Briefing highlights

- Toronto affordability worst in generation

- Economy grows 0.6% in January

- BlackBerry stock surges after earnings

- Dutch launch tax raids on bank

- Trump to order trade practice probe

- Li family buys Reliance Home Comfort

Affordability stressed

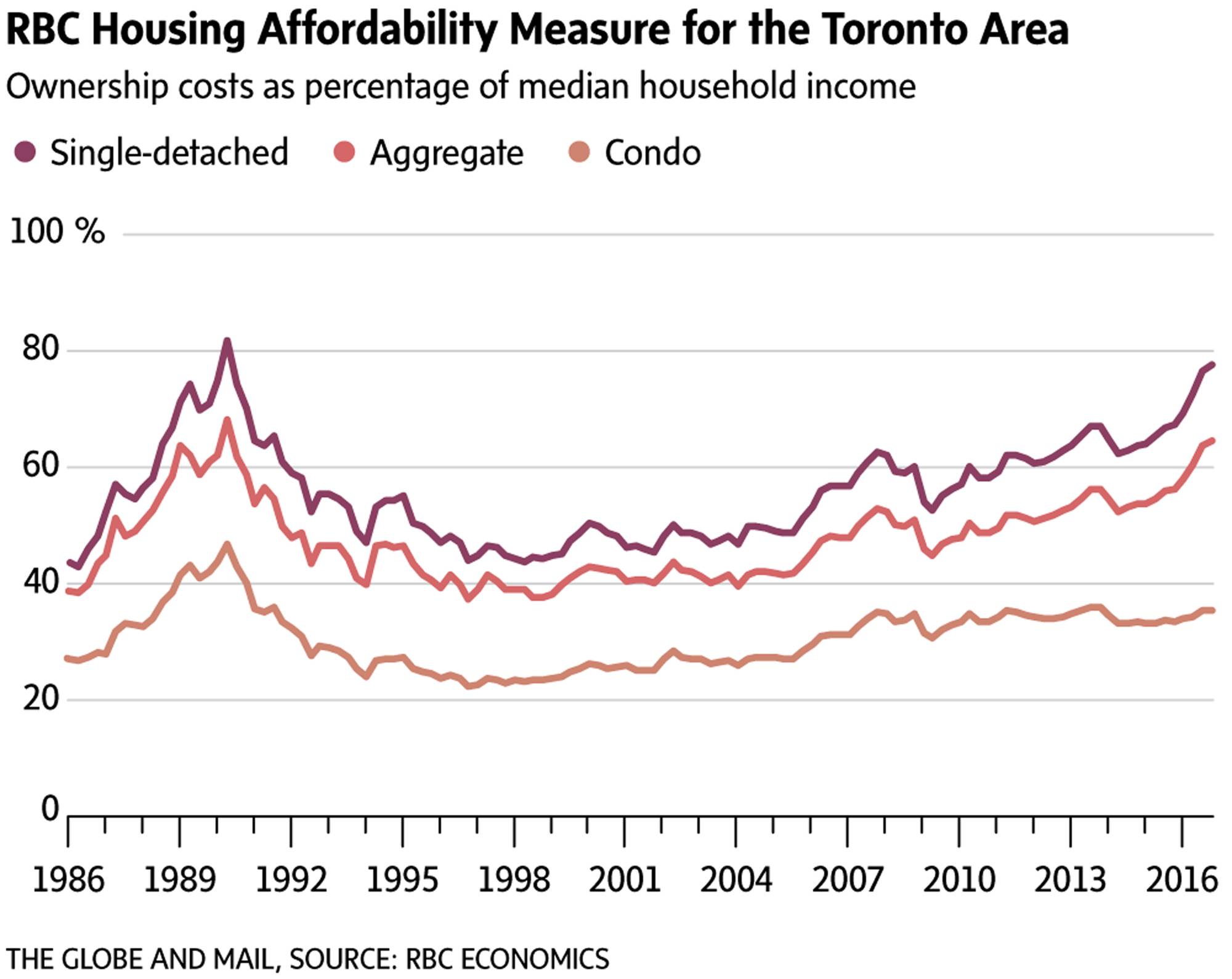

Affording a home in Toronto is the toughest it has been in more than 25 years, Royal Bank of Canada warns.

Which takes us back to 1990, and we don’t want to go there.

