Okta Inc Cl A(OKTA-Q)NASDAQ

Cybersecurity Stocks Q4 Results: Benchmarking CrowdStrike (NASDAQ:CRWD)

Wrapping up Q4 earnings, we look at the numbers and key takeaways for the cybersecurity stocks, including CrowdStrike (NASDAQ:CRWD) and its peers.

Cybersecurity continues to be one of the fastest-growing segments within software for good reason. Almost every company is slowly finding itself becoming a technology company and facing rising cybersecurity risks. Businesses are accelerating adoption of cloud-based software, moving data and applications into the cloud to save costs while improving performance. This migration has opened them to a multitude of new threats, like employees accessing data via their smartphone while on an open network, or logging into a web-based interface from a laptop in a new location.

The 9 cybersecurity stocks we track reported a mixed Q4; on average, revenues beat analyst consensus estimates by 1.9% while next quarter's revenue guidance was in line with consensus. Valuation multiples for growth stocks have reverted to their historical means after reaching highs in early 2021, and while some of the cybersecurity stocks have fared somewhat better than others, they have not been spared, with share prices declining 6.9% on average since the previous earnings results.

CrowdStrike (NASDAQ:CRWD)

Founded by George Kurtz, the former CTO of the antivirus company McAfee, CrowdStrike (NASDAQ:CRWD) provides cybersecurity software that protects companies from breaches and helps them detect and respond to cyber attacks.

