Silver Can Be Gold on Steroids

Silver can be a speculator’s dream or nightmare.

Throughout history, more than a few silver investors have lost their fortunes in the silver market. While Spain became the world’s leading economic power when explorers found a massive silver deposit in Potosi, Bolivia, the collapse of silver prices caused the demise of the Spanish empire. Last century, the Hunt Brothers transformed a large fortune into a small one when they tried to corner the silver futures market in the late 1970s and early 1980s. In 1995, together with three other traders at Salomon Inc., I organized, structured, and executed an over $1 billion proprietary silver purchase when silver was trading at around $5 per pound. The speculative risk position peaked at over 250 million ounces, more than the Hunt brothers had bought two decades before.

At nearly $22.40 per ounce on December 6, silver is starting to look like it is on a bullish launchpad. The iShares Silver Trust (SLV) is a highly liquid silver ETF product that tracks the price action in the silver futures market.

Silver’s volatility is higher than gold’s

Silver tends to be far more volatile than gold because its speculative interest can lead to explosive or implosive price action.

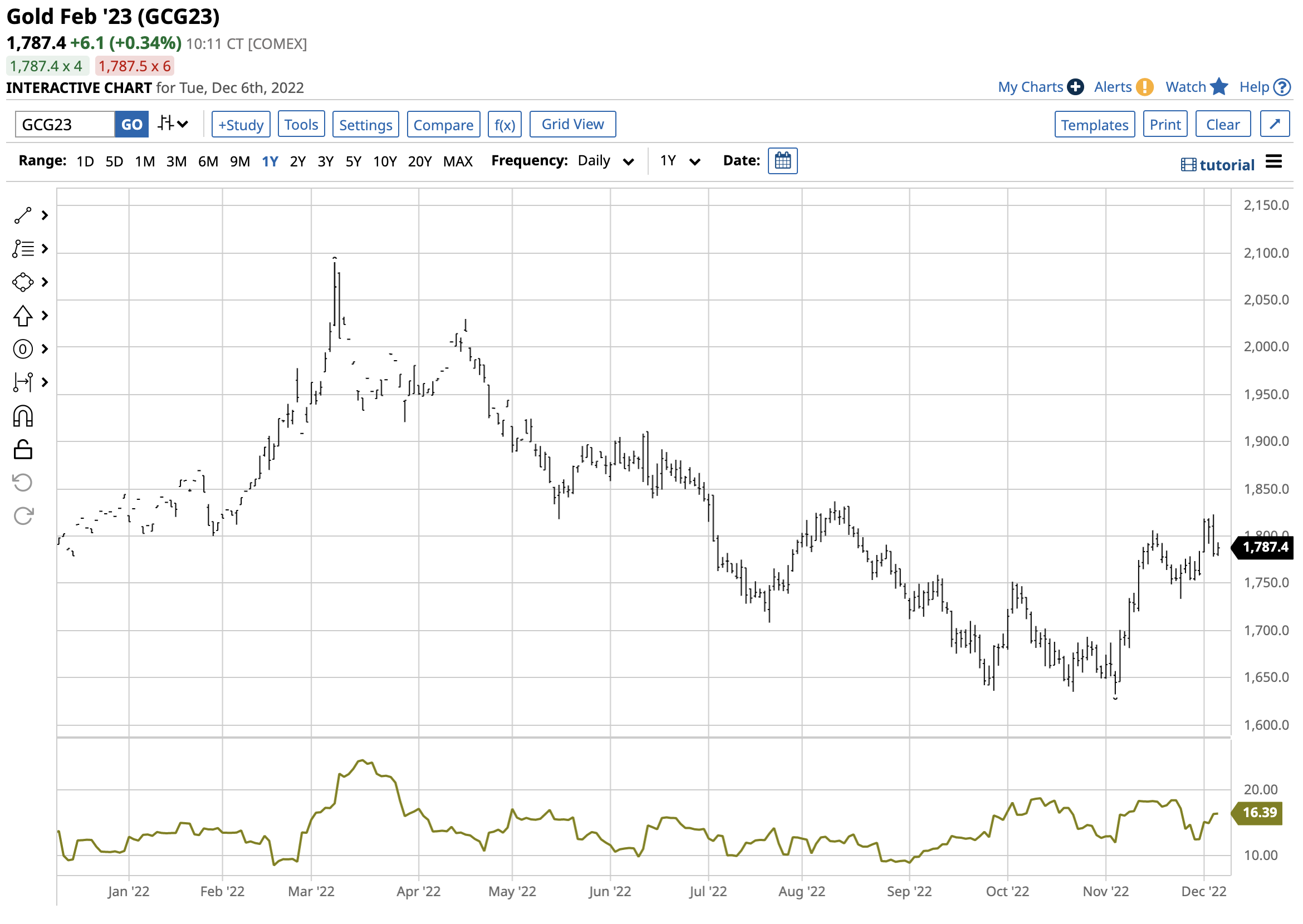

The one-year chart shows that fourteen-day historical volatility in March COMEX silver futures stood at 32.33% on December 6.

The same metric in February COMEX gold futures was at less than half that level at 16.39%. The comparison shows silver often moves far more than gold on a percentage basis during bull and bear market trends.

Constructive technical action in silver

COMEX silver futures have been in a bullish trend since reaching a bottom on September 1, 2022.

The chart highlights March silver’s decline to $17.56 per ounce, the lowest level since June 2020. The continuous futures contract fell to $17.32 on September 1. Since then, silver has made higher lows and higher highs, with the March contract reaching its latest peak at $23.690 per ounce on December 5. In a little over three months, silver appreciated by 36.8%.

