Russell 2000 E-Mini(QRZ19)CME

3 Dividend Stocks Leading the Dow in 2024

Investing in blue-chip dividend stocks can be a low-cost way to generate a steady stream of passive income. Generally, blue-chip stocks are considered to be market leaders in mature industries, allowing them to derive predictable cash flows across economic cycles - a portion of which is then distributed to shareholders via dividends. Moreover, these payouts have the potential to increase at a steady pace each year, enhancing your effective yield over time.

Notably, after lagging the broader market in 2023 as artificial intelligence (AI)-fueled tech stocks took the lead, a number of old-school dividend-paying stocks are pacing the Dow Jones Industrial Average ($DOWI) rally as we enter the second month of 2024. Here's a look at three top dividend stocks leading the Dow so far this year.

1. IBM Stock

International Business Machines (IBM) pays shareholders a quarterly dividend of $1.66 per share, translating to a forward yield of 3.62%. Over the past decade, IBM has focused on widening its cloud infrastructure business, where it competes with giants such as Amazon(AMZN), Microsoft(MSFT), and Google (GOOGL), which account for 65% of the market. Comparatively, IBM ended Q2 of 2023 with a market share of 3% in the public cloud segment.

IBM increased its sales by just 2% year-over-year in 2023 to $62 billion, as its top line grew by 4% in Q4. However, its free cash flow grew by 20% year over year to $11 billion, allowing the company to pay $6 billion to shareholders in dividends. With a payout ratio of 55%, IBM has room to increase dividends going forward. In the last 20 years, IBM has raised dividends by 12.5% annually.

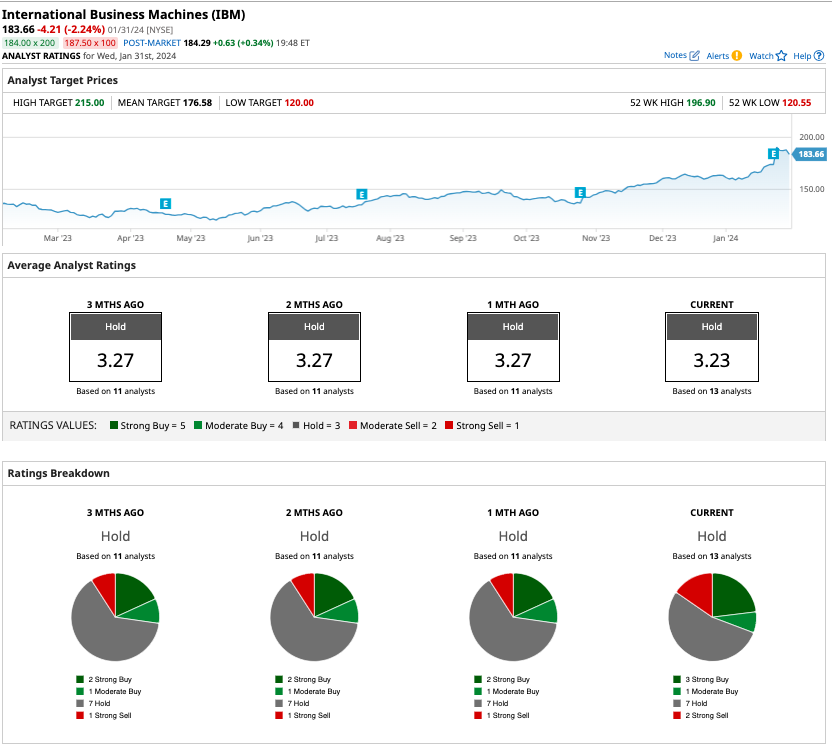

So far in 2024, IBM has rallied 13%, making it the second-best performer on the Dow.

Out of the 13 analysts covering IBM stock, three recommend “strong buy,” one recommends “moderate buy,” seven recommend “hold,” and two recommend “strong sell.” The average target price for IBM is $176.58, which is below its current trading price.

