3 stats

Here are three key numbers to keep in mind when you’re talking about Canada’s housing markets: 24, 17 and 10.

Those, according to research from Bank of America Merrill Lynch, highlight the frothy nature of real estate in British Columbia and Ontario, compared with the rest of the country.

They’re the number of existing home sales per 1,000 people.

In B.C., home to Canada’s hottest market, the ratio is 24 per 1,000 in Vancouver. In Ontario, where Toronto is also a hotbed, it’s 17. And in the rest of Canada, it’s just 10, according to the bank’s North America economist, Emanuella Enenajor.

“Although Canada’s housing market may not be in a bubble, the B.C. (British Columbia) market likely is,” Ms. Enenajor said in her report.

“British Columbia, Canada’s westernmost province, accounts for only 13 per cent of Canada’s population, with median incomes and population growth in line with the national average,” she added.

“However, the province’s housing market is very strong, as demand for housing, presumably from foreign buyers, is pushing up prices.”

The Ontario market, Ms. Enenajor said, is also climbing “uncomfortably,” though it’s not as uncomfortable as in B.C.

The latest readings of the markets show Vancouver and Toronto still going strong.

“Greater Toronto sales surged 21.1 per cent year over year in February, lifting benchmark prices 11.3 per cent,” noted BMO Nesbitt Burns senior economist Sal Guatieri.

“But even these numbers look pedestrian compared with Greater Vancouver, where sales blasted 36.3 per cent higher and prices accelerated 22.2 per cent, both to new highs.”

Will these markets cool down the road?

“In theory, rapidly rising prices should curb demand,” Mr. Guatieri said in a recent research note.

“In practice, there is no sign of this happening; in fact, quite the opposite.”

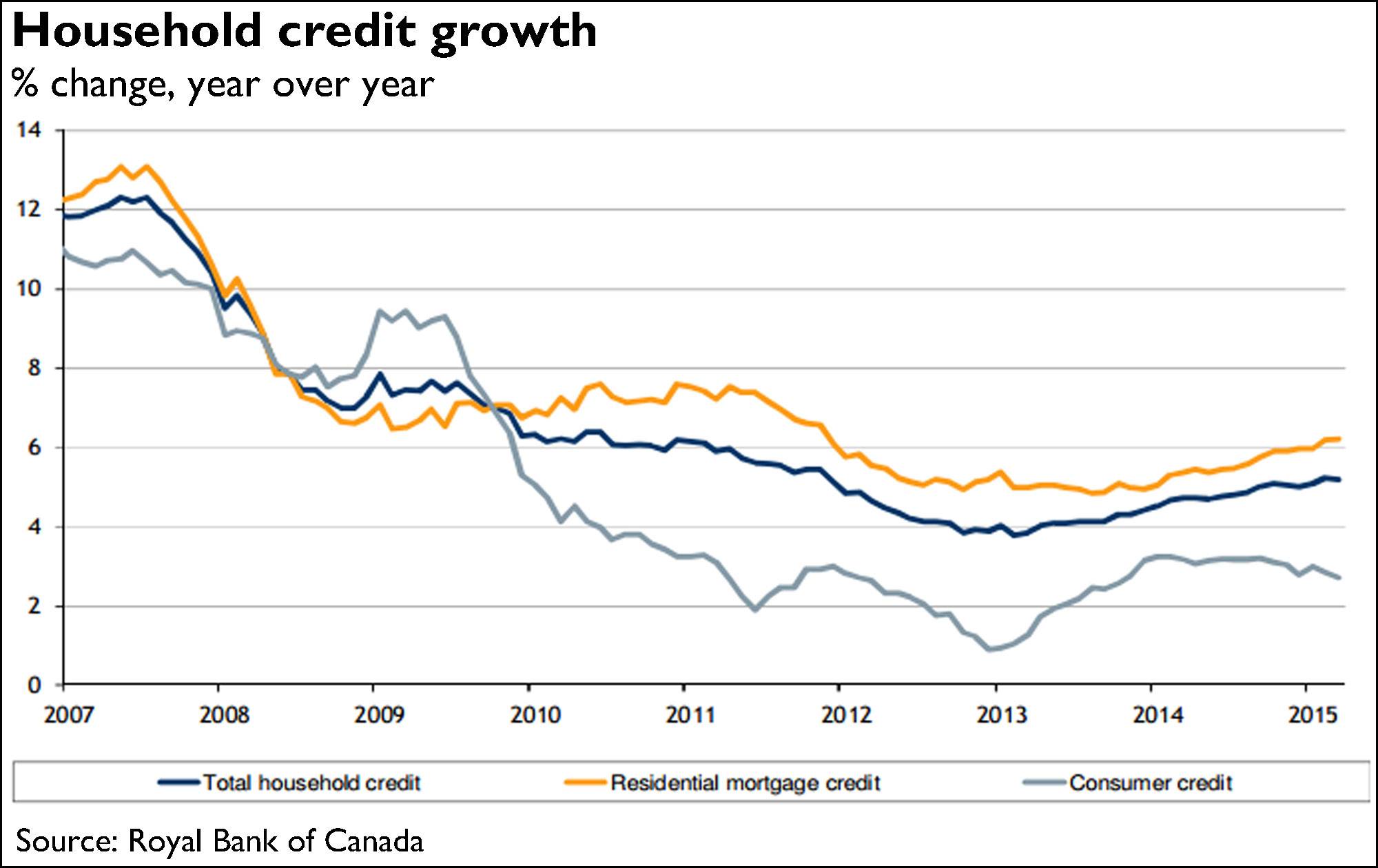

Outstanding residential mortgage balances in Canada now stand at almost $1.4-trillion, up 6.2 per cent in January from a year earlier.

Total credit has climbed to $1.9-trillion.

“Even with consumer credit easing, robust residential mortgage borrowing is keeping overall household credit growth on an upward trend,” said Royal Bank of Canada economist Laura Cooper, noting that January’s rise matched that of December, for the fastest pace since September, 2012.

“The implementation of new mortgage regulations in February may help to temper the appetite for mortgage loans, although given the elevated levels of outstanding debt, these evolving household credit trends are unlikely to materially alter the [Bank of Canada’s] concerns about the level of vulnerability in the financial system,” she added.

A scene I'd love to see ...

“Sorry for intruding.”

Bank of Canada holds

Business investment in Canada remains “very weak” because of the hit to the country’s resource sector, the Bank of Canada warned today as it held its key rate steady.

The central bank’s overnight rate stands at 0.5 per cent, which markets had expected, particularly as it had already signalled it’s waiting to see the extent of the stimulus unveiled by the federal government in its March 22 budget.

As The Globe and Mail’s Barrie McKenna reports, Governor Stephen Poloz and his Bank of Canada colleagues noted the rebound in oil prices, and the subsequent rise of the Canadian dollar.

But both are now averaging levels near what the central bank had expected.

“The Bank of Canada tried to say as little as possible today as it waits to see what stimulus the federal budget delivers,” said chief economist Avery Shenfeld of CIBC World Markets.

“The theme was to minimize any of the good or bad news seen since January, with the picture for economic growth, oil, inflation and the currency all being described as broadly in line with what the [monetary policy report] had assumed,” he added.

“So there wasn’t much concern expressed here about the rebound in the Canadian dollar and its impact on export growth, but nor was there more than a short nod to growth coming in above expectations in Q4 and likely headed that way in Q1.”