Bank of America sees rate cut

Bank of America Merrill Lynch believes the next act by the Bank of Canada may well be a rate cut.

Some observers expect Canada's central bank will move next to hike its benchmark rate, albeit not any time soon. But Bank of America's Emanuella Enenajor and Ian Gordon aren't counting on that.

"As the Fed hikes, the spillover effect of higher long-term rates in Canada will likely tighten financial conditions, reducing the need for any BoC policy tightening," Ms. Enenajor, Bank of America's Canada and U.S. economist, and Mr. Gordon, a foreign exchange strategist, say in a new report, referring to the Fed's first rate hike, expected by the fall.

"Even as the Fed begins a gradual rate hike cycle this year, we think the BoC will remain accommodative, and will likely ease by another 25 basis points to 0.5 per cent if growth disappoints, as we expect," they add in their report, titled "Handcuffed by the Fed."

Governor Stephen Poloz and his Bank of Canada colleagues surprised markets in January with a cut in their benchmark overnight rate to 0.75 per cent, taking out what they called "insurance" amid the oil shock.

But the central bank believes the impact of the plunge in crude prices was "front-loaded," meaning a lame first quarter for economic growth but potentially better times from there on in.

Ms. Enenajor and Mr. Gordon, though, expect that the tighter financial conditions in Canada that will follow a Fed hike will "exert a notable headwind to domestic growth," which could in turn prompt the Bank of Canada to move lower, likely in October.

This all has ramifications for the Canadian dollar, too, and many obsevers expect it to sink again in time.

"In this environment of divergent monetary policy, we see flows into Canadian fixed income struggling, weighing on the demand for the C$ given a sizeable current account deficit," said Ms. Enenajor and Mr. Gordon.

"Together with our assessment that the C$ remains fundamentally overvalued, we remain comfortable with our forecast for USD-CAD to finish 2015 at 1.27."

Referring to the U.S. and Canadian dollars by their symbols, they mean by that the loonie should close the year at over 78.5 cents U.S.

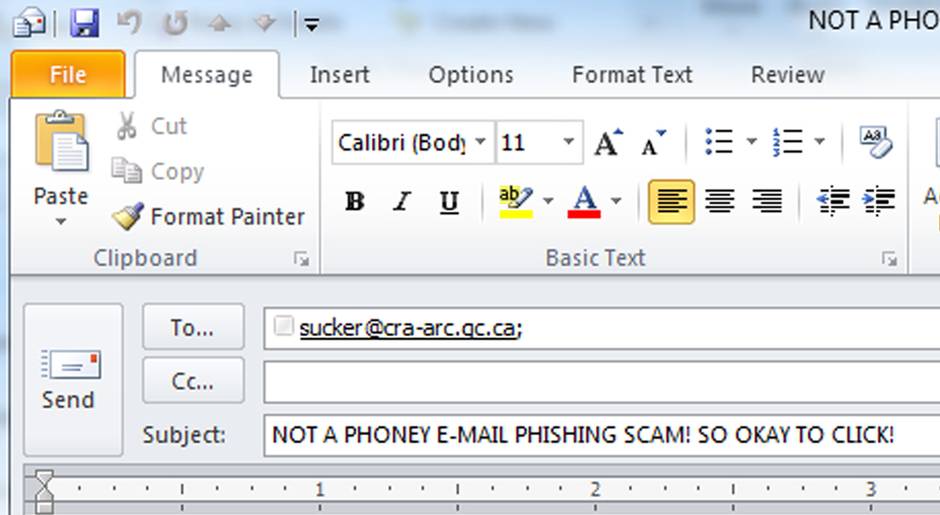

An e-mail I'd love to see

Home sales, prices rise

Canada's housing market continues to perk up.

But you've got to remember that, as housing goes, it's Vancouver and Toronto and then the ROC.

Home sales climbed 2.3 per cent in April from March, and 10 per cent from a year earlier, the Canadian Real Estate Association said today.

Average prices shot up 9.5 per cent from a year earlier. But if you strip out Canada's two hot markets, prices were up just 3.4 per cent.

The MLS home price index, deemed a better measure, rose almost 5 per cent from a year earlier.

"As expected, low mortgage interest rates and the onset of spring ushered many home buyers off the sidelines, particularly in regions where winter was long and bitter," said the Canadian Real Estate Association's president, Pauline Aunger.

Compared to a year earlier, sales climbed in about 70 per cent of Canada's local markets. That, however, was led by British Columbia's lower mainland, Toronto and Montreal.

And here's a key stat: New listings were flat compared to March.

Calgary's housing market is still on the ropes, with prices up only 2.2 per cent, the smallest gain in three years.

Factory sales climb

Canada's manufacturers scored a much better-than-expected sales gain in March, affected partly by the moves in the Canadian dollar.

Factory sales climbed 2.9 per cent, Statistics Canada said, largely on the back of a production boost in the aerospace sector and gains in the auto industry.

That's a rebound from a revised drop of 2.2 per cent in February.

Sales in March gained in 10 of 21 industries measured, accounting for about 60 per cent of all manufacturing.

5.1%

Rise in new factory orders

Aerospace production jumped by more than 42 per cent in March, having tumbled 29 per cent in February.

"As is typical for this industry, fluctuations in the value of the Canadian dollar had an impact on the production, which is measured in Canadian currency," Statistics Canada said.

"The depreciation of the Canadian dollar in March caused the value of sales and inventories held in U.S. dollars to increase."

Factory inventories slipped 0.4 per cent, unfilled orders declined 0.2 per cent, and new orders increased 5.1 per cent.

"Despite recent disappointments, Canadian manufacturing showed signs of life in March," said Nick Exarhos of CIBC World Markets, though he noted that the results were actually mixed given the impact of just two sectors, aerospace and autos.

"The good news is that, despite this month’s outsized improvement, the factory sector still has room to run after a string of weaker figures in the prior months."