Just Society

The first budget from Prime Minister Justin Trudeau’s Liberal government in many ways reflects the principles on which he was raised.

With a more modern twist, of course. That of satisfying the markets.

There's no point in comparing Mr. Trudeau to his father. He’s his own man. But in scanning through yesterday’s budget, one can’t help but note how many of the measures would fit so well in Pierre Trudeau’s famous vision of a “Just Society.”

It’s just for Canada’s indigenous peoples. It’s just for low-income earners and the disenfranchised. And it’s just enough for Bay Street.

Finance Minister Bill Morneau’s document struck a chord among economists and strategists, who believe that Canada’s fiscal standing is such that it can handle a string of deficits, the first one in the area of $30-billion.

The markets weren’t surprised, and the Canadian dollar, though down, didn't fall on the budget.

“Finance Minister Morneau’s budget largely put the meat on the bones of the election campaign platform, albeit with the numbers looking much different given the revenues lost thanks to an economic deceleration over the past year,” said CIBC World Markets chief economist Avery Shenfeld.

“In addition to fiscal stimulus in the short term, the budget reshapes Canada’s support to families with children, and pledges billions in aid for indigenous peoples.”

As The Globe and Mail’s Gloria Galloway reports, those billions are pegged for education, health and social development, though the money is far from immediate.

And, as Erin Anderssen writes, the new Canada Child Benefit puts money in the pockets of families that need it.

And, of course, there’s spending on infrastructure that is meant to give the flagging economy a bit of a bump, bring down an unemployment rate that’s not only elevated but rising, and help those who can’t find work.

This all had to be accomplished without upsetting the markets and jeopardizing Canada’s triple-A credit rating.

So here’s what observers say:

“This is a stimulative fiscal plan, providing a moderate shot in the arm commensurate with a Canadian economy that is growing slowly, but growing nonetheless. The budget responds to economic pressures without breaking the bank, and still leaves the sovereign’s long-term fiscal sustainability on a strong footing.” Warren Lovely, National Bank Financial

