S&P 500 VIX Mini(VJZ23)CFE

The Magnitude of the Magnificent Seven

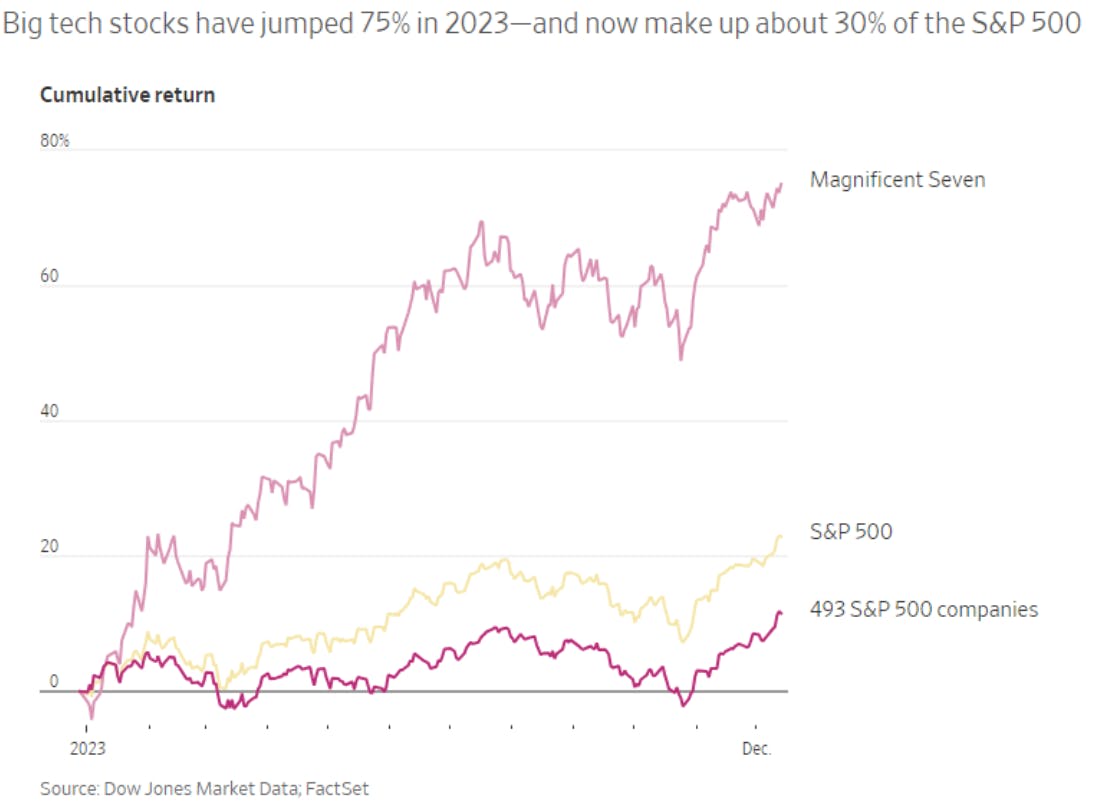

A lot can change in a year. In looking back at the data of last year, the calendar performance of the S&P 500 was -18.11% and investor sentiment was truly pessimistic. However, despite the issues that have plagued the markets in 2023, the performance of the index has been markedly better with a year-to-date performance of 26.39% (as of December 26th, 2023). What is more interesting is that the performance of the index has been powered by a group of companies, fondly referred to as the Magnificent Seven.

The Magnitude of the Magnificent Seven

The stellar performance of NVIDIA, Meta Platforms Inc. (Facebook), Tesla Inc., Amazon.com Inc., Alphabet Inc. (Google), Microsoft Corp, and Apple Inc., collectively referred to as the 'Magnificent Seven,' has not only been a major highlight this year, but their combined weight in the equity market landscape has been also a main headline.

For instance, the Magnificent Seven currently have a higher weighting in the MSCI World Index than all the stocks in the United Kingdom, China, France, and Japan combined. Furthermore, the group is trading at a forward P/E ratio of 33x versus 21x for the remaining 493 companies of the S&P 500 index.

The Tech Landscape

The technology sector, especially the Magnificent Seven, has become a haven for many against the backdrop of a macroeconomic environment still filled with uncertainty. In looking at the performance of these firms over the years, they have been a source of incredible wealth generation, while still providing avenues to grow shareholder value over time (see article on Benefitting from Quality Businesses).

While the fervor behind the tech sector can be attributed to many developments, in 2023, mass layoffs and the shift toward Artificial Intelligence are contributing factors. As stated in many press releases and published articles, many tech firms have – and still are – ‘right-sizing’ their staff to levels they deem appropriate, given the current market conditions.

As reported by Tech Crunch, more than 240,000 jobs were lost in 2023, a total that’s already 50% higher than last year and growing. Although layoffs have negative consequences due to their impact on individuals, the market often perceives these actions as 'cost-cutting' measures, which are expected to benefit these organizations in the long term.

Throughout the year, no two words have been stated together in greater frequency than ‘Artificial Intelligence,’ as almost every firm has mentioned their use of it or stated their intention to utilize it within their business operations.

Source: IOT Analytics

One of the top beneficiaries in the AI revolution is NVIDIA Corporation, which has seen a material benefit from this wave. Known initially for their graphics processing chips in computer games, NVIDIA now powers a vast array of AI applications. Meanwhile, Microsoft continues to benefit from its investment in OpenAI, the company behind ChatGPT, despite recent corporate governance issues.

Simply put, big tech has provided big profits in 2023 – the Magnificent Seven especially. Though the economic landscape may change, the quality, societal contribution, and growing necessity of these firms – and those like them – make them crucial investments that investors should have exposure to within their portfolios.

Canadian ETFs, US Big Tech

For Canadian investors seeking exposure to companies operating in the technology space, the product optionality available is broad in nature. For investors seeks pure-play exposure to the sector, the TD Technology Leaders Index ETF (Ticker: TEC) provides exposure to global mid- and large-capitalization companies operating in both the traditional and disruptive realms of the technology industry.

For investors seeking solutions capable of enhancing the strong performance of the technology sector, Harvest ETFs has two funds that meet said criteria. Both the Harvest Tech Achievers Enhanced Income ETF (Ticker: HTAE) and Harvest Tech Achievers Growth & Income ETF (Ticker: HTA) provide investors with access to 20 of the largest, globally focused technology companies. While HTA utilizes a covered call strategy to enhance portfolio income potential and lower portfolio volatility, HTAE employs the same strategy while utilizing leverage.

Finally, for investors seeking a more thematic exposure to big tech, the Horizons Global Semiconductor Index ETF (Ticker: CHPS) provides exposure to companies engaged in the production and development of semiconductors and semiconductor equipment.

Please note this article is for information purposes only and does not in any way constitute investment advice. It is essential that you seek advice from a registered financial professional prior to making any investment decision.