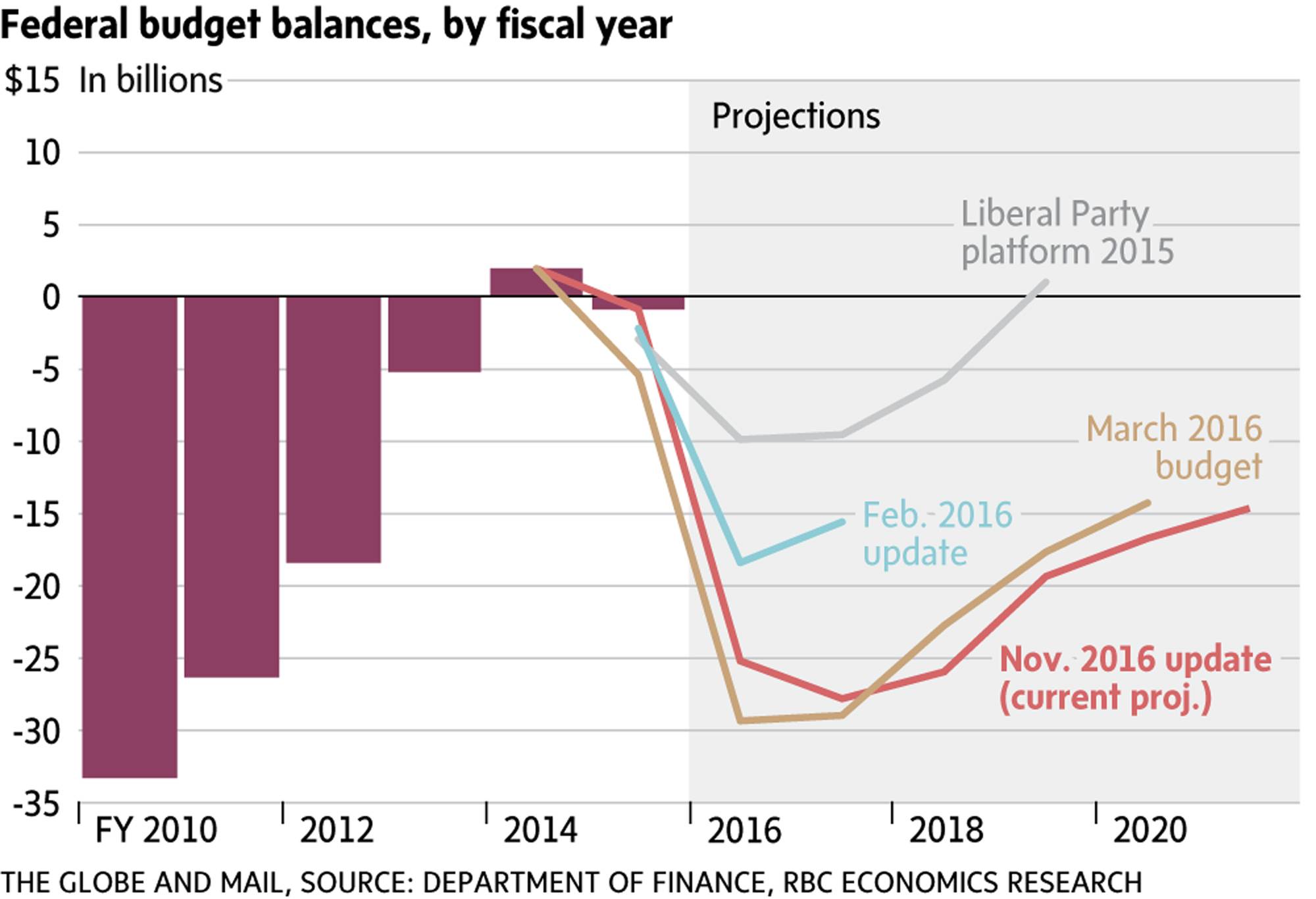

Some economists wonder whether the Trudeau government will ever balance its books.

So we can expect another string of deficits when Finance Minister Bill Morneau unveils his budget after markets close.

“The government campaigned on a pledge to run small deficits for a few years and then return to a balanced budget,” said Royal Bank of Canada chief economist Craig Wright and economist Laura Cooper.

“That plan evaporated soon after the election, as Ottawa greatly expanded its spending program.”

Mr. Morneau’s budget is expected to disclose deficits of $25-billion to $30-billion for the next couple of years, then a narrower $15-billion by the 2021-22 fiscal year, Mr. Wright and Ms. Cooper said.

“Those deficits would add $130-billion to the federal debt load,” they noted.

“While the federal debt-to-GDP ratio will remain low relative to other G7 countries, Canada compares less favourably to the handful of other triple-A-rated countries,” they added in a lookahead to the budget.

“Ottawa is basing its projections on the assumption that nominal interest rates will remain below nominal GDP growth. That bet will face longer odds as rates rise and the economic expansion ages.”

