Five Below Inc(FIVE-Q)NASDAQ

3 Nasdaq Stocks to Buy on the Dip

After a rough start to the year for tech stocks, the major market benchmarks closed out last week strong. Both the S&P 500 Index ($SPX) and Nasdaq Composite ($NASX) set new highs in Friday's session, with strength in semiconductor stocks leading the way.

However, there are still plenty of stocks out there to buy on the dip, as investors remain on edge amid flaring tensions in the Red Sea, along with stubbornly strong economic data that has deflated expectations for an imminent Fed rate cut.

Yet, even amid these macroeconomic headwinds, there are pockets of opportunity where investors can deploy their capital to generate significant alpha. Here's a look at three stocks on the Nasdaq that have room to run.

Melco Resorts & Entertainment Stock

Based out of Hong Kong and founded in 2004, Melco Resorts and Entertainment (MLCO)is a leading developer, owner, and operator of integrated resort facilities in Asia and Europe. Operating 4 resorts in 3 countries, Melco currently commands a market cap of $3.48 billion.

Melco stock is down 14% on a YTD basis.

In its latest results for the third quarter, Melco reported significant improvement in both the top line and bottom line, despite falling short of consensus estimates. The company reported total operating revenues of $1.02 billion for Q3, up 321% from $241.8 million in the year-ago period. Growth across all the key segments, particularly the core casino segment ($812.1 million, +346.3% YoY), aided the overall increase in revenues. Losses also narrowed considerably to $0.03 per share from $0.52 per share in the previous year.

The company also reported significant yearly improvement across all its properties in terms of occupancy and revenue per available room, highlighting operational strength.

In terms of key markets, some forecasts call for Macau gaming revenues to surpass $29 billion in 2024. With a 16% share in the gaming market of Macau, this growth should provide a tailwind for Melco's revenues. Likewise, Asia's fastest-growing gaming market of Philippines is projected to double revenue by 2028, and Melco remains a key player in that market with its City of Dreams resort.

Forward revenue growth for MLCO is pegged at 33.27%, much above the sector median of 5.25%.

Although Melco carries a sizeable $8.3 billion debt balance, it also has a cash balance of $1.54 billion, and remains on track to become free cash flow positive in two of its key markets (Macau and Manila) in 2024.

Analysts have a rating of “Moderate Buy” for Melco, with a mean target price of $13.73. This denotes an upside potential of roughly 80% from current levels. Out of 6 analysts covering the stock, 4 have a “Strong Buy” rating and 2 have a “Hold” rating.

Semtech Stock

Founded in 1960 and based in California, Semtech (SMTC) is a leading global supplier of high-performance analog and mixed-signal semiconductors and algorithms. Semtech's products are used in a wide range of applications, including wireless and wired communications, infrastructure, industrial, automotive, and medical devices.

Commanding a market cap of $1.2 billion, Semtech stock nearly erased its year-to-date deficit with Friday's rally, but is still down more than 3% so far in 2024. Over the past year, the shares have shed about 32.6%.

In Q3, Semtech posted number that beat expectations on both the top and bottom line. Net sales of $200.9 million were up 13.1%, while adjusted earnings slipped to $0.02 per share from $0.65 per share in the prior year, as operating costs shot up by 21.3%. Nevertheless, EPS surpassed the consensus estimate for a loss of $0.15 per share. In fact, the company's bottom line has topped expectations in four out of the past five quarters.

Looking ahead, SMTC's IoT system sales, which account for about 50% of total sales, are expected to have bottomed out, and inventory levels are set to normalize from 2024. The company closed the quarter with a cash balance of $123.8 million.

