Advertising data platform LiveRamp (NYSE:RAMP) beat analysts' expectations in Q3 FY2024, with revenue up 9.6% year on year to $173.9 million. The company also expects next quarter's revenue to be around $160 million, slightly above analysts' estimates. It made a non-GAAP profit of $0.47 per share, improving from its profit of $0.28 per share in the same quarter last year.

Is now the time to buy LiveRamp? Find out by accessing our full research report, it's free.

Started in 2011 as a spin-out of RapLeaf, LiveRamp (NYSE:RAMP) is a software-as-a-service provider that helps companies better target their marketing by merging offline and online data about their customers.

The digital advertising market is large, growing, and becoming more diverse, both in terms of audiences and media. As a result, there is a growing need for software that enables advertisers to use data to automate and optimize ad placements.

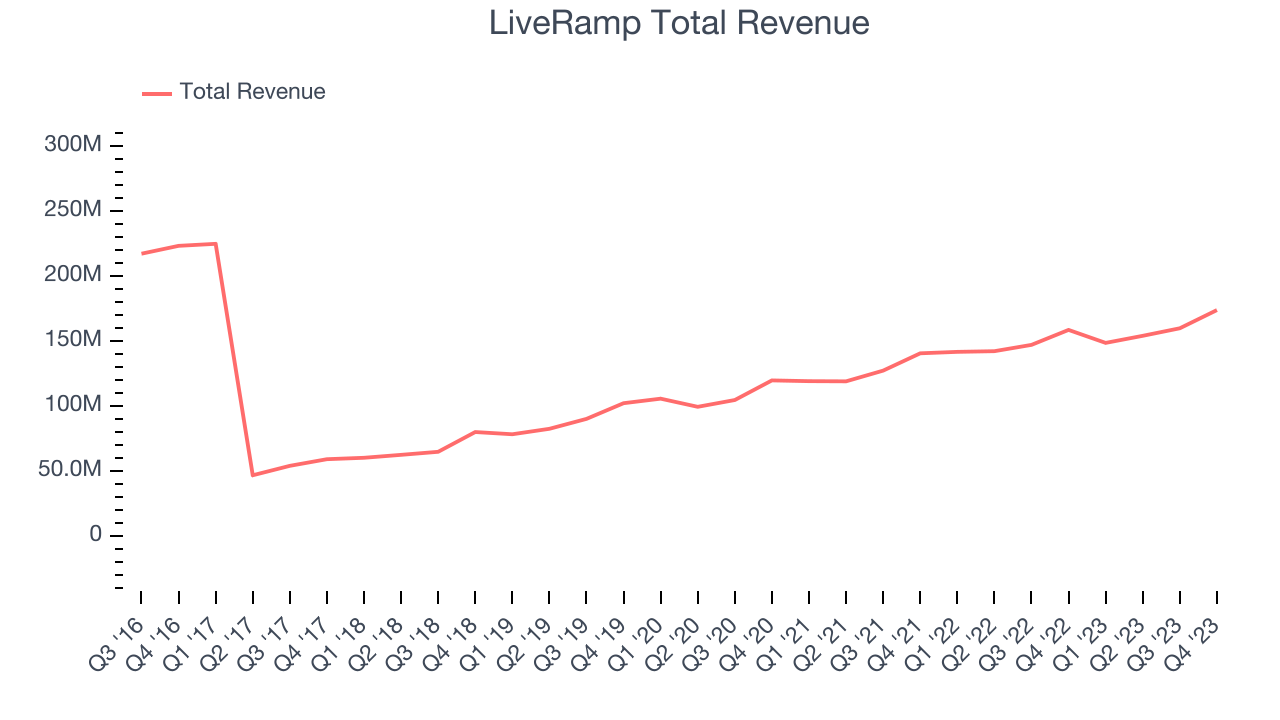

As you can see below, LiveRamp's revenue growth has been unremarkable over the last two years, growing from $140.6 million in Q3 FY2022 to $173.9 million this quarter.

LiveRamp's quarterly revenue was only up 9.6% year on year, which might disappoint some shareholders. However, we can see that the company's revenue grew by $14 million quarter on quarter, re-accelerating from $5.80 million in Q2 2024.

Next quarter's guidance suggests that LiveRamp is expecting revenue to grow 7.7% year on year to $160 million, improving on the 4.9% year-on-year increase it recorded in the same quarter last year. Looking ahead, analysts covering the company were expecting sales to grow 10.1% over the next 12 months before the earnings results announcement.

It’s not often you find a high-quality company at a significant discount to its historical P/E multiple, but that’s exactly what we found. Click here for your FREE report on this attractive Network Effect stock at a very silly price.

LiveRamp reported 895 customers at the end of the quarter, flat versus the previous quarter. That's an welcome improvement from the trend of previous quarters, when the company was losing customers.

We were impressed by LiveRamp's strong growth in customers this quarter. We were also glad next quarter's revenue guidance came in higher than Wall Street's estimates. Overall, this quarter's results seemed fairly positive. The market was likely expecting more, however, and the stock is down 2.3% after reporting, trading at $41 per share.

So should you invest in LiveRamp right now? When making that decision, it's important to consider its valuation, business qualities, as well as what has happened in the latest quarter. We cover that in our actionable full research report which you can read here, it's free.

One way to find opportunities in the market is to watch for generational shifts in the economy. Almost every company is slowly finding itself becoming a technology company and facing cybersecurity risks and as a result, the demand for cloud-native cybersecurity is skyrocketing. This company is leading a massive technological shift in the industry and with revenue growth of 50% year on year and best-in-class SaaS metrics it should definitely be on your radar.

All market data (will open in new tab) is provided by Barchart Solutions. Copyright © 2024.

Information is provided 'as is' and solely for informational purposes, not for trading purposes or advice. For exchange delays and terms of use, please read disclaimer (will open in new tab).