%Uranium, the fissile element that powers the %Nuclear industry, saw a renaissance through 2023. After languishing for years, the spot price surged over 100% per pound and surpassed $80 by early 2024, driven by renewed global interest in nuclear energy's potential to address climate change. At COP28, 22 countries committed to tripling the world's nuclear capacity by 2050, recognizing the need for reliable, carbon-free baseload power.

The joint commitment was taken as a strong signal by the market, with major players such as %MorganStanley (NYSE: $MS) naming uranium as one of their “top picks” in the commodities space. Their price forecast for the end of Q2 2024 is $95 - which would represent a 35% increase from current prices.

“Demand is likely to stay strong as reactors continue to come online, while mine supply remains constrained,” said Morgan Stanley analyst Amy Gower as part of their first coverage of %Cameco (TSX: $CCO) (NYSE: $CCJ).

The enthusiasm comes amid a uranium market plagued by persistent oversupply and underinvestment following a series of high-profile nuclear accidents. Abundant stockpiles from the Cold War era have suppressed prices below $80 per pound for decades, rendering most mines uneconomical. But as demand rapidly rises with no sign of slowing down, outstripping the industry's limited production capability, a supply crunch looms on the horizon.

It is against this backdrop that opportunities arise for ambitious explorers willing to spearhead the development of the next generation of uranium deposits. One such company, Aero Energy, is positioning itself at the forefront of this endeavor, leveraging a unique asset base and proven team in the Athabasca Basin of Saskatchewan.

Aero Energy: Pursuing High-Grade Discovery in Saskatchewan's Prolific Athabasca Basin

%AeroEnergy (TSXV: $AERO) (OTC: $AAUGF) (FRA:UU3) is a uranium exploration company focused on advancing a district-scale uranium project in the prolific Athabasca Basin region of Saskatchewan. Their efforts are bolstered by a high-level technical team, led by the former senior project manager of NexGen, who was instrumental to the Arrow Uranium Deposit discovery, the largest, highest grade 'to-be-developed' uranium deposit in Canada.

The %AthabascaBasin hosts the world's largest and highest-grade uranium deposits, with over 900 million pounds produced historically and 1.34 billion pounds of remaining known resources. High-grade discoveries in this region have created significant shareholder value for exploration companies.

Making the Grade

AERO has already identified over 50 shallow, drill-ready targets within its 250,000 acres of mineral rights around the Uranium City area. This significant land package covers most of the major uranium-bearing geologic horizons. The company's key projects boast dozens of high-grade surface uranium showings up to 27% U3O8, as well as 10 new uranium zones from recent drilling efforts. One of their projects hosts the past-producing Gunnar Mine, which historically yielded 18 million pounds of U3O8 and at one point was the world's largest uranium mine.

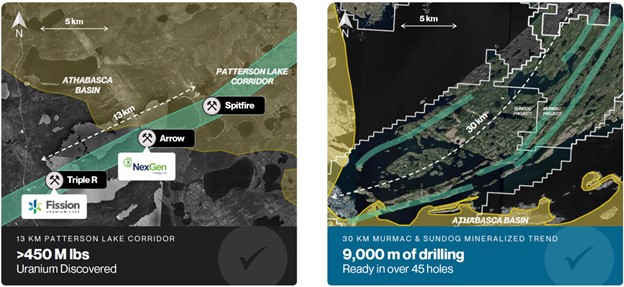

Previous exploration efforts in this district primarily focused on the "Beaverlodge-style" deposit model, targeting lower-grade, fault-hosted mineralization visible at the surface. This approach did not target, and would not have been effective for, the high-grade "Unconformity-related" basement-hosted deposits akin to %NexGen Energy’s Arrow Deposit (TSX: $NXE) and Fission Uranium’s Triple R Deposit (TSX: $FCU).