2. Verizon Communications Stock

A telecom giant, Verizon Communications (VZ) is part of a recession-resistant sector known for its generous yields, with the quarterly dividend payment of $0.67 per share translating to a yield of 6.28%. While sales were down 0.3% year-over-year in Q4, Verizon reported operating cash flow of $37.5 billion, capital expenditures of $18.8 billion, and free cash flow of $18.7 billion in the December quarter.

Comparatively, Verizon paid $11 billion in dividends, indicating a payout ratio of 59%. Verizon’s strong cash flow allowed it to lower balance sheet debt, as its leverage ratio fell to 2.6x in 2023 from 2.7x in 2022.

Verizon forecasts capital expenditures between $17 billion and $17.5 billion in 2024, which should drive future cash flows and dividends higher. The company has raised dividends for 17 consecutive years at an annual rate of 4% over this period.

Year-to-date, VZ is up 12.7%, pacing right behind IBM in the Dow's top three performers of 2024 so far.

Out of the 20 analysts covering Verizon stock, seven recommend “strong buy,” three recommend “moderate buy,” and two recommend “hold.” The average target price for VZ is $44.47, about 4.6% above its current price.

3. Merck & Company Stock

The final Dow Jones dividend stock on my list is Merck & Company (MRK), which offers a yield of 2.55%. Merck pays shareholders a quarterly dividend of $0.77 per share, and these payouts have risen by 40% in the last five years.

Valued at $306 billion by market cap, Merck is among the largest healthcare companies in the world. While Verizon and IBM have trailed the broader markets over the past decade, Merck has returned 229% to shareholders in dividend-adjusted gains during the last 10 years.

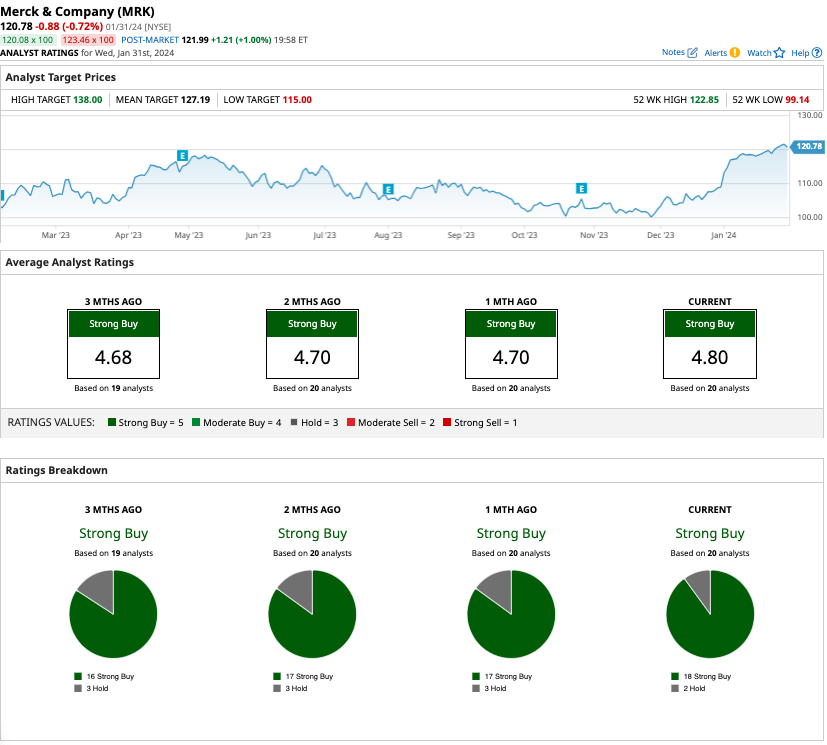

On a year-to-date basis, MRK is extending its lead as the top-performing Dow component of 2024 today, up another 3.6% on the session after Q4 earnings. Since the start of January, the shares have added 14.8%.

A key driver of sales for Merck is the company’s cancer drug Keytruda, which rakes in $20 billion annually. While the patent for Keytruda will expire in 2028, Merck continues to expand its portfolio of solutions by investing in research developments and acquisitions.

Out of the 20 analysts covering Merck stock, 18 recommend “strong buy” and two recommend “hold.” The average target price for MRK is $127.19, 1.7% above current levels.

On the date of publication, Aditya Raghunath did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.