Illustration by Erick M. Ramos

Hello,

Welcome to the fifth and last challenge of the MoneySmart Bootcamp. Our final session is about an essential but often neglected aspect of personal finance: disaster-proofing your life.

Of course, we all know to do at least some worst-case-scenario-planning. Car insurance is mandatory. Home insurance is a no-brainer. And many people take out life insurance when they have kids.

But do you have tenant insurance if you’re a renter? Did you write a will? Do you know what a power of attorney is? (No judgment: I didn’t know either until I started covering personal finance.) You may not even realize those should be on your crisis-prep checklist too.

And even some of the obvious line items on that list aren’t as straightforward as you might think. For example: Does your home insurance protect you against flooding or a sewer backup? And will your employer’s disability policy keep paying if you’re unable to work for more than two years? You’ll be surprised at what you might find in the fine print.

Below is an overview of common holes that you may want to plug in your disaster plan and tips on how to go about it.

Home and tenant insurance pitfalls

Just because you – or your landlord – have home insurance doesn’t mean you have enough coverage. Watch out for these three pitfalls:

- Tenant insurance (also called renter’s insurance). Think your landlord’s insurance policy will cover the cost of repairing or replacing your stuff if it’s damaged or stolen? Think again. If you rent, you need tenant insurance, which also protects you if someone sues you for causing damage to other units or for injuring themselves or incurring damage to their property while in your rental. A general rule is to get at least $100,000 of coverage, though some recommend $1-million, depending on the value of your stuff and rental unit.

- Flood insurance. A standard home or tenant insurance policy will kick in for things like broken pipes and a leaking dishwasher. But if outside water is streaming in through your door and windows or backing up into your basement, you’re likely on your own unless you’ve signed up for additional water-damage coverage, which is optional. This isn’t just for those who live near a river, lake or the ocean. Climate change has helped make flooding the No. 1 source of home insurance claims in Canada – and an estimated 1.7 million households are exposed to that risk.

- Condo insurance. Condominiums – also called strata in British Columbia and parts of Alberta – have a commercial policy that will cover the building structure itself and common areas. Condo owners often think that’s all they need. In fact, you’ll want to take out your own individual condo policy if you don’t want to be stuck paying out of pocket for things like damage to your belongings, extra living expenses if your unit becomes unlivable, or compensation to your neighbour if your showers leaks into their living room. You may want to talk to an insurance broker to make sure your policy properly complements your condo corporation’s insurance so you don’t have to foot the bill for anything neither plan covers. Finally, tread carefully when choosing your condo in the first place. Soaring insurance rates and deductibles have become the bane of many condo owners. Before buying, ensure that your building has adequate coverage and the condo corporation is setting aside enough money in its reserve fund, which serves to pay for repairs and maintenance. Your real estate lawyer will help you with that.

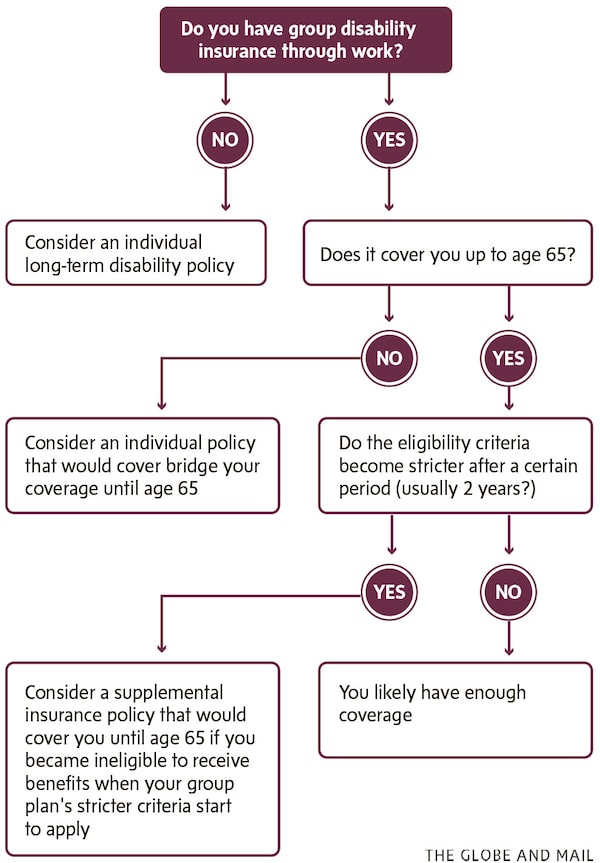

Watch for this catch in your disability insurance

If an injury or illness knocks you out of commission for an extended period of time – or even permanently – long-term disability (LTD) insurance will replace part of your paycheque.

Keep in mind:

- Your workplace coverage. If you have a group benefits plan at work, it likely includes an LTD policy. Some employers have coverage for work-related injuries or sickness through provincial workers’ compensation boards, which is mandatory in some industries. These employers may also offer a supplemental group plan.

- The catch. If you have a group plan, check your insurance booklet. Some plans offer coverage only for a limited period, such as 10 years. But even if your maximum coverage period extends until age 65, many insurers adopt stricter eligibility rules after you’ve been on disability for two years. Often, after the two-year mark you’ll lose coverage unless you’re deemed unable to perform not only your old job but any job for which you’re reasonably qualified, something called an “any-occupation” test. The risk is you’ll lose your income when you’re still too sick or injured to go back to earning your regular paycheque. If you can’t figure out whether your insurer will switch to an any-occupation test after a period of time, it’s worth e-mailing HR to get clarity.

- What then? You can buy a supplemental individual policy, but it will be pricey. One way to limit your premium is to elect to have a waiting period of two years before receiving the benefits from your personal LTD insurance. Remember: Your workplace plan will likely cover those first two years.

- If you don’t have coverage through work. If you work for yourself or a smaller employer who doesn’t offer a generous benefit package, it’s worth considering an individual policy that would replace at least some of your earnings. Keep in mind that, generally, disability income from an individual plan is tax-free. This means you could match your regular take-home pay with benefits that are substantially lower than your pretax paycheque.

Who needs a will and what’s a power of attorney?

Writing a last will and testament isn’t just for celebrities and rich uncles. And it’s also a good idea to have a power of attorney (POA), a legal document that sets out instructions about who should make decisions on your behalf – and how – should you become unable to make your own.

Here are a few things to know:

- Everyone needs a will – even if you’re single. If you’re a parent, a will sets out, among other things, who you want to take care of your children in the event of your death. If you’re in a common-law relationship, a will can help your partner stake a claim to your assets, something they may not be automatically entitled to if you’re not married. You may want to have a will even if you’re single and have no strong feelings about who should get your stamp collection. In general, an up-to-date will makes it easier for your survivors to settle your affairs. Without it, a court would have to appoint someone to administer your estate (what you own, along with any debts), which can take a while. Having a will can also help reduce the chance of family legal squabbles.

- Two types of POA. Unlike a will, which only comes into effect after you’re gone, powers of attorney apply when you are alive, and set down your wishes about your care and who will act on your behalf should you become incapacitated. With a POA for property, you authorize someone else to make decisions about your property and finances. A POA for personal care appoints someone to speak for you on health care decisions. It also sets out your wishes on matters such as whether you want to be kept on life support if doctors believe there’s no chance you’ll regain consciousness. Admittedly, these aren’t pleasant scenarios to ponder, but they do deserve some thought. A POA for personal care can also be called a health directive or representation agreement.

- Low-cost options to get it done. Online services such as Willful.co and LegalWills.ca work a bit like tax software – you’ll get prompts to input information and answer questions – and allow you to make a will and POAs for an affordable fee. If you’d like a bit more hand-holding, some law offices have set up bare-bones services that will guide budget-conscious clients through the process.

Picture This

Try this at home

- Check your home or tenant insurance policy: Does it cover you in case of flooding?

- Now dig out your workplace benefits booklet. What does it say about disability coverage?

- You can get disability insurance quotes online from various insurers – start comparing. Don’t forget to check also how your premium would change if you chose a longer waiting period (but don’t try to save money by opting for stricter eligibility criteria or a shorter coverage period that wouldn’t carry you until retirement).

A final word

This is it! Congratulations on making it through the MoneySmart Bootcamp. I hope everything you learned over the last five weeks helped you feel more confident about tackling some of the money decisions you’re facing. But remember, a one-off bootcamp isn’t enough for a healthy lifestyle – you have to keep at it. The same holds for personal finance: It’s a lifelong learning journey.

If you like this newsletter course, you might also like Stress Test, The Globe’s award-winning personal finance podcast for Gen Z and millennials. Listen for free wherever you get your podcasts.

Erica Alini

Erica Alini