Clean electricity will become the cornerstone of Canada’s energy future and the use of fossil fuels will drop significantly if the country is to reach its goal of net-zero greenhouse-gas emissions by 2050, according to a new federal analysis.

The report, released Tuesday, is the Canada Energy Regulator’s (CER’s) first long-term outlook modelling net-zero by 2050. It outlines three scenarios: global net-zero, Canada net-zero and the continuation of current measures. But the agency emphasized that the scenarios aren’t predictions about the future or policy recommendations but sketches of Canada’s possible energy future.

“Uncertainty is inherent in all energy modelling exercises,” Gitane De Silva, the CER’s chief executive, wrote in her introduction to the report. “I am sure not everyone will agree with the assumptions we made, nor our findings.”

Nevertheless, Ms. De Silva said the report presents scenarios “that can help Canadians and policy makers see what a net-zero world could look like, visualize the goal, and make informed decisions.”

Canada, the world’s fourth-largest oil producer, is grappling with how to best balance its economic reliance on fossil-fuel production with the global goal of reducing greenhouse-gas (GHG) emissions to avoid the worst effects of climate change.

Under the global net-zero scenario, Canada achieves net-zero emissions by 2050 and the rest of the world reduces emissions enough to limit global warming to 1.5 C. The Canada net-zero scenario envisages a future where we hit net-zero by 2050 but other countries move more slowly.

The current measures scenario relies on a model whereby Canada sticks to the emissions-reduction measures in place today – the eventual $170-a-tonne carbon tax by 2030-31, for example, but not an oil-and-gas emissions cap being developed by Ottawa.

Federal Natural Resources Minister Jonathan Wilkinson said in an interview that the report helps paint a clearer picture for Canadians about what a net-zero future looks like.

“This is a tool that that will enable us to actually have a better conversation with Canadians about some of the changes that we expect to see,” he said of the report, which also emphasizes that Canada’s energy future will in large part be guided by external trade pressures as other countries eye net-zero goals.

“These are forces that are well beyond the control of the Government of Canada. This is about global demand and global price,” Mr. Wilkinson said.

Electricity demand becomes the most important energy source for Canadians in both of the report’s net-zero scenarios. Under the global scenario, for example, it grows 120 per cent from 2021 to 2050 – almost triple the annual rate from 1995 to 2019. The Canada scenario moves the dial even further, with demand growing 135 per cent from 2021 to 2050.

In both cases, wind power flowing into the grid grows rapidly, as does hydroelectricity, which is currently the largest source of generation in Canada. Natural gas-fired generation with carbon capture, utilization and storage (CCUS) will become a key power source, particularly in Alberta and Saskatchewan. Nuclear also gets a look-in, with electricity generation from small module reactors set to comprise 12 per cent of total electricity generation by 2050.

Electricity demand grows more slowly in the current measures scenario but still increases by 62 per cent by 2050.

The surge in consumption comes from replacing current technologies with alternatives such as electric vehicles and heat pumps. The natural flow-on effect is a marked decrease in fossil-fuel consumption.