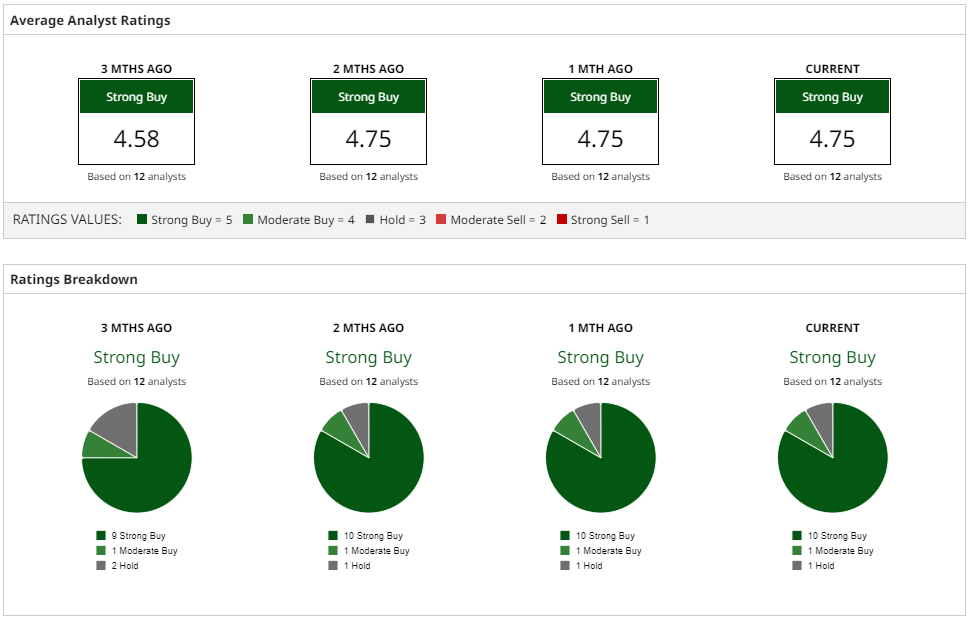

Overall, analysts remain bullish on Semtech stock, with an average rating of “Strong Buy” and a mean target price of $31.40. This denotes an upside potential of 48% from current levels. Out of 12 analysts covering the stock, 10 have a “Strong Buy” rating, 1 has a “Moderate Buy” rating, and 1 has a “Hold” rating.

Five Below Stock

Founded in 2002, Five Below (FIVE) is a discount variety retailer focused on trendy, impulse-purchase items priced between $1 and $5, with some exceptions exceeding $5. Headquartered in Philadelphia, Five Below has grown to over 1,400 stores across 44 states as of January 2024. Its market cap currently stands at $10.5 billion.

Five Below stock is down 12.4% on a YTD basis.

In Q3 2023, Five Below's net sales rose by 14.2% from the previous year to $736.4 million. The growth in net sales was driven by the opening of 74 new stores in the quarter, taking its store count to 1,481 in 43 states, up 14.6% from the year-ago period. Although the company's EPS fell 10.3% year-over-year to $0.26, it surpassed the analyst estimate of $0.23. Notably, the company's EPS has topped expectations in each of the past five quarters.

Over the past 10 years, Five Below's revenue and EPS have expanded at CAGRs of 21% and 26.1%, respectively. This robust growth is expected to continue, as analysts are forecasting the company's forward revenue and EPS growth at 13.12% and 9.53%, compared to the respective sector medians of 5.27% and 0.76%.

The retailer closed the quarter with a cash balance of about $163 million, compared to $44.2 million in the previous year. For the nine months ended Oct. 28, 2023, the company's net cash from operating activities improved to an inflow of $91.9 million, reversing an outflow of $45 million in the year-ago period.

FIVE is looking to expand its footprint aggressively, as it works towards tripling its store count by 2030. With 204 net new stores already opened in FY23, the retailer is looking to add 230 and 260 new units in FY25 and FY26, respectively. Coupled with expectations of strong same-store sales growth due to continued robust demand for the company's low-priced products, the headroom for solid growth appears intact for Five Below.

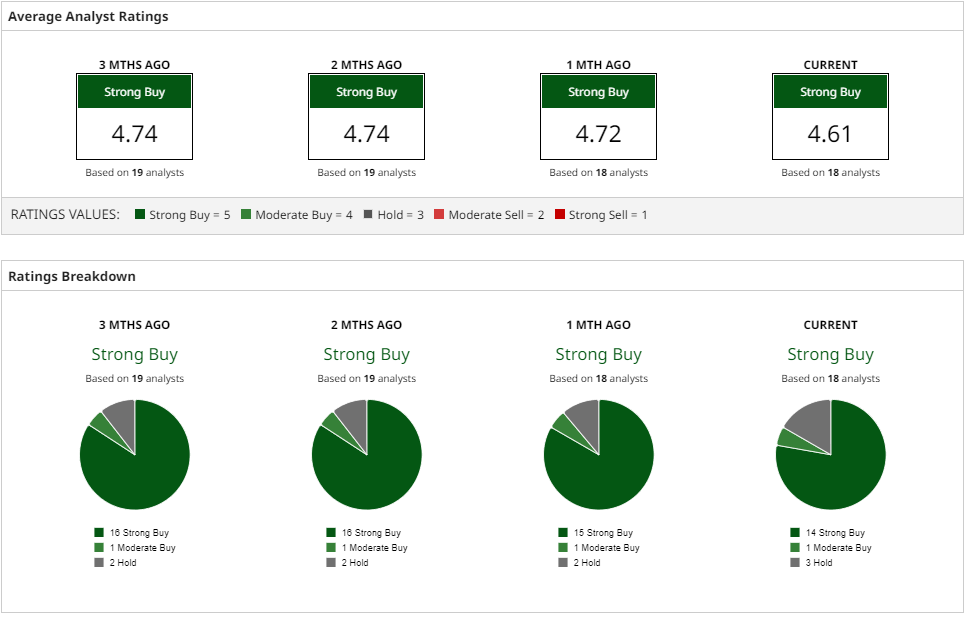

Analysts have an average rating of “Strong Buy” for FIVE stock with a mean target price of $222.11, indicating an upside potential of about 19% from current levels. Out of 18 analysts covering the stock, 14 have a “Strong Buy” rating, 1 has a “Moderate Buy” rating, and 3 have a “Hold” rating.

On the date of publication, Pathikrit Bose did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

Provided Content: Content provided by Barchart. The Globe and Mail was not involved, and material was not reviewed prior to publication.