Not only that, the “squeeze” is spreading in Southern Ontario, with evidence suggesting the Toronto area is now a “high-risk” zone that calls for government intervention, said RBC chief economist Craig Wright and senior economist Robert Hogue.

Their housing affordability measure – the proportion of median pretax income needed to juggle mortgage payments, property taxes and utility bills – puts Toronto at its most stressed since 1990.

Indeed, the level of 64.6 per cent in the fourth quarter is the worst since the mid-1980s, according to this measure, which is based on a down payment of 25 per cent and a 25-year, five-year fixed-rate mortgage.

“The severe strain afflicting Toronto-area buyers primarily reflects elevated and still rapidly escalating single-detached home prices (resulting from a shortage of supply relative to strong demand); however, increasing condo apartment values also contributed,” Mr. Wright and Mr. Hogue said in Thursday’s report.

“RBC’s affordability data strongly indicate that the Toronto-area market is in a high-risk zone.”

And it’s spreading, the study said, citing nearby areas such as Hamilton and St. Catharines.

Last year’s federal mortgage and tax measures have done little to cool Toronto down, the RBC economists said, and more action may be needed.

“The last time affordability was in such a state (in 1990), Toronto’s housing market subsequently fell into a deep and prolonged slump,” Mr. Wright and Mr. Hogue noted.

“The situation is different this time because most of the affordability stress is concentrated in the single-detached segment – whereas it was pervasive in 1990 – however, recent acceleration in condo prices tells us that stress soon will mount significantly in this segment, too,” they warned.

“Left unchecked, this situation will get worse, putting at high risk Canada’s largest housing market. Further policy intervention would be prudent to avoid a 1990s-style outcome.”

Ontario Finance Minister Charles Sousa has said he’s looking at budget measures to see the affordability burden.

And, as The Globe and Mail’s Jeff Gray reports, Toronto Mayor John Tory said Thursday he’s open to a tax on vacant homes, a move that would hit property speculators.

There are, Mr. Tory said, an estimated 65,000 homes sitting empty in the city.

Economy expands

Canada’s economy kicked off the year in fine form, with growth in January of 0.6 per cent, a far better reading than analysts had expected.

The gains were widespread across the goods and services industries, with manufacturing coming in at 1.9 per cent, Statistics Canada said, noting the factory sector has expanded every month since mid-2016 but for October.

Mining, quarrying and oil and gas extraction also rebounded by 1.9 per cent, having contracted in December.

Blackberry's loss narrows

BlackBerry Ltd. shares surged after the Canadian company posted a narrower fourth-quarter loss.

BlackBerry said its quarterly loss narrowed to $47-million (U.S.) or 9 cents a share, basic, from $238-million or 45 cents a year earlier.

“I am pleased to report that our Q4 results came in at or above expectations in all major metrics,” chief executive officer John Chen said in unveiling the numbers.

“In the quarter, we continued to grow our mix of software and services revenue across the company,” he added.

“In turn, this allowed us to expand our operating margin and report positive free cash flow.”

Authorities raid Swiss bank

Authorities have raided the operations of a Swiss bank across Europe and elsewhere.

No one involved is naming the bank, though Credit Suisse says its “offices in London, Paris and Amsterdam were contacted by local authorities concerning client tax matters,” and that it’s co-operating.

The Credit Suisse statement came as Dutch financial authorities said they raided the offices of an unnamed Swiss bank in the Netherlands, Germany, France, Britain and Australia after a tip-off. Their investigation into suspected tax evasion and money laundering involves dozens of people, they said.

Two people have been detained and assets including real estate, luxury cars, paintings, jewellery and gold have been seized.

Britain’s tax watchdog said separately that it had launched a criminal probe into a global financial institution, an investigation that centres on “senior employees from within the institution, along with a number of its customers.”

Trump to order probe

President Donald Trump is poised to order a study of trade practices among America’s big trading partners.

“Trump is due to sign a new executive order today, starting a 90-day country-by-country review of the U.S. trade deficit (with China’s contribution to receive close attention),” said Elsa Lignos, RBC’s global head of foreign exchange strategy.

“Trump is set to meet Chinese President Xi next Thursday/Friday in the U.S. (Trump warned it wou ld be a ‘very difficult’ discussion but markets have become used to much talk and expecting little action.)”

Want to interact with other informed Canadians and Globe journalists? Join our exclusive Globe and Mail subscribers Facebook group