February COMEX gold futures fell to a low of $1,632.30 on November 3 and rose to a high of $1,822.90 on December 5, an 11.7% increase. Silver’s rally was over three times gold’s on a percentage basis.

Silver is an industrial metal

Silver is an industrial commodity required for solar panels, electrical switches, chemical-producing catalysts, and other products. Nearly every computer, mobile phone, automobile, and appliance contains silver. Currently, the most significant industrial silver consumer is the photovoltaic sector, as the green revolution that is harnessing the sun’s power for electricity. In the past years, approximately 50% of the annual silver supply has gone to industrial applications, and 25% of the yearly demand comes from silver jewelry and eating utensils, or silverware. The remaining 25% has historically been investment demand.

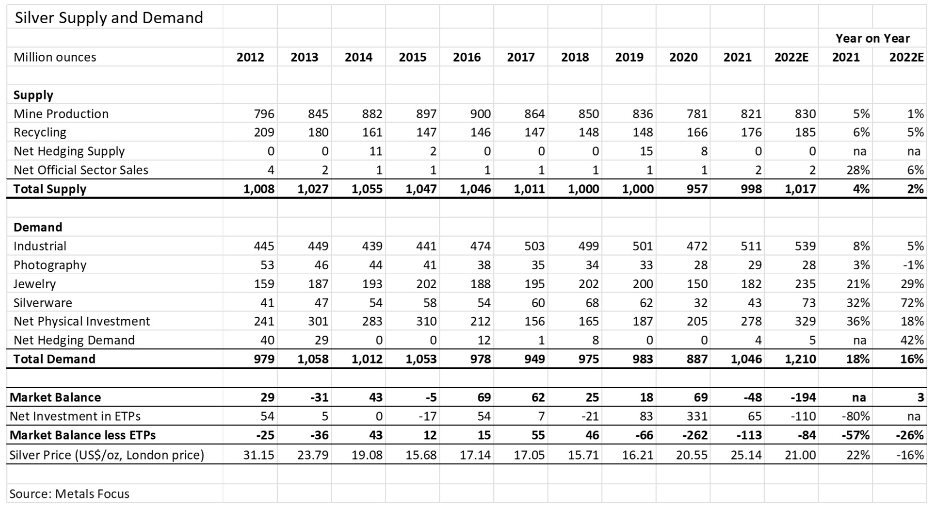

A recent report from the Silver Institute shows that while supply has remained relatively constant over the past decade, the demand has increased.

Source: The Silver Institute

The chart shows the increase in industrial and investment demand from 2020 to 2021, and the estimates are for even higher demand in 2022 from the industrial, jewelry, and silverware sectors.

Silver is a financial asset

While supply and industrial demand fundamentals are critical for silver’s price action, investment demand drives the price higher or lower each year. Silver’s path of least resistance depends on the market’s sentiment, which has turned bullish since September 1, 2022.

Silver is a financial asset that tends to move higher or lower with gold. While rising interest rates and the strong U.S. dollar had weighed on silver, causing it to drop from just over $30 in February 2021 to $17.32 in early September, the price has made a comeback. The recent low in the U.S. 30-Year Treasury bond futures was 117-19 when silver was on the low. The last time the bond was at that level was in February 2011, when silver was at a low of $27.955, on its way to a high of $49.52 in April 2011. However, the last time the dollar index was above the 104 level was in 2002, when silver’s high was only $5.15 per ounce.

At $22.40 per ounce on December 6, the price action in silver remains bullish despite the two-decade high in the U.S. dollar index, with the long bond futures below the 130 level. Silver is an investment alternative, and at $22.40 on December 6, the price was only marginally lower in 2022, outperforming stocks, bonds, cryptocurrencies, and most other assets. Fundamentals, inflation, geopolitical turmoil, and other factors point to higher precious metals prices in 2023. Given its penchant for explosive price action, silver could lead the way when the sentiment leads investors to flock to the silver market.

SLV is an alternative to physical bulky silver or leveraged silver futures

The most direct route for a risk position in silver is via the physical market for bars and coins. However, silver is bulky, and storing the metal can be problematic. The COMEX silver futures have a physical delivery mechanism that causes the price to converge with physical prices during the delivery period. However, futures are highly leveraged and margined instruments. Each silver contract contains 5,000 ounces. At $22.40, the total value is $112,000. The current original margin requirement is $9,350 per contract or around 8.35% of the value. Futures traders holding silver risk positions must pay and receive daily changes above the $8,500 maintenance margin level, making volatile futures cumbersome for retail investors.

The iShares Silver Trust (SLV) provides an alternative to the silver physical and futures market as the ETF holds physical bullion and trades on the stock market. At $20.50 per share on December 6, SLV had $11.1 billion in assets under management. SLV trades an average of over 16.8 million shares daily and charges a 0.50% management fee. SLV is a highly liquid ETF product. The continuous silver futures contract rose from $17.32 on September 1 to $23.46 on December 5, a 35.45% increase.

Over the same period, SLV rose from $16.19 to $21.39 per share or 32.1%, as the ETF does an excellent job tracking nearby silver futures prices.

If the recent rise in precious metal prices is the start of a rally that will last into 2023, silver can perform as gold on steroids because of its speculative attraction and history of explosive and implosive price behavior.

More Metals News from Barchart

- Stocks Moderately Lower on Weakness in Technology Stocks

- Dollar Jumps as Bond Yields Climb on Strong U.S. Economic News

- Gold Fell from the Highs- Interest Rates and the U.S. Dollar Reveal the Precious Metal’s Strength

- Stocks Decline as Strong U.S. Economic News Boosts Bond Yields