B&G Foods Holdings(BGS-N)NYSE

B&G Foods (NYSE:BGS) Exceeds Q4 Expectations

Packaged foods company B&G Foods (NYSE:BGS) reported Q4 FY2023 results topping analysts' expectations, with revenue down 7.2% year on year to $578.1 million. The company expects the full year's revenue to be around $2.00 billion, in line with analysts' estimates. It made a non-GAAP profit of $0.30 per share, down from its profit of $0.40 per share in the same quarter last year.

Is now the time to buy B&G Foods? Find out by accessing our full research report, it's free.

B&G Foods (BGS) Q4 FY2023 Highlights:

- Revenue: $578.1 million vs analyst estimates of $571.7 million (1.1% beat)

- EPS (non-GAAP): $0.30 vs analyst estimates of $0.30 (1% beat)

- Management's revenue guidance for the upcoming financial year 2024 is $2.00 billion at the midpoint, in line with analyst expectations and implying -3.1% growth (vs -4.5% in FY2023)

- Management's EPS guidance for the upcoming financial year 2024 is $0.90 at the midpoint, above expectations of $0.85 (5.9 % beat)

- Gross Margin (GAAP): 21.7%, up from 20.6% in the same quarter last year

- Market Capitalization: $736.7 million

Started as a small grocery store in New York City, B&G Foods (NYSE:BGS) is an American packaged foods company with a diverse portfolio of more than 50 brands.

Packaged Food

As America industrialized and moved away from an agricultural economy, people faced more demands on their time. Packaged foods emerged as a solution offering convenience to the evolving American family, whether it be canned goods, prepared meals, or snacks. Today, Americans seek brands that are high in quality, reliable, and reasonably priced. Furthermore, there's a growing emphasis on health-conscious and sustainable food options. Packaged food stocks are considered resilient investments. People always need to eat, so these companies can enjoy consistent demand as long as they stay on top of changing consumer preferences.The industry spans from multinational corporations to smaller specialized firms and is subject to food safety and labeling regulations.

Sales Growth

B&G Foods carries some recognizable brands and products but is a mid-sized consumer staples company. Its size could bring disadvantages compared to larger competitors benefiting from better brand awareness and economies of scale. On the other hand, B&G Foods can still achieve high growth rates because its revenue base is not yet monstrous.

As you can see below, the company's annualized revenue growth rate of 1.6% over the last three years was weak for a consumer staples business.

This quarter, B&G Foods's revenue fell 7.2% year on year to $578.1 million but beat Wall Street's estimates by 1.1%. Looking ahead, Wall Street expects revenue to decline 3.8% over the next 12 months.

Today’s young investors won’t have read the timeless lessons in Gorilla Game: Picking Winners In High Technology because it was written more than 20 years ago when Microsoft and Apple were first establishing their supremacy. But if we apply the same principles, then enterprise software stocks leveraging their own generative AI capabilities may well be the Gorillas of the future. So, in that spirit, we are excited to present our Special Free Report on a profitable, fast-growing enterprise software stock that is already riding the automation wave and looking to catch the generative AI next.

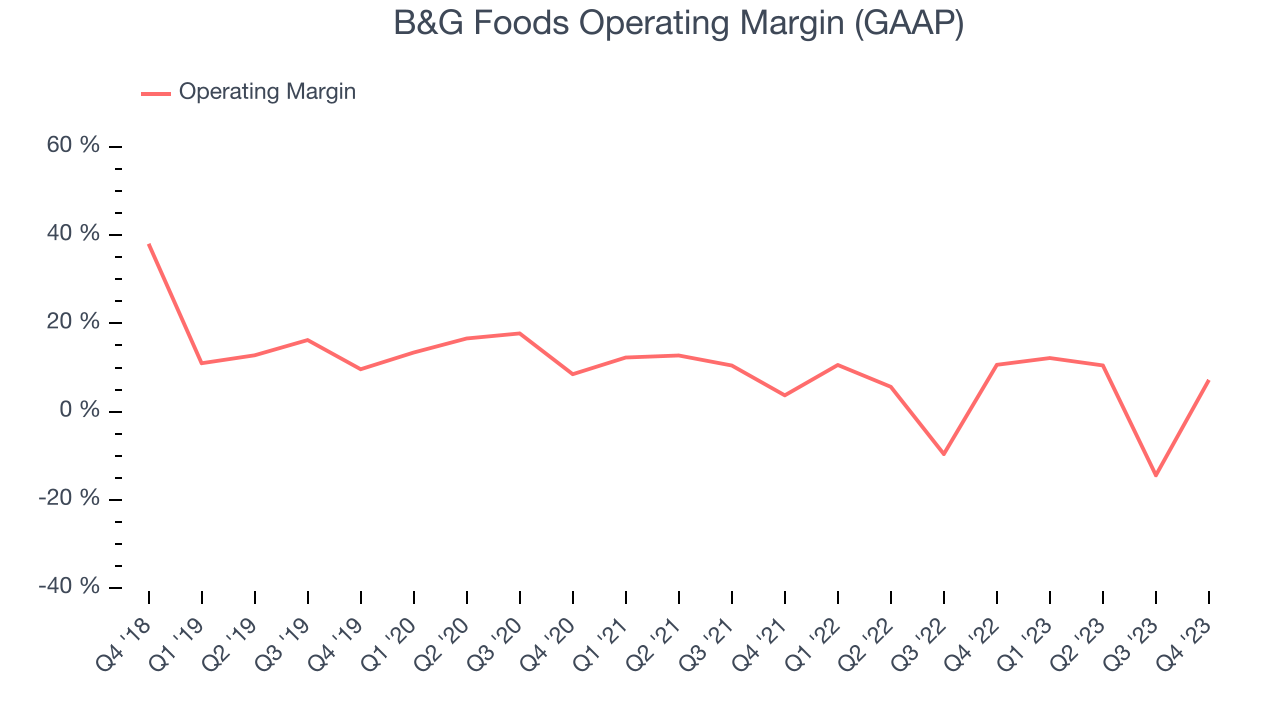

Operating Margin

Operating margin is a key profitability metric for companies because it accounts for all expenses enabling a business to operate smoothly, including marketing and advertising, IT systems, wages, and other administrative costs.

This quarter, B&G Foods generated an operating profit margin of 7.2%, down 3.4 percentage points year on year. Conversely, the company's gross margin actually increased, so we can assume the reduction was driven by operational inefficiencies and a step up in discretionary spending in areas like corporate overhead and advertising.

Zooming out, B&G Foods was profitable over the last eight quarters but held back by its large expense base. It's demonstrated subpar profitability for a consumer staples business, producing an average operating margin of 4.2%. Its margin has also seen few fluctuations, meaning it will likely take a big change to improve profitability.

Zooming out, B&G Foods was profitable over the last eight quarters but held back by its large expense base. It's demonstrated subpar profitability for a consumer staples business, producing an average operating margin of 4.2%. Its margin has also seen few fluctuations, meaning it will likely take a big change to improve profitability. Key Takeaways from B&G Foods's Q4 Results

It was great to see B&G Foods's strong earnings forecast for the full year, which exceeded analysts' expectations. We were also glad its revenue, gross margin, and EPS outperformed Wall Street's estimates this quarter. The only minor negative was that its operating margin missed analysts' expectations. Zooming out, we think this was still a good quarter, showing that the company is staying on track. The stock is up 4.2% after reporting and currently trades at $9.77 per share.

So should you invest in B&G Foods right now? When making that decision, it's important to consider its valuation, business qualities, as well as what has happened in the latest quarter. We cover that in our actionable full research report which you can read here, it's free.