Snap One Holdings Corp(SNPO-Q)NASDAQ

Snap One (NASDAQ:SNPO) Misses Q4 Revenue Estimates

Smart living technology company Snap One (NASDAQ:SNPO) missed analysts' expectations in Q4 FY2023, with revenue down 1.4% year on year to $264.4 million. The company's full-year revenue guidance of $1.10 billion at the midpoint also came in 2.1% below analysts' estimates. It made a GAAP loss of $0.08 per share, down from its loss of $0.05 per share in the same quarter last year.

Is now the time to buy Snap One? Find out by accessing our full research report, it's free.

Snap One (SNPO) Q4 FY2023 Highlights:

- Revenue: $264.4 million vs analyst estimates of $266.4 million (0.8% miss)

- Adj EBITDA: $29.8 million vs analyst estimates $26.3 million (13.3% beat)

- EPS: -$0.08 vs analyst estimates of -$0.10 (19.8% beat)

- Management's revenue guidance for the upcoming financial year 2024 is $1.10 billion at the midpoint, missing analyst estimates by 2.1% and implying 3.2% growth (vs -5.5% in FY2023) (although adjusted EBITDA guidance for the same period was ahead of expectations)

- Gross Margin (GAAP): 41.7%, up from 39.4% in the same quarter last year

- Market Capitalization: $593.9 million

Management Commentary“We delivered another strong year in 2023 despite continued global uncertainty, channel inventory destocking, and rising interest rates,” said Snap One CEO John Heyman.

Founded to revolutionize the way people interact with their homes and offices, Snap One (NASDAQ:SNPO) is a provider of smart living technology, offering innovative home automation, audio-video, and security products.

Leisure Products

Leisure products cover a wide range of goods in the consumer discretionary sector. Maintaining a strong brand is key to success, and those who differentiate themselves will enjoy customer loyalty and pricing power while those who don’t may find themselves in precarious positions due to the non-essential nature of their offerings.

Sales Growth

A company's long-term performance can indicate its business quality. Any business can enjoy short-lived success, but best-in-class ones sustain growth over many years. Snap One's annualized revenue growth rate of 15.8% over the last four years was solid for a consumer discretionary business.  Within consumer discretionary, a long-term historical view may miss a company riding a successful new product or emerging trend. That's why we also follow short-term performance. Snap One's recent history shows its momentum has slowed as its annualized revenue growth of 2.6% over the last two years is below its four-year trend.

Within consumer discretionary, a long-term historical view may miss a company riding a successful new product or emerging trend. That's why we also follow short-term performance. Snap One's recent history shows its momentum has slowed as its annualized revenue growth of 2.6% over the last two years is below its four-year trend.

This quarter, Snap One missed Wall Street's estimates and reported a rather uninspiring 1.4% year-on-year revenue decline, generating $264.4 million of revenue. Looking ahead, Wall Street expects sales to grow 4.5% over the next 12 months, an acceleration from this quarter.

Unless you’ve been living under a rock, it should be obvious by now that generative AI is going to have a huge impact on how large corporations do business. While Nvidia and AMD are trading close to all-time highs, we prefer a lesser-known (but still profitable) semiconductor stock benefitting from the rise of AI. Click here to access our free report on our favorite semiconductor growth story.

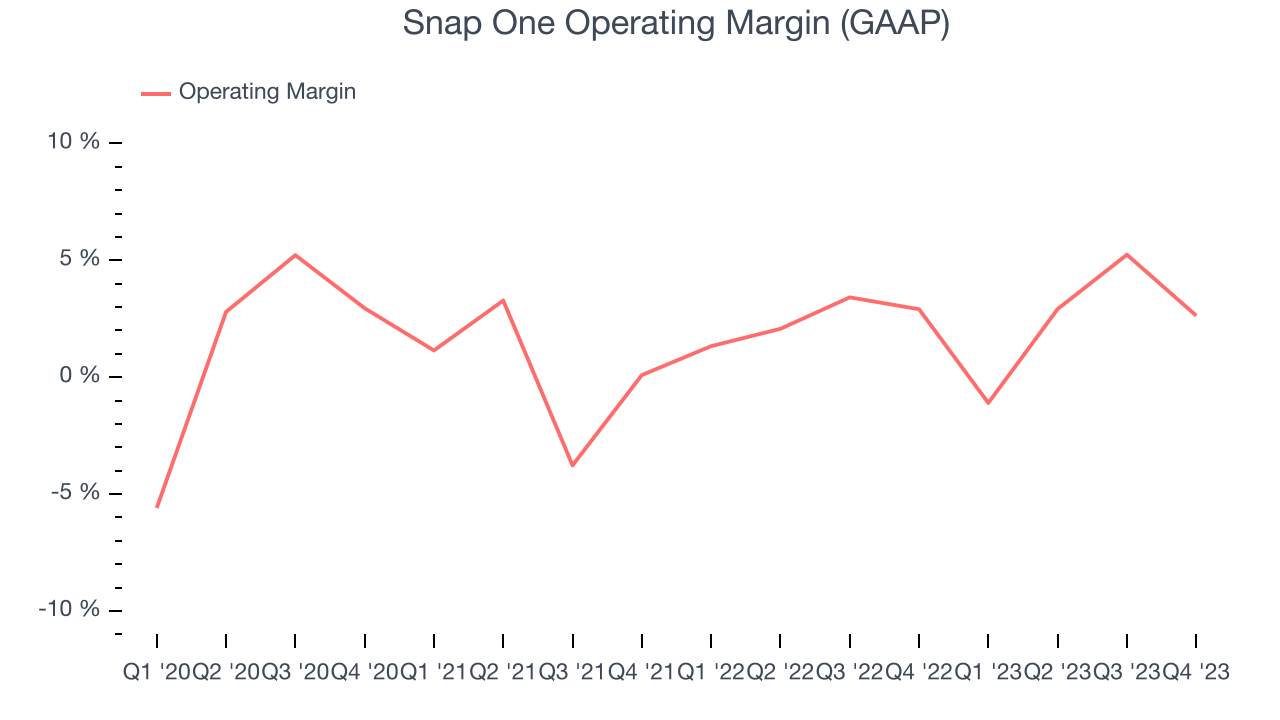

Operating Margin

Operating margin is a key measure of profitability. Think of it as net income–the bottom line–excluding the impact of taxes and interest on debt, which are less connected to business fundamentals.

Snap One was profitable over the last eight quarters but held back by its large expense base. Its average operating margin of 2.5% has been among the worst in the consumer discretionary sector.

In Q4, Snap One generated an operating profit margin of 2.6%, in line with the same quarter last year. This indicates the company's costs have been relatively stable.

Over the next 12 months, Wall Street expects Snap One to maintain its LTM operating margin of 2.5%.Key Takeaways from Snap One's Q4 Results

We enjoyed seeing Snap One exceed analysts' adjusted EBITDA and EPS expectations this quarter. We were also glad its full year adjusted EBITDA guidance outperformance expectations. On the other hand, its full-year revenue guidance missed and its revenue fell short of Wall Street's estimates, although the market seems to be overlooking topline weakness in favor of better profitability. Overall, this was a decent quarter for Snap One. The stock is up 4% after reporting and currently trades at $7.82 per share.

So should you invest in Snap One right now? When making that decision, it's important to consider its valuation, business qualities, as well as what has happened in the latest quarter. We cover that in our actionable full research report which you can read here, it's free.