For more than three decades, the non-profit Toronto Artscape Inc. was one of the few providers of affordable housing and studio space for artists in Toronto, then and now a brutally inhospitable city for financially struggling creatives. In October, 2015, after years of research and planning, the organization announced that it intended to build a much different kind of facility.

It was a left turn that would bring Artscape and its mission to the brink of demise.

Together with The Daniels Corp., a prominent developer that had recently partnered with Artscape on smaller projects, the non-profit announced a plan for something it called Artscape Daniels Launchpad, a new venue that would anchor a complex on Toronto’s waterfront. Artscape was getting into the co-working and incubator game, banking on the same optimism that many tech startups and venture firms had embraced in the 2010s. Financially, logistically and strategically, Launchpad was the most ambitious project Artscape had ever undertaken.

With Launchpad, artists would pay monthly membership fees to access shared spaces and high-cost tools they might need in order to become self-sufficient entrepreneurs, including recording studios and woodworking shops. It was to be a major departure from the non-profit’s many former projects, which had offered living and working space for artists in old, and later brand-new, buildings across Toronto.

The long-gestating project would eventually nab nearly $10-million in federal and provincial funding, and was supported unanimously by Artscape’s board, made up of Toronto developers, financial executives, city councillors, artists and artist-support workers.

“It will be a game changer for artists and designers,” Artscape’s then-chief executive, Tim Jones, said at the time. “A jolt of urban acupuncture that will help bring Toronto’s waterfront to life.”

Launchpad didn’t do any of that. In late August, 2023, suffocating under an unmanageable pile of debt – including $70,000-a-month payments to Toronto-Dominion Bank tied directly to the new facility – the organization revealed that it expected to be placed in receivership. It had fallen victim to its own ambition.

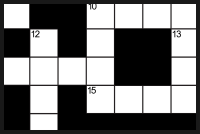

A Globe and Mail analysis, which included an examination of a decade of Artscape’s finances, found that Launchpad was the primary reason for the non-profit’s financial collapse. After Launchpad’s announcement, the cost of the project rose to $31-million, while the non-profit’s debt ballooned, more than doubling from $17.6-million at the end of 2017 to $37.5-million at the end of 2019.

Although Artscape refinanced its Launchpad debt with a fixed-rate loan in late 2021 before interest rates rose, it struggled to repay that debt. Launchpad’s post-lockdown memberships topped out at 500 – just 100 more members than it had in its opening month in 2018. Artscape began restructuring earlier this year, and tried to sell off Launchpad, but couldn’t do so in time.

In early November, the organization announced that its facility management contracts and leases for buildings it didn’t own would be transferred to other non-profits, as it prepared its owned facilities, including Launchpad, for the receivership process.

Grace Lee Reynolds, current Artscape Inc. CEO, acknowledged that Launchpad’s cost and debt were 'the primary contributor to the financial challenge.'Handout

In a statement to The Globe after being presented with its findings, current Artscape CEO Grace Lee Reynolds acknowledged that Launchpad’s cost and debt were “the primary contributor to the financial challenge.”

Jones, who left Artscape in early 2021, said in an e-mail that the large quantities of debt the organization had amassed under his watch were not responsible for the organization’s collapse. Launchpad, he argued, could have been sold at a profit if the pandemic hadn’t hampered demand for commercial real estate. “It is simply not possible to disentangle Artscape’s ability to service debt or exercise its worst-case back-up plan from the impact that the pandemic had on its ability to do so,” he wrote.

But interviews with more than two dozen current and former Artscape staff members, directors, affiliates and artist tenants suggest that the risks presented by Launchpad were overshadowed by exuberance, and that the new facility’s revenue model became a source of worry for insiders months before the pandemic began.

The organization’s August announcement has left members of Toronto’s arts community, one of Canada’s largest, wondering if they will be left in the cold. Artscape’s projects were some of the highest-profile efforts to keep artists in Toronto, where creatives are often priced out of the very neighbourhoods whose reputations they once helped establish.

Artscape played a key role in turning once-sleepy areas, such as the city’s West Queen West and Distillery District neighbourhoods, into global destinations, by giving hundreds of artists affordable places in older, leased buildings, so they could build communities.

As rising real-estate prices threatened that model, Artscape began working with developers to secure space for artists in new buildings, helping creativity thrive in a rapidly redeveloping Toronto.

Among the Artscape tenants now facing an uncertain future is Angela Molina, a sound engineer who has rented a live-work space in Artscape Triangle Lofts, near Queen Street West, since 2015. She discovered in mid-August that water was flooding into her apartment from a floor above. When she moved out temporarily, to Artscape’s Gibraltar Point facility on the Toronto Islands, she began hearing whispers about receivership.

Artscape Youngplace, a former public school, located at 180 Shaw St. in Toronto.Christie Vuong/The Globe and Mail

A few days later, when she returned to the unit, she discovered her point of contact at Artscape no longer had a job with the non-profit. Her unit was a construction zone, with HVAC turned off. As Autumn crept in, she said, Artscape’s troubles made her wonder whether she would have heating for the winter.

Artscape’s publicly disclosed finances suggest Launchpad was a significant risk from the get-go.

Kate Bahen, the managing director of Charity Intelligence, a group that performs financial analyses of Canadian charities – which are very similar in structure to non-profits – said Artscape’s financial decisions were unsustainable. “They pursued a very aggressive expansion, and didn’t have the money to pay for it – it’s as simple as that,” she said, after reviewing Artscape’s finances at The Globe’s request. “I never saw a way for how they were going to service this debt.”