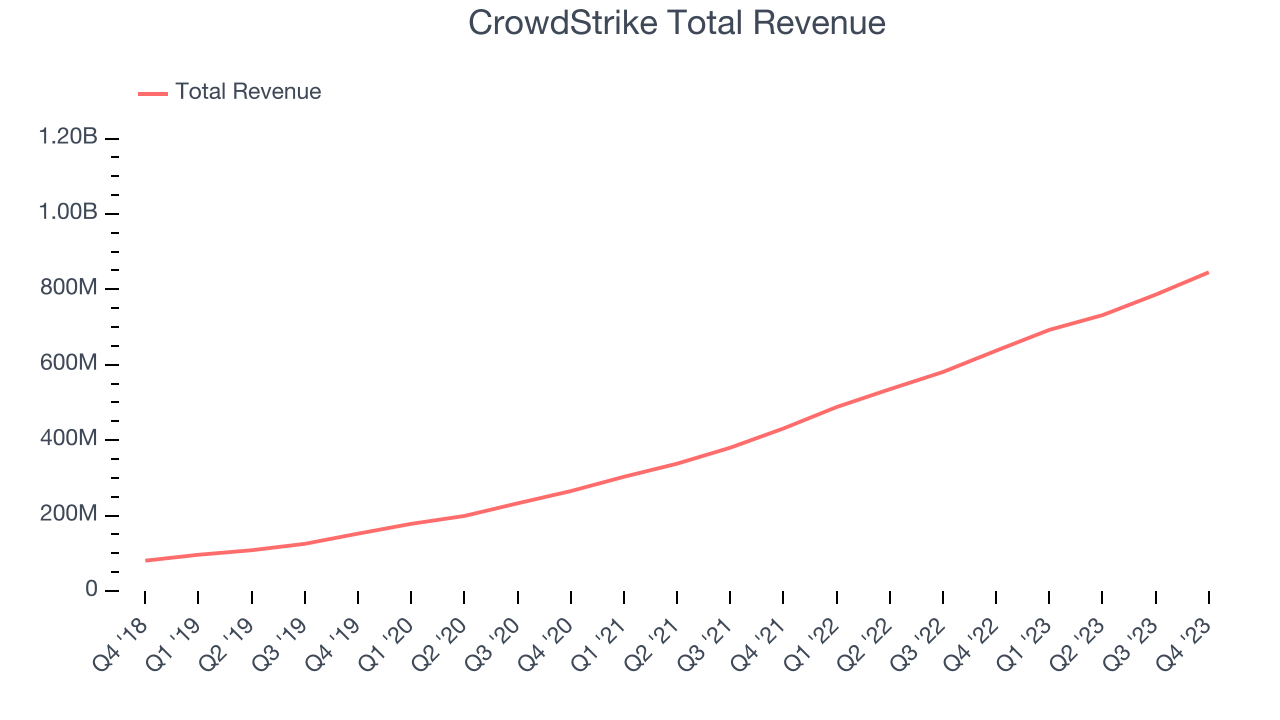

CrowdStrike reported revenues of $845.3 million, up 32.6% year on year, in line with analyst expectations. It was a solid quarter for the company, with an impressive beat of analysts' billings estimates and a decent beat of analysts' ARR (annual recurring revenue) estimates. While forward guidance for next quarter and the full year were only slightly above expectations, non-GAAP EPS guidance was more convincingly ahead, showing better-than-expected profitability.

"CrowdStrike delivered an exceptionally strong and record fourth quarter with net new ARR growth accelerating to 27% year-over-year, reaching a new high of $282 million and ending ARR growing 34% year-over-year to reach $3.44 billion,” said George Kurtz, CrowdStrike's president, chief executive officer and co-founder.

The stock is up 8% since the results and currently trades at $321.83.

Read why we think that CrowdStrike is one of the best cybersecurity stocks, our full report is free.

Best Q4: Okta (NASDAQ:OKTA)

Founded during the aftermath of the financial crisis in 2009, Okta (NASDAQ:OKTA) is a cloud-based software-as-a-service platform that helps companies manage identity for their employees and customers.

Okta reported revenues of $605 million, up 18.6% year on year, outperforming analyst expectations by 3%. It was a very strong quarter for the company, with an impressive beat of analysts' billings estimates and optimistic revenue guidance for the next quarter.

Okta pulled off the highest full-year guidance raise among its peers. The stock is up 17.3% since the results and currently trades at $102.45.

Is now the time to buy Okta? Access our full analysis of the earnings results here, it's free.

Weakest Q4: Palo Alto Networks (NASDAQ:PANW)

Founded in 2005 by cybersecurity engineer Nir Zuk, Palo Alto Networks (NASDAQ:PANW) makes hardware and software cybersecurity products that protect companies from cyberattacks, breaches, and malware threats.

Palo Alto Networks reported revenues of $1.98 billion, up 19.3% year on year, in line with analyst expectations. It was a weak quarter for the company, with full-year revenue guidance missing analysts' expectations.

Palo Alto Networks had the weakest full-year guidance update in the group. The stock is down 25.6% since the results and currently trades at $272.38.

Read our full analysis of Palo Alto Networks's results here.

SentinelOne (NYSE:S)

With roots in the Israeli cyber intelligence community, SentinelOne (NYSE:S) provides software to help organizations efficiently detect, prevent, and investigate cyber attacks.

SentinelOne reported revenues of $174.2 million, up 38.1% year on year, surpassing analyst expectations by 2.8%. It was a mixed quarter for the company, with an impressive beat of analysts' revenue estimates but underwhelming revenue guidance for the next year.

SentinelOne scored the fastest revenue growth among its peers. The company added 73 enterprise customers paying more than $100,000 annually to reach a total of 1,133. The stock is down 19.5% since the results and currently trades at $22.47.

Read our full, actionable report on SentinelOne here, it's free.

Rapid7 (NASDAQ:RPD)

Founded in 2000 with the idea that network security comes before endpoint security, Rapid7 (NASDAQ:RPD) provides software as a service that helps companies understand where they are exposed to cyber security risks, quickly detect breaches and respond to them.

Rapid7 reported revenues of $205.3 million, up 11.3% year on year, surpassing analyst expectations by 1.9%. It was a weak quarter for the company, with full-year revenue guidance missing analysts' expectations.

The company added 114 customers to reach a total of 11,526. The stock is down 14.9% since the results and currently trades at $48.49.

Read our full, actionable report on Rapid7 here, it's free.

Join Paid Stock Investor Research

Help us make StockStory more helpful to investors like yourself. Join our paid user research session and receive a $50 Amazon gift card for your opinions. Sign up here.