Quarterly earnings results are a good time to check in on a company’s progress, especially compared to other peers in the same sector. Today we are looking at Airbnb (NASDAQ:ABNB), and the best and worst performers in the consumer internet group.

The ways people shop, transport, communicate, learn and play are undergoing a tremendous, technology-enabled change. Consumer internet companies are playing a key role in lives being transformed, simplified and made more accessible.

The 34 consumer internet stocks we track reported a slower Q4; on average, revenues beat analyst consensus estimates by 0.5% while next quarter's revenue guidance was 1.2% below consensus. Stocks have been under pressure as inflation (despite slowing) makes their long-dated profits less valuable, but consumer internet stocks held their ground better than others, with the share prices up 3.8% on average since the previous earnings results.

Founded by Joe Gebbia and Brian Chesky by renting out a blowup bed on the floor of their San Francisco apartment, Airbnb (NASDAQ:ABNB) is the world’s largest online marketplace for lodging, primarily homestays.

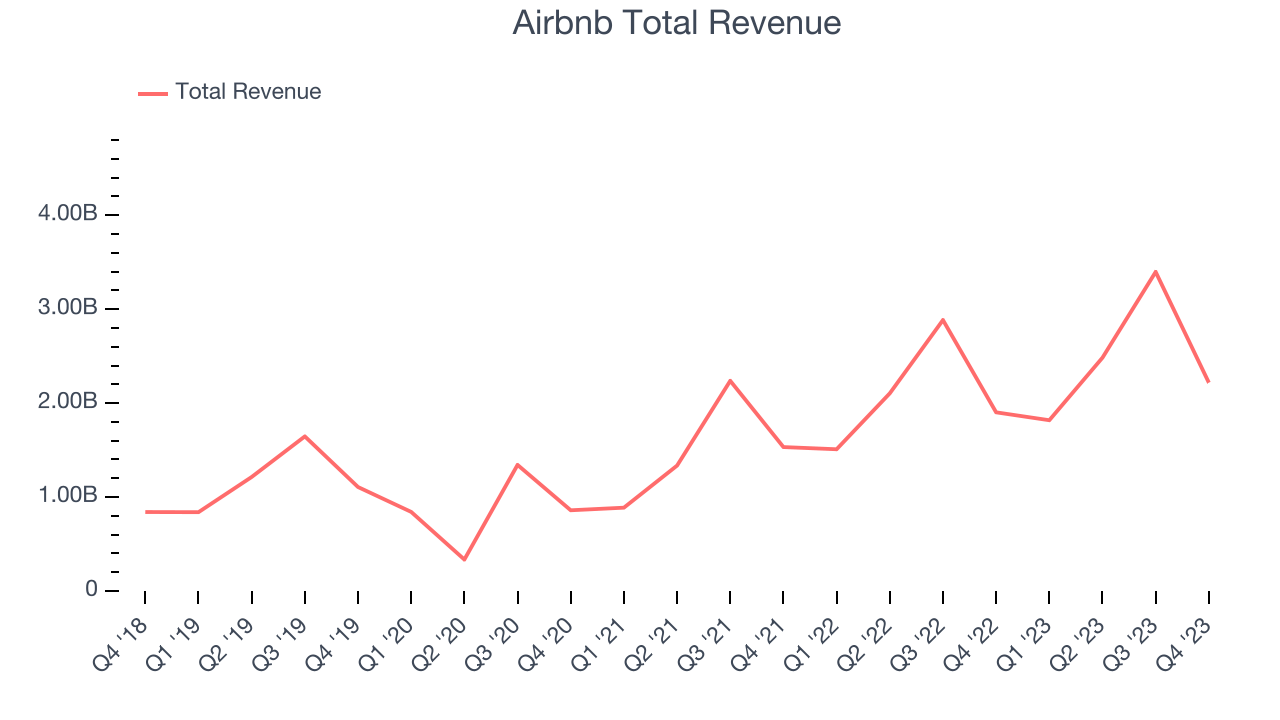

Airbnb reported revenues of $2.22 billion, up 16.6% year on year, topping analyst expectations by 2.5%. It was a mixed quarter for the company, with revenue exceeding expectations on better-than-expected 'Nights & Experiences Booked' (a key volume metric). On the other hand, its revenue growth slowed. Additionally, the company guided to adjusted EBITDA margins of "at least 35%" due to investments in "incremental growth opportunities", below expectations of a margin slightly over 36%.

The stock is up 5.9% since the results and currently trades at $159.86.

Is now the time to buy Airbnb? Access our full analysis of the earnings results here, it's free.

Originally started as an online auction platform, MercadoLibre (NASDAQ:MELI) is a one-stop e-commerce marketplace and fintech platform in Latin America.