Through modern exploration technologies, Aero Energy's exploration strategy focuses on targeting basement-hosted, high-grade uranium deposits that can extend over 1 kilometer deep into the basement rocks. Major deposits like NexGen's Arrow show the massive potential of these types of deposits. At their core Murmac and Sundog projects, Aero has identified numerous surface uranium showings and over 70 kilometers of underexplored conductive trends. With over 45 shallow drill targets already outlined from 20-150m depth, Aero Energy is set to aggressively pursue a potential new discovery on this underexplored uranium project in the Athabasca Basin.

As part of a recent exploration update press release, CEO Galen McNamara stated: "We are working closely with our operating partners to combine historical geological evidence with modern on-the-ground science. This will guide us to picking the best set of targets to be drilled for discovery in the upcoming drill program as we drive towards unlocking the full potential of the Murmac Uranium Project to maximize value for our stakeholders."

The company's properties share similarities with the Patterson Corridor, where discoveries like Triple R and Arrow have generated over $5 billion in value for NexGen and Fission Uranium. AERO’s landholdings feature a comparable 30-kilometer mineralized trend, suggesting strong potential to make a similar major high-grade discovery.

AERO boasts an experienced management team, led by CEO Galen McNamara, former senior project geologist at NexGen, who played an instrumental role in leading the exploration of the Arrow Uranium Deposit. This deposit is now considered the largest high-grade development project in the world. The company is backed by a proven technical team with a track record of uranium deposit discoveries and delineation in the Basin. AERO is currently leveraging $7.6 million recently spent on exploration by previous owners.

The company has outlined an aggressive work program involving an over 10,000-meter drill program across 50+ high-priority targets, as well as conducting additional geophysical and geochemical surveys to develop more targets. Investors can anticipate a steady news flow from the release of ongoing drilling results.

Running the Numbers

From a financial perspective, Aero Energy's share structure consists of 96.3 million common shares trading on the TSXV (AERO), OTC (AAUGF), and Frankfurt (UU3) exchanges. With a recent $0.17 share price, the company carries a compelling $15.17 million market capitalization. Including warrants and options, there are 120.7 million fully-diluted shares outstanding. Aero Energy also owns a notable 10 million shares of Minas Metals.

The company’s clear roadmap to earning a 100% interest in its core project areas over the next 3-4 years, along with strong fundamentals and its experienced, tenured team, make it a small cap to keep an eye on in the sizzling uranium sector.

About Aero Energy Limited

Aero Energy Limited, (TSX.V:AERO; OTC:AAUGF; FRA:UU3) a junior mineral exploration company, engages in the acquisition, exploration, and evaluation of mineral properties in Canada. The company explores for uranium deposits. Its flagship optioned properties include the Sun Dog, Strike, and Murmac, as well as fully owned properties located in Athabasca Basin.

Disclaimer: This article is for informational purposes only and does not constitute a solicitation or offer. The accuracy of the information is not guaranteed. Consult with your financial advisor before making any decisions relating to Aero Energy Limited or any other company named herein. Unauthorized use, disclosure or distribution of this article is prohibited. Aero Energy Limited is not liable for errors or omissions in this article. This article is not and should not be construed as an offer to sell or the solicitation of an offer to purchase or subscribe for any investment. No information in this article should be construed as individualized investment advice. A licensed financial advisor should be consulted prior to making any investment decision. We make no guarantee, representation or warranty and accept no responsibility or liability as to its accuracy or completeness. Castle Rising assumes no warranty, liability or guarantee for the current relevance, correctness or completeness of any information provided within this article and will not be held liable for the consequence of reliance upon any opinion or statement contained herein or any omission. Yolowire has been compensated eight hundred dollars by Castle Rising for distribution of this Aero Energy Limited press release. Furthermore, we assume no liability for any direct or indirect loss or damage or, in particular, for lost profit, which you may incur as a result of the use and existence of the information, provided within this article. Be extremely careful, investing in securities carries a high degree of risk; you may likely lose some or all of the investment. Yolowire was not compensated by any public company mentioned herein to disseminate this press release.