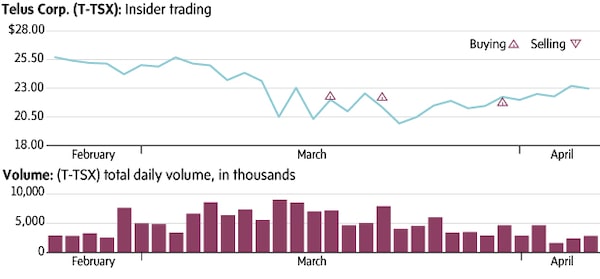

While the COVID-19 impact on Telus Corp. remains to be seen, the company had the good fortune of closing a $1.5-billion equity financing on Feb. 26 priced at $26 a share (split-adjusted). As the stock fell in March, we saw insiders buying. CFO Douglas French was one of them, picking up shares at $22.10. In our experience, CFOs generally tend to be a conservative lot, so when we see one buying, we take note. The most recent Telus insider buying took place March 31 when another officer bought at $21.75.

stock

Ted Dixon is CEO of INK Research, which provides insider news and knowledge to investors. For more background on insider reporting in Canada, visit the FAQ section at www.inkresearch.com. Securities referenced in this profile may have already appeared in recent reports distributed to INK subscribers. INK staff may also hold a position in profiled securities.

Chart reflects public-market transactions of common shares or unit trusts by company officers and directors.

Be smart with your money. Get the latest investing insights delivered right to your inbox three times a week, with the Globe Investor newsletter. Sign up today.

Ted Dixon

Ted Dixon