Skechers U.S.A.(SKX-N)NYSE

This Undervalued Growth Stock Is a Strong Buy

Consumer stocks may not appear as appealing as artificial intelligence (AI)-powered Big Tech stocks like Amazon (AMZN) and Microsoft (MSFT) right now. Nonetheless, there are numerous advantages to including consumer stocks in one's portfolio.

To name one, consumer companies with well-known brands frequently have a competitive advantage due to customer loyalty and pricing power. This provides some stability and predictability during periods of economic volatility in comparison to other sectors. This brand loyalty also generates a consistent revenue stream, even during periods of inflation, when consumer spending is limited.

Furthermore, consumer companies operating on a global scale offer exposure to various economies, which balances risks and provides more growth opportunities.

Here, we'll look at Skechers (SKX), a consumer company whose brand value and strong fundamentals have boosted its stock price by up to 429% in the last 10 years, outperforming the S&P 500 Index's ($SPX) 170% gain over this time frame.

While the stock is down 4.5% YTD, Wall Street's high price target of $72.00 implies potential upside of about 21% in the next 12 months. Let’s find out why.

What Does Skechers Do?

Founded in 1992, California-based Skechers is a global footwear brand popular for its comfortable and stylish designs. Its innovative product line connects with customers, keeping the brand relevant and appealing. Skechers has a global presence, with products now available in over 180 countries. The company has roughly 5,170 stores worldwide, and its products are also available online and through third-party partners.

Its brand strength is reflected by an increase in sales from $1.56 billion in 2012 to $8 billion in 2023. Its earnings per share (EPS) have also grown from $0.06 in 2012 to $3.49 at the end of 2023.

Skechers Ends 2023 On A Strong Note

Recently, Skechers reported another strong quarter and a solid end to the full year 2023. The company has two segments: wholesale and direct-to-consumer.

While wholesale sales fell, direct-to-consumer sales rose by 24.3% for the full year. Total net sales for 2023 grew 7.5% to $8 billion, while earnings increased a massive 46.6% to $3.49 per share. Both revenue and earnings exceeded Wall Street's expectations. Skechers international sales accounted for 62% of total sales for the year, up 13.3% from the previous year.

Skechers' strategic decision to collaborate with athletes and high-profile celebrities, like Martha Stewart and Snoop Dogg, has helped the company reach a larger audience. The company has expanded its existing performance product offerings - such as running, walking, golf, and pickleball - to include football and basketball, bolstered by a partnership with Europe's leading football goal scorer Harry Kane. Furthermore, on its Q4 earnings call, the company mentioned signing a deal with "New York Knicks All-Star Julius Randle and LA Clippers Terance Mann for Skechers basketball."

With these strategic collaborations, the company intends to increase brand awareness and continue driving growth.

Strong Cash Position Boosts Skechers' Global Presence

Skechers ended the year with cash, cash equivalents, and investments totaling $1.39 billion, an improvement of 75.9% from 2022. Increased earnings and positive working capital improvements, particularly inventory reductions of 16.1% year on year, contributed to this year's strong cash balance.

The company is aggressively expanding its global presence, entering emerging markets while strengthening its position in established ones to broaden its customer base. In the fourth quarter, the company opened 27 stores in China, four in Colombia, three locations each in the U.K., Italy, Mexico, and Thailand, and many more, bringing the total number of new stores opened this year to 67.

As of Feb. 1, Skechers already has four new locations in the U.S. and China, two in Thailand, two each in Colombia and South Korea, one in Costa Rica, one each in Chile, India, Malaysia, and Panama. The company plans to open 140 to 160 new stores globally by 2024. Given the rapid growth, Skechers' strong cash position is impressive.

The company expects to generate $8.6 billion to $8.8 billion in revenue in 2024, representing a 7.5% to 10% year-over-year growth rate. Furthermore, earnings could increase by 4.6% to 10.3%, landing between $3.65 and $3.85 per share.

Meanwhile, analysts predict Skechers revenue and earnings will increase by 9.7% and 12.9%, respectively, in 2024. Based on 2024 estimates, the stock is trading at 14 times forward earnings. Compared to its historical average price-to-earnings ratio of 22x, Skechers is a reasonably priced growth stock.

What Does Wall Street Say About SKX?

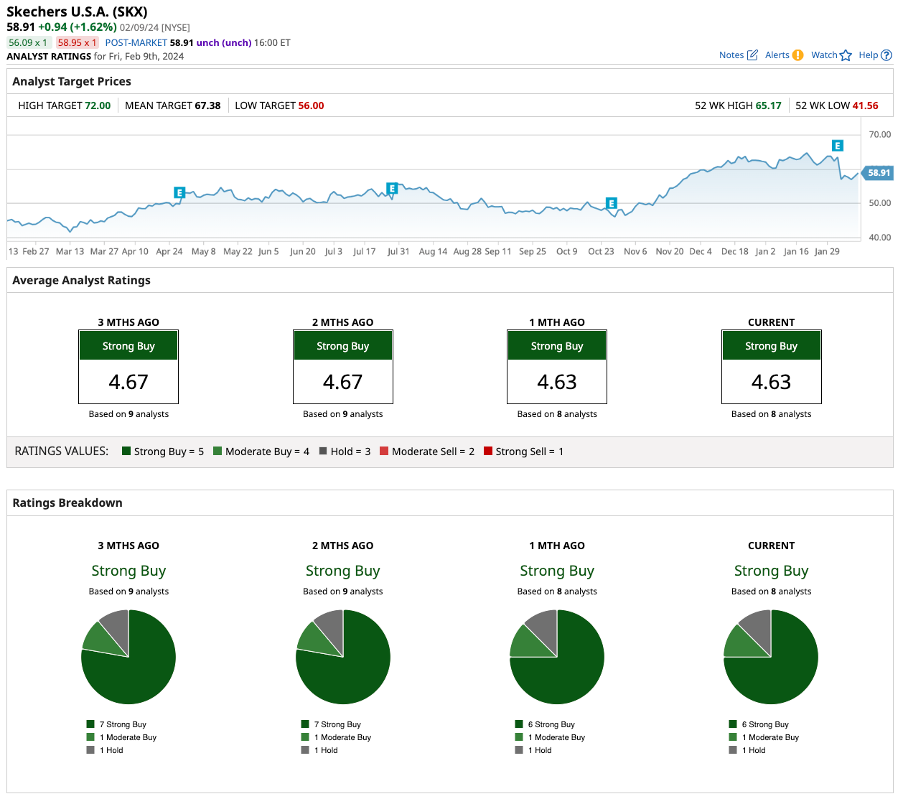

Wall Street has given Skechers stock a “strong buy” rating overall. Out of eight analysts covering the stock, six rate it a “strong buy,” one recommends a “moderate buy,” and one rates it a “hold.”

The mean target price for Skechers stock is $67.38, which is 13.1% higher than current levels. Furthermore, its high target price of $72.00 indicates a 21% upside potential over the next 12 months.

The Bottom Line on Skechers Stock

Valued at $9.07 billion, Skechers stock has returned 36% over the past 52 weeks. Its strong cash position (despite aggressive expansion), brand strength, and growing revenue and earnings, all give me confidence that the stock will continue to return value to shareholders if held for the long term. Skechers is a good addition to any portfolio for diversification purposes, especially at this reasonable price.

On the date of publication, Sushree Mohanty did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

Provided Content: Content provided by Barchart. The Globe and Mail was not involved, and material was not reviewed prior to publication.