Cattle- The Bullish Stampede Continues

In my Q1 2023 Barchart report on animal proteins, I highlighted the rise in live and feeder cattle futures that posted gains in 2022 and Q1 2023. The feeder cattle futures rose 10.08% last year and moved another 9.32% higher in Q1 2023, with the nearby May futures contract settling at $2.05250 per pound on March 31.

Nearby live cattle futures moved 13.03% higher in 2022 and gained another 6.62% over the first three months of 2023. The June live cattle futures settled at $1.6835 per pound at the end of Q1.

With the peak demand season starting at the end of this month, cattle prices remain strong. Moreover, the weekly charts show a bullish stampede that began at the April 2020 lows continues.

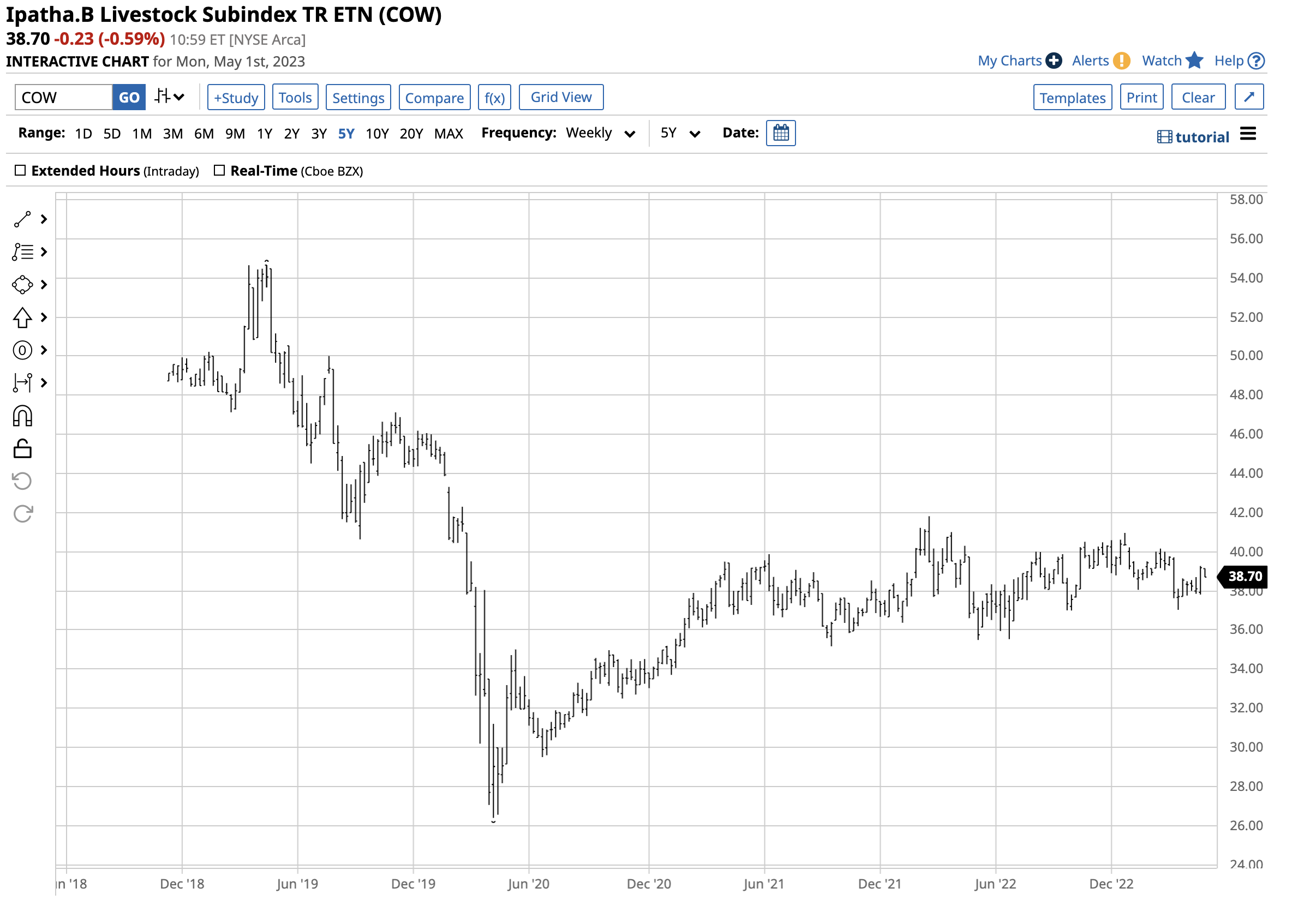

The iPath Series B Livestock Subindex TR ETN product (COW) tends to follow cattle futures prices higher and lower.

