Aluminum Rallies in Early 2023

The price of LME high-grade three-month aluminum forwards declined 15.30% in 2022, after a 41.76% rise in 2021 and an 8.28% rise in 2020. In my Q4 base metals report on Barchart, I highlighted that aluminum forwards closed 2022 at $2,378 per metric ton. Aluminum’s density is lower than most common metals and is approximately one-third less dense than steel. Aluminum production is energy intensive. Aluminum producers refine bauxite into alumina and smelt alumina into aluminum. Bauxite contains impurities, including iron oxide, silica, and titania. Aluminum is 100% recyclable; around 75% of all the aluminum ever produced remains in use. Recycled aluminum is energy efficient, taking about 5% of the energy required to make new aluminum.

The iPath Series B Aluminum Subindex TR ETN product (JJU) tracks the base metal’s price higher and lower.

Aluminum’s properties make it a critical metal

Aluminum is a silvery-white, soft, malleable, and lightweight metal. The ability to recycle with considerably fewer energy requirements makes aluminum a green metal. Aluminum is non-corrosive, easily machined, cast, lightweight, durable, non-magnetic, non-sparking, excellent heat, and electrical conductor. Aluminum is a “wonder metal” because of its lightweight, low density, and strength.

Aluminum is used in cans, foils, kitchen utensils, window frames, beer kegs, airplane parts, and car parts, and it has many other applications as it resists continuous oxidation.

China is the leading producer and consumer

In 2021, China was by far the world’s leading smelter producer of aluminum.

Source: Statista

The chart shows China’s smelter production was more than the other ten leading countries’ combined output.

Meanwhile, China is also the top aluminum-consuming country, and even though it leads the world in production, China is often an importer to meet domestic requirements. In mid-2021, China needed to purchase aluminum abroad to meet its needs.

Higher lows since 2001- A bullish start to 2023

LME aluminum forwards trade on the London Metal Exchange, and while the metal’s price declined in 2022, the trend since the 2001 low remained primarily bullish.

The long-term chart of three-month LME aluminum forwards highlights the price reached a low of $1,255 per metric ton in November 2001. In February 2009, aluminum fell to a higher low of $1,279, in November 2015, the bottom was $1,432.50 per ton. As the global pandemic gripped markets in early 2020, aluminum forwards fell to a higher low of $1,455 and took off on the upside, reaching over $4,000 by March 2022. After correcting to another higher low of $2,080.50 in September 2022, the price increased. It will put in a bullish key reversal trading pattern in January if the three-month forwards settle above the $2,577 level on January 31. Aluminum forwards were nearby at the $2,589.50 level on January 30.

The short-term LME aluminum chart illustrates the bullish pattern of higher lows and higher highs since the late September 2022 low.