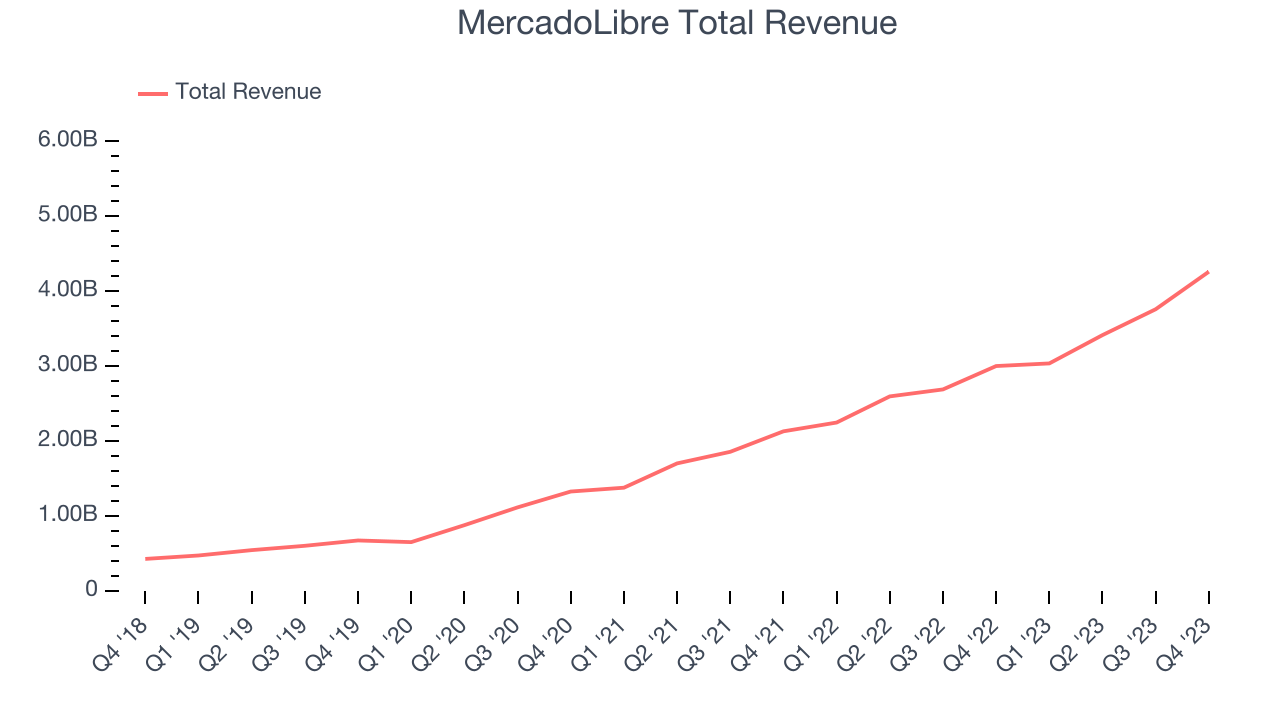

MercadoLibre reported revenues of $4.26 billion, up 41.9% year on year, outperforming analyst expectations by 2.8%. It was an impressive quarter for the company. MercadoLibre's robust user growth enabled it to beat analysts' revenue, total payment volume (TPV), and gross merchandise volume (GMV) estimates.

The stock is down 16.3% since the results and currently trades at $1,525.

Is now the time to buy MercadoLibre? Access our full analysis of the earnings results here, it's free.

Created by IAC’s mergers of Angie’s List and HomeAdvisor, ANGI (NASDAQ: ANGI) operates the largest online marketplace for home services in the US.

Angi reported revenues of $300.4 million, down 27.3% year on year, falling short of analyst expectations by 2.8%. It was a weak quarter for the company, with a decline in its user base and slow revenue growth.

The stock is down 2.1% since the results and currently trades at $2.37.

Read our full analysis of Angi's results here.

With Amazon founder Jeff Bezos as an early investor, Remitly (NASDAQ:RELY) is an online platform that enables consumers to safely and quickly send money globally.

Remitly reported revenues of $264.8 million, up 38.6% year on year, surpassing analyst expectations by 1.3%. It was a very strong quarter for the company, with impressive growth in its user base and exceptional revenue growth.

The company reported 5.9 million active buyers, up 40.5% year on year. The stock is up 15.9% since the results and currently trades at $20.5.

Read our full, actionable report on Remitly here, it's free.

Started as a physical textbook rental service, Chegg (NYSE:CHGG) is now a digital platform addressing student pain points by providing study and academic assistance.

Chegg reported revenues of $188 million, down 8.4% year on year, surpassing analyst expectations by 1.1%. It was a weak quarter for the company, with a decline in its user base and slow revenue growth.

The company reported 4.6 million users, down 8% year on year. The stock is down 22.4% since the results and currently trades at $7.2.

Read our full, actionable report on Chegg here, it's free.

Join Paid Stock Investor Research

Help us make StockStory more helpful to investors like yourself. Join our paid user research session and receive a $50 Amazon gift card for your opinions. Sign up here.

All market data (will open in new tab) is provided by Barchart Solutions. Copyright © 2024.

Information is provided 'as is' and solely for informational purposes, not for trading purposes or advice. For exchange delays and terms of use, please read disclaimer (will open in new tab).