Bank of Nova Scotia went further, questioning whether Prime Minister Justin Trudeau’s Liberals could balance the budget by the end of what would be a second mandate.

“An outline for returning to balanced books is not anticipated in the upcoming budget,” said Scotiabank chief economist Jean-François Perrault and his colleague Mary Webb.

“Excluding a risk adjustment, a shortfall narrower than $20-billion, at roughly 0.8 per cent of GDP, is expected by [fiscal year 2021],” they added.

“Although the ratio of Ottawa’s accumulated deficit to GDP may be roughly stabilized, without significant austerity, balanced books by FY24 at the end of the Liberals’ second mandate appear to be a stretch.”

Bank of Montreal senior economist Robert Kavcic asked this question in his report: “Deficits forever?” That’s because Ottawa is “showing no interest in balancing the books,” he added.

“The reasoning, at least federally, is that deficits don’t matter, so long as debt is stable as a share of GDP,” said Mr. Kavcic.

“The issue is that the Canadian economy is flashing above-potential growth again, and that’s when building fiscal capacity is usually a good idea.”

Here’s what else economists expect to see:

The buffer

The budget traditionally comes with a “fiscal cushion” to shelter Ottawa against things it didn’t count on.

Mr. Morneau dumped that in his fall update, but observers believe he’ll now bring it back.

“Expect to see it reinstated in this budget, a move that would push the deficit profile up an additional $6-billion or so throughout the forecast horizon relative to what was tabled in the fall,” said RBC’s Mr. Wright and Ms. Cooper.

“If reinstated, we would want the budget to explicitly state that, if the cushion is not needed, the funds will go towards debt reduction rather than turn into a slush fund for future spending.”

Spending

The Liberals promised to spend, and that’s what they’re doing.

“Having significantly ramped up spending since taking office, the government should provide some details behind its many initiatives,” said Mr. Wright and Ms. Cooper.

“Over the medium term, the largest share of that spending will be on infrastructure, and we anticipate the budget will shed more light on intended projects as well as flesh out the structure of Ottawa’s proposed infrastructure bank.”

Ottawa’s massive 12-year infrastructure scheme will be a “hot topic,” added Scotiabank’s Mr. Perrault and Ms. Webb.

“The substantive delays on other Phase 1 projects during fiscal 2016-17 (FY17) will likely be addressed in the budget, boosting FY18 activity as the provinces and municipalities expand their capital plans to match available federal funding,” they said.

“The budget also is expected to reference the government’s desired acceleration of the investment already funded under the prior administration’s infrastructure plan.”

The economy

Things are certainly going better than they had been, with economists now raising their forecasts for 2017 real economic growth to about 2.3 per cent from 2016’s 1.4 per cent.

“That leaves 2016 two-tenths better than Ottawa expected in the fall update, and the current year tracking three-tenths better (nominal GDP also looks stronger),” said BMO’s Mr. Kavcic.

“All told, Ottawa could be working with a bottom line that is roughly $3-billion better than a few months ago, before any policy changes.”

Yes, but ...

“The government assumed last year’s budget would lift GDP growth by about half a percentage point in each of 2016 and 2017,” said Mr. Wright and Ms. Cooper.

“Given scant evidence that this occurred, the budget may say that more of the growth will come this year, or spill into next,” they added.

“That lag underscores how difficult it is for a government to use fiscal policy to support growth given time lapses in implementation.”

Taxes

Here’s what we really want to hear about.

And it’s a tricky area because Mr. Morneau is delivering a budget without really knowing U.S. President Donald Trump’s plans.

Mr. Trump has promised to cut business and personal taxes, which threaten Canada’s competitiveness, but the Trudeau government is operating almost blind for now.

“While there is speculation that changes to the capital-gains tax regime may be introduced in this budget, the likelihood of these changes seems remote so long as we have no information on the impending tax reform in the U.S.,” said Mr. Perrault and Ms. Webb.

“That being said, the Trudeau government’s emphasis on the middle class should not be underestimated, and there is a strong risk that targeted changes (such as those affecting incorporated businesses) to the capital-gains regime will be forthcoming in this budget or subsequent policy announcements.”

But wait ...

“Ottawa still has much work to do on its plan to sift through the wide range of tax credits, but it’s not clear what will be announced in this budget,” Mr. Kavcic said.

“Policy makers could hold back for more clarity south of the border, and use the fall update as a second mini-budget,” he added.

“That said, it’s clear that the higher end of the income spectrum will remain under assault, with the capital-gains inclusion rate an area rumoured to be on the block.”

The Liberals don’t have a lot of wiggle room on taxes, said Mr. Wright and Ms. Cooper. But raising revenue is now “more pressing” because they’ve been spending so much, the RBC economists said, also noting the speculation over capital gains.

“That move could be hard to square with the government’s billing of the document as an innovation budget, given that some sectors use stock-based compensation to attract talent.”

Want to interact with other informed Canadians and Globe journalists? Join our exclusive Globe and Mail subscribers Facebook group