Nasdaq Other Finance Index(OFIN)INDEX/NASDAQ

SciPlay (NASDAQ:SCPL) Posts Better-Than-Expected Sales In Q2

Digital casino game developer SciPlay (NASDAQ:SCPL) beat analysts' expectations in Q2 FY2023, with revenue up 18.6% year on year to $189.9 million. SciPlay made a GAAP profit of $41.4 million, improving from its profit of $32.3 million in the same quarter last year.

Is now the time to buy SciPlay? Find out by accessing our full research report, it's free.

SciPlay (SCPL) Q2 FY2023 Highlights:

- Revenue: $189.9 million vs analyst estimates of $181.3 million (4.72% beat)

- EPS: $0.25 vs analyst expectations of $0.26 (3.28% miss)

- Free Cash Flow of $53.6 million, up 41.4% from the previous quarter

- Gross Margin (GAAP): 69.4%, down from 70.1% in the same quarter last year

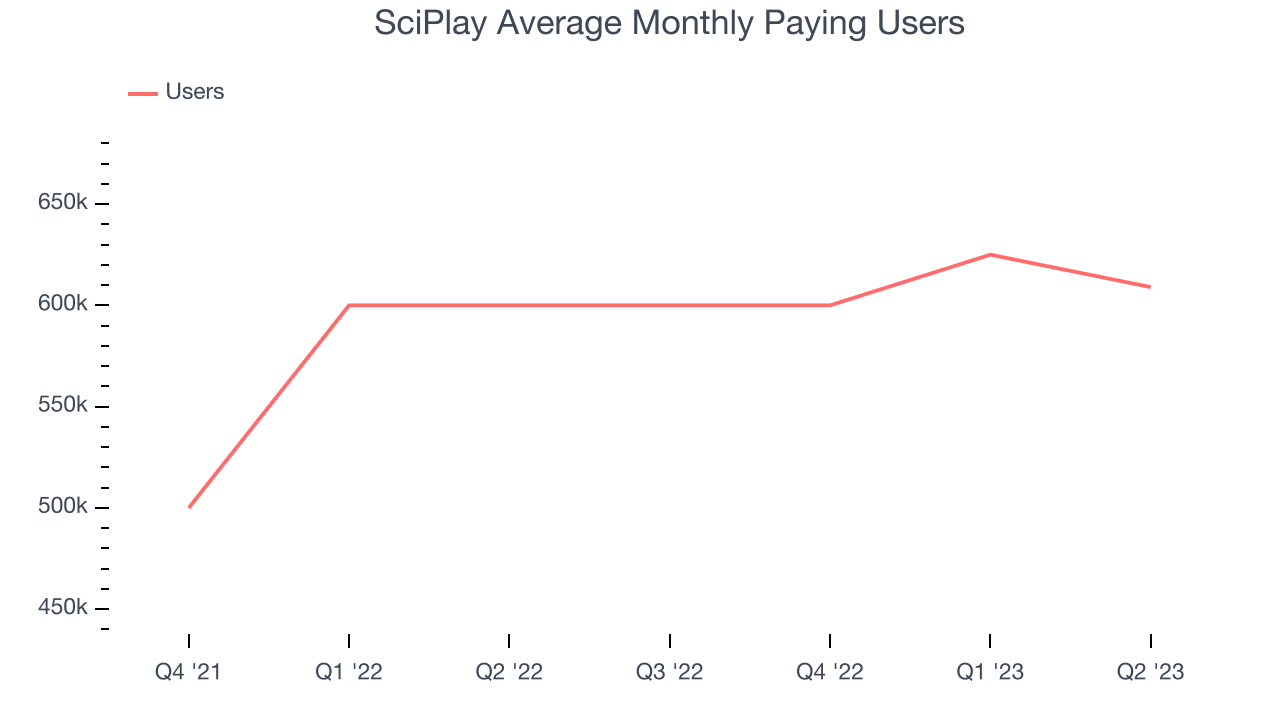

- Average Monthly Paying Users: 610,000, up 9,000 year on year

Josh Wilson, Chief Executive Officer of SciPlay, commented, "SciPlay has consistently grown our business and led the social casino market in performance over the past six consecutive quarters. Our strong and consistent growth reflects the delivery of great gaming and entertainment experiences to our players, and the unrivaled execution of our team.

Headquartered in Las Vegas, SciPlay (NASDAQ:SCPL) offers digital casino games that favor repetition over skill.

Since videogames were invented in the 1970s, they have gradually taken more share of entertainment time. Ubiquitous mobile devices have powered a surge in “snackable” games that can be played on the go. Over time, games have developed more social engagement features where friends can play games together over the internet. The business models of games publishers have become less volatile due to digitization of distribution, in game monetization, and like Hollywood, an increasing dependence on surefire hit franchises. Covid driven lockdowns accelerated adoption and usage of videogames – a trend that has not slowed.

Sales Growth

SciPlay's revenue growth over the last three years has been mediocre, averaging 13.5% annually. This quarter, SciPlay beat analysts' estimates and reported 18.6% year-on-year revenue growth.

Ahead of the earnings results, analysts covering the company were projecting sales to grow 1.73% over the next 12 months.

While most things went back to how they were before the pandemic, a few consumer habits fundamentally changed. One founder-led company is benefiting massively from this shift and is set to beat the market for years to come. The business has grown astonishingly fast, with 40%+ free cash flow margins, and its fundamentals are undoubtedly best-in-class. Still, its total addressable market is so big that the company has room to grow many times in size. You can find it on our platform for free.

Usage Growth

As a video gaming company, SciPlay generates revenue growth by expanding both the number of people playing its games as well as how much each of those players spends on (or in) their games.

Over the last two years, SciPlay's users, a key performance metric for the company, grew 8.56% annually to 0.61 million. This is decent growth for a consumer internet company.

In Q2, SciPlay added 9 thousand users, translating into 1.5% year-on-year growth.

Key Takeaways from SciPlay's Q2 Results

With a market capitalization of $419.5 million, SciPlay is among smaller companies, but its $394.9 million cash balance and positive free cash flow over the last 12 months give us confidence that it has the resources needed to pursue a high-growth business strategy.

It was good to see SciPlay beat analysts' revenue expectations this quarter. That really stood out as a positive in these results. Overall, this quarter's results seemed fairly positive and shareholders should feel optimistic. The stock is flat after reporting and currently trades at $19.65 per share.

So should you invest in SciPlay right now? When making that decision, it's important to consider its valuation, business qualities, as well as what has happened in the latest quarter. We cover that in our actionable full research report which you can read here, it's free.

One way to find opportunities in the market is to watch for generational shifts in the economy. Almost every company is slowly finding itself becoming a technology company and facing cybersecurity risks and as a result, the demand for cloud-native cybersecurity is skyrocketing. This company is leading a massive technological shift in the industry and with revenue growth of 50% year on year and best-in-class SaaS metrics it should definitely be on your radar.

The author has no position in any of the stocks mentioned in this report.