Artscape began in the 1980s as part of the Toronto Arts Council, which was then run by Rita Davies. She co-founded the non-profit with support from the photographer and film artist Ric Amis, and from Dale Martin, who at the time was a Toronto city councillor. In 1991, with operations funding from the city, Artscape leased space for one of its first facilities, in a Toronto Economic Development Corporation-owned building on Atlantic Avenue, in the city’s Liberty Village neighbourhood. This allowed Artscape to sublease 48 studios to artists at below-market rates, across 30,000 square feet.

This strategy was a lifeline for many artists, some of whom, like Amis, lived or worked illegally in warehouses. “Moving into Artscape as a young artist meant that I was paying rent geared to income, which really made it possible to focus on my career,” said Catherine Heard, an interdisciplinary visual artist and University of Windsor professor who spent more than two decades living and working in Artscape’s 900 Queen St. West location, which the non-profit opened in 1995 through a mix of donations and traditional financing. Her one-bedroom live-work apartment’s move-in rent in the late nineties, geared to her income, was about $200, when the market rate was about $700. “It was absolutely critical to me as a young artist,” she said.

Tim Jones, former President and CEO of Artscape. Under Jones, Artscape took a broader view of what was called 'creative placemaking' – the notion that artists add value to communities, both cultural and monetary.Galit Rodan/The Globe and Mail

Artscape spent the nineties securing studio and live-work spaces largely in older buildings around Toronto. It eventually signed a two-decade lease on Gibraltar Point, the site of a former school on the Toronto Islands, which it rented to artists as studio space, and for residencies. Thousands of artists have passed through since 1999, many for short-term residencies. It’s not uncommon to see Artscape thanked in book acknowledgements by authors who have stayed there.

In the late nineties, to oversee its next era, Artscape tapped Jones, who had been general manager of the city’s Buddies in Bad Times Theatre and had helped build out two venues for that organization, including its current home just off Yonge Street.

Under Jones, Artscape took a broader view of what was called “creative placemaking” – the notion that artists add value to communities, both cultural and monetary. The change in tack was due in part to a renewed surge of interest in Toronto real estate and changes to affordable-housing funding. In this economic environment, some of Artscape’s buildings were being put up for sale or redevelopment.

One of Artscape’s first successes in this period was becoming an anchor tenant in the east-end Distillery District in 2003. The non-profit leased space cheaply from a private developer across two heritage buildings and converted it into dozens of subleased artist studios, as well as performing-arts spaces that would become home to Tapestry Opera and Nightwood Theatre.

The gamble worked: the new tenants helped bring visitors to the Distillery, boosting the neighbourhood’s reputation and dining scene, and helping establish it as a premier destination in Toronto. “Many of the projects that Artscape came up with were in response to opportunities that presented themselves, or that we cultivated,” said Celia Smith, Artscape’s president from 2008 to 2016, who now runs the Luminato arts and culture festival.

During Jones’s time as CEO, Artscape became a significant cultural leader in the city. The non-profit converted some boarded-up century-old streetcar barns into Artscape Wychwood Barns in 2008, building on its Distillery District experience. The project included a mix of public space and rental live-work studios. Artscape converted a school just off of Queen Street West into an artists’ hub. And it was starting to be seen as a promising partner for developers, who under provincial legislation could gain extra density for their projects in exchange for community benefits, such as arts facilities.

Christie Vuong/The Globe and Mail

Artscape cultivated close relationships with some of Ontario’s most prominent developers, including Tridel, Great Gulf, MOD Developments, Sorbara Group, DiamondCorp and others. These deals – known as Section 37 agreements, because they are authorized under that part of Ontario’s Planning Act – were mutually beneficial: they gave the developers access to density bonuses, and they generated millions in donations that flowed back to the non-profit.

One of Artscape’s closest relationships was with The Daniels Corp., with which it partnered on projects that helped expand its footprint and services, including an event space in Toronto’s Entertainment District called Sandbox. Artscape ran Sandbox like a social enterprise: the fees it charged to corporate clients helped subsidize the costs of artist and community events there. Daniels also gave Artscape more than $6-million between 2017 and 2019, through the company and its affiliated family foundation.

To energize cities with cultural initiatives, governments around the world have supported artists in myriad ways. Toronto was no different. It gave an annual grant to Artscape, in recent years worth $415,000, to support the non-profit’s operations around the city, making Artscape among the biggest recipients of this type of funding. Artscape has received $5.69-million in these grants since 2008, in addition to $1.84-million in density-bonus grants through the Planning Act over the past seven years.

Some observers felt this amounted to a municipal stamp of approval. For developers who wanted more density, partnering with Artscape “was a good branding idea,” said Oliver Pauk, who runs a competing artist-space organization called Akin, which leases studios in buildings that are slated for redevelopment but have years left before they are scheduled to be vacated.

Over time, some of Artscape’s facilities became sources of frustration – and others no longer exist.

Leasing costs soared at Artscape’s flagship Liberty Village building, and it was eventually sold, its tenants left in the lurch. More recently, the non-profit was unable to extend its 20-year lease in the Distillery District, cutting off 14 per cent of Artscape’s annual revenue and leaving tenants, including Tapestry Opera, scrambling for new spaces.

And within a few years after Wychwood Barns opened, its tenants began raising concerns about noise, unexpected tax bills and lead-paint dust, leading to questions about Artscape’s ability to fulfill its landlord responsibilities there during its ambitious expansion. “I received many complaints about the rents they were charging, and that the support they were giving was frankly minimal,” said former city councillor Joe Mihevc, a past Artscape director whose riding included the Wychwood facility.

Interest in Launchpad was strong at the start – about 