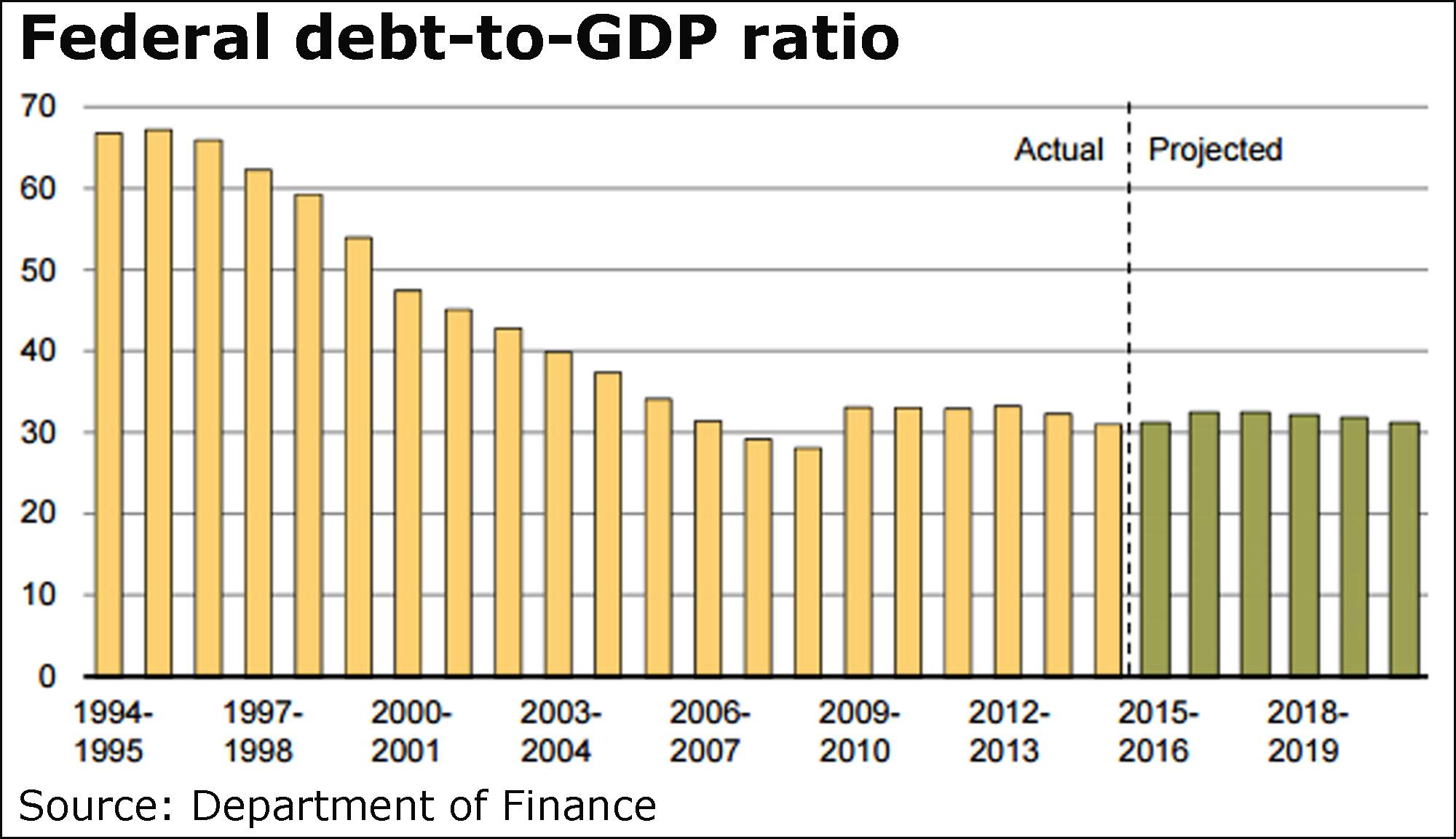

“One notable aspect of the overall medium-term fiscal plan is that after peaking this fiscal year at 32.5 per cent, the projected debt-to-GDP falls back to 31.6 per cent in 2019-20 and 20.9 per cent in the 2020-21 budget, basically returning to pre-Liberal government levels ... in time for the next electoral cycle. This perhaps suggests that the perceived need to demonstrate fiscal restraint might have been one constraint on a more aggressive approach toward delivering fiscal stimulus.” Daniel Hui, JPMorgan Chase

“The Department of Finance estimates that the new measures announced in the budget will boost growth by 0.5 of a percentage point in fiscal year 2016-17 and by one percentage point in fiscal year 2017-18. However, while low- to middle-income families have a high propensity to consume their income, we believe that in the current context where households in Canada are extremely indebted, there is a risk that most of the new Child Care Benefit will be saved rather than consumed.” Charles St-Arnaud, Nomura

“While a balanced budget is not explicit in the forecast, implicitly it may be achieved within the five-year time horizon given both RBC’s relatively more optimistic [economic] growth forecast and the presence of sizable ... annual adjustments for risk. This suggests that any surprise to the fiscal track is likely to be smaller than forecast deficits and a potential balanced budget at some point over the next few years.” Craig Wright and Paul Ferley, Royal Bank of Canada

“New governments often try to make their mark with their first budget, and today’s is no exception. Consistent with election promises, the budget is filled with changes to the tax system, increased spending, and tweaks to a number of programs. Although budget deficits are the order of the day, there appears to be a credible path back to balance. The additional stimulus will help provide some impetus to growth, but is not likely to spur any reaction from the Bank of Canada.” Derek Burleton and Brian DePratto, Toronto-Dominion Bank

“Today’s budget includes net new fiscal measures of $7-billion per year as far out as [fiscal year 2020-21] ... Thus, even five years out, the fiscal plan now includes deficits well above the previously pledged maximum limit of $10-billion. Has the long-term economic outlook changed that dramatically in the past five months? In a word, no.” Douglas Porter and Robert Kavcic, BMO Nesbitt Burns

“Altogether, the household-oriented measures taken by Finance Minister Bill Morneau will contribute to mitigate the risks associated to household indebtedness, by far the largest concern for financial stability in Canada. In comparison to households, the budget provides a softer tailwind to businesses.” Luc Valée and Sébastien Lavoie, Laurentian Bank Securities

A photo of Al Capone I'd love to see ...