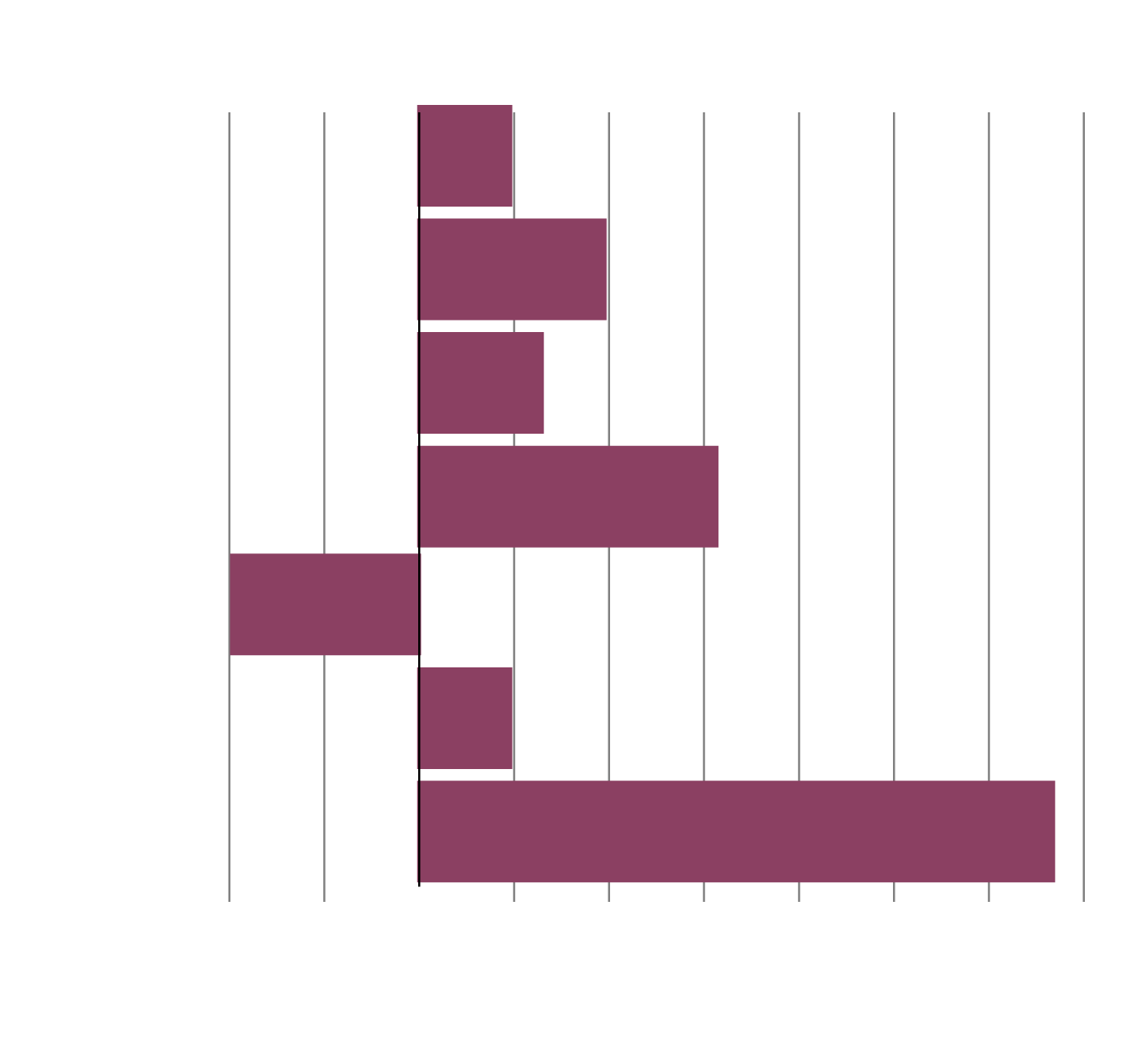

Change in electricity generation

By fuel, 2021 to 2050, Global net-zero scenario

Biomass

Hydro

Natural gas

with CCUS*

Nuclear

Fossil fuels

Solar

Wind

-100

-50

0

50

100

150

200

250

300

350

Terawatt hours

*Carbon capture, utilization and storage (CCUS)

john sopinski/the globe and mail, Source: canada

energy regulator

Change in electricity generation

By fuel, 2021 to 2050, Global net-zero scenario

Biomass

Hydro

Natural gas

with CCUS*

Nuclear

Fossil fuels

Solar

Wind

-100

-50

0

50

100

150

200

250

300

350

Terawatt hours

*Carbon capture, utilization and storage (CCUS)

john sopinski/the globe and mail, Source: canada

energy regulator

Change in electricity generation

By fuel, 2021 to 2050, Global net-zero scenario

Biomass

Hydro

Natural gas

with CCUS*

Nuclear

Fossil fuels

Solar

Wind

-100

-50

0

50

100

150

200

250

300

350

Terawatt hours

*Carbon capture, utilization and storage (CCUS)

john sopinski/the globe and mail, Source: canada energy regulator

The global net-zero scenario paints a bleak picture for Canada’s oil and gas sector. By 2050, crude oil production falls to 1.2 million barrels a day (Mmb/d) and natural-gas production to 5.9 billion cubic feet a day – 76 per cent lower and 68 per cent lower than 2022 levels.

Oil sands production will be particularly hard-hit, falling to 0.58 MMb/d in 2050 under the global net-zero scenario, or 83 per cent lower than in 2022. Under the Canada net-zero model, by 2050 it’s 30 per cent lower.

If, however, the country continues along its current path, the CER report forecasts that oil production will be 20 per cent higher in 2050 than in 2022, and natural-gas production 24 per cent higher.

Jean-Denis Charlebois, the regulator’s chief economist, said conventional production could prove more resilient than the oil sands under both net-zero scenarios, because of price uncertainty and the cost of decarbonization measures such as CCUS.

The report hasn’t changed the plans of Pathways Alliance, a collaboration of Canada’s largest oil sands producers that aims to reach net-zero production by 2050. Mark Cameron, the alliance’s vice-president, said the net-zero scenarios underscore the importance of CCUS in meeting its goal.

“Last year was a record year for global oil demand,” he noted in an interview. “So I don’t think I would assume that we’re going to ... all of a sudden be on that global net-zero track. So I think we really need to focus on what we can do to reduce emissions at home and Canada.”

Mr. Wilkinson said the report underscores the urgency with which the oil and gas sector must decarbonize production “both to enable Canada to meet its own domestic climate obligations, but also to enhance the competitiveness of our products in international markets.”

Chris Severson-Baker, executive director of the Pembina Institute, a think tank, said the energy transformation outlined in the report “demands proactive preparations on the part of responsible governments, federally and provincially, in order for Canada to remain competitive.”

Emma Graney

Emma Graney