Aluminum stocks have been trending lower

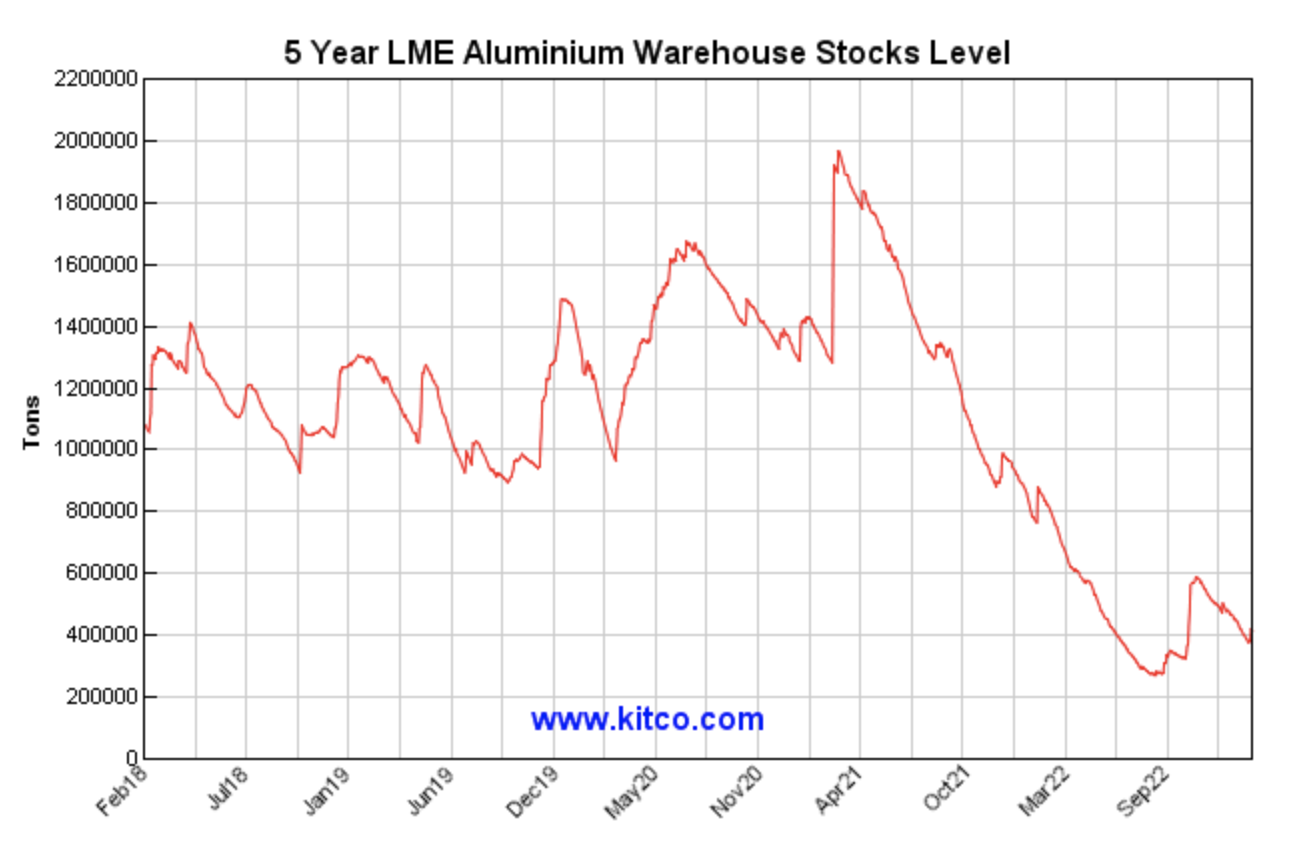

One factor that shed light on aluminum’s supply and demand fundamentals is the LME stockpile data.

Source: LME/Kitco

The chart shows the sharp decline in exchange aluminum inventories. As of January 30, the LME reported 411,650 tons in its warehouse network. Over the past decade, aluminum stocks have been at much higher levels. A January 2 article on Barchart highlighted that aluminum inventories declined 72% in 2022 and that “warehouse stockpiles of major metal categories hit the lowest level in 25 years on the London Metal Exchange (LME).”

Since China, the world’s leading producer and consumer continue to import aluminum, the significant decline in stockpiles is a bullish factor.

JJU is an aluminum ETN product

The most direct route for a risk position in aluminum is via the London Metal Exchange. Shares of aluminum-producing companies tend to move higher and lower with the metal’s price. Meanwhile, the iPath Series B Aluminum Subindex TR ETN product (JJU) is an alternative to the LME forwards. At $53.99 per share on January 31, JJU had $6.384 million in assets under management. JJU trades an average of 7,513 shares daily and charges a 0.45% management fee. JJU is not a highly liquid ETF but tracks the metal’s price. LME aluminum forwards rose from $2,080.50 on September 28, 2022, to a high of $2,679.50 on January 18, or 28.8%.

The chart highlights the rise from $43.37 to $56.22 per share or 29.6% over the same period. While JJU did an excellent job tracking the LME aluminum price, the illiquid ETF can suffer from wide bid-offer spreads that make executing buying or selling orders challenging. Moreover, JJU only trades during hours when the U.S. stock market operates and can miss highs or lows during European hours when the LME operates.

Aluminum prices have been trading in a bullish trend over the past years, making price corrections buying opportunities. The supply and demand fundamentals and the declining stockpiles favor higher prices in 2023.

More Metals News from Barchart

- Stocks Climb as U.S. Labor Costs Ease

- Dollar Rebounds as Stocks Falter

- Stocks Fall as Higher Bond Yields Weigh on Tech

- Gold Continues on a Bullish Path

On the date of publication, Andrew Hecht did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.