A bullish weekly chart in the fat cattle

Live or “fat” cattle have attained a desirable weight (1150-1375 pounds for heifers and 1200-1500 pounds for steers) to be sold to packers for processing into animal protein products.

The weekly chart highlights the steady rise in live cattle futures prices from the April 2020 pandemic-inspired 81.45 cents per pound low to the latest $1.7770 per pound April 2023 peak.

The monthly chart dating back to 1970 shows nearby live cattle futures traded to a record peak in April 2023, surpassing the previous $1.7165 November 2014 record high.

While the price of June futures at just below $1.65 on May 2 was below the closing price of nearby futures on March 31, the trend remains bullish as the beef market moves into the 2023 peak grilling season.

The feeders are equally bullish

Feeder cattle are weaned calves recently sent to feed lots and are typically six to ten months old.

The weekly chart illustrates the rise from the April 2020 pandemic-inspired $1.0395 low to the most recent April 2023 $2.1220 high on the continuous contract.

The monthly chart shows feeder cattle futures rose to the highest price since August 2015 in April 2023 but remain below the October 2014 $2.4520 per pound record peak. Meanwhile, the August futures were sitting at over the $2.27 per pound level on May 2, as the bullish trend continues as the beef market moves into the 2023 grilling season.

The recent decline in feed prices has supported the feeders

Feeder cattle prices tend to be highly sensitive to corn prices as coarse grain is a primary ingredient in cattle feed. Higher corn prices tend to weigh on feeder cattle prices as animal protein producers cut back on supplies. Falling corn prices can support the feeders as ranchers increase their feeder cattle herds as sending the animals to feed lots becomes more economical.

The chart highlights the decline in CBOT corn futures from over $7 in October to below $6 per bushel in early May 2023. Corn’s decline has supported feeder cattle prices, encouraging producers to increase output with feeder and live cattle futures in bullish trends.

The reasons for even higher beef prices

The following factors support a continuation of the bullish trends in the live and feeder cattle futures markets:

- The trend is always your best friend in markets across all asset classes. Live and feeder cattle trends remain higher in May 2023.

- Seasonality favors higher beef prices until the end of the 2023 grilling season in September/October.

- While the USDA slightly lowered the forecast for beef prices in Q1 2023 in the April WASDE report, it increased its projected prices for all other quarters on “continued strength in demand.”

- Beef export demand is rising in Asian markets.

- Inflation remains at the highest level in decades, despite rising interest rates. Increasing energy, labor, financing, and other input prices put upside pressure on animal protein wholesale and retail prices.

The bullish trends in the live and feeder cattle futures will likely continue over the coming weeks and months. Even though the markets could experience a significant pullback after the 2023 grilling season in the fall, prices look likely to make higher lows.

COW is the livestock ETN product

The most direct route for a risk position in the cattle arena is via the Chicago Mercantile Exchange’s feeder and live cattle futures and futures options. The only ETF/ETN product that tracks cattle prices is the iPath Series B Livestock Subindex TR ETN product (COW). COW settled at $38.55 at the end of Q1 and was slightly higher at $38.70 per share on May 2, 2023.

The chart shows the rise in the COW ETN from the April 2020 $26.40 low to just under the $39 per share level on May 2. The trajectory of COW’s rise is much lower than in the cattle market, but the ETN includes hog prices, which have been far more volatile over the past two years.

At $38.70 per share, COW had $27.371 million in assets under management. COW trades an average of 4,098 shares daily and charges a 0.45% management fee. The bullish stampede in the cattle futures arena continues in early May 2023, and other than the futures markets, the COW ETN is the only product that correlates with beef prices.

More Livestock News from Barchart

- Monday Fades in Hog Futures Market

- Monday Fade in Cattle Trade

- Hog Futures Fade Friday’s Rally

- Red Close for Cattle Futures

On the date of publication, Andrew Hecht did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.