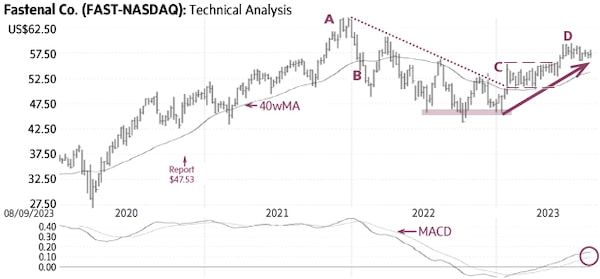

Our previous report (November 13, 2020 – US$47.53) identified a rising trend and provided targets of US$54 and US$59. Fastenal FAST-Q reached a high of US$64.74 in December 2021 for a 36% gain in about one year (A).

In 2022, Fastenal declined below its 40-week Moving Average (40wMA -B), remained below a falling trendline throughout the year (dotted line) but found good support near US$45 (shaded area). In early-2023, the stock rallied above the 40wMA (C) and stayed in a four-month trading range mostly between US$51 and US$55 (dashed lines). The recent rise above this range suggests the start of a new up-trend (D).

Fastenal is currently in the midst of a minor correction for a better entry level. There is good support near US$54-55; only a sustained decline below US$53 would be negative.

A rise above US$58-59 would signal the resumption of the long-term uptrend toward Point & Figure targets of US$69 and US$74. Potentially higher targets are visible.

stock

Monica Rizk is the Senior Technical Analyst of the Phases & Cycles publication (www.capitalightresearch.com). Chart source: www.decisionplus.com

Be smart with your money. Get the latest investing insights delivered right to your inbox three times a week, with the Globe Investor newsletter. Sign up today.

Monica Rizk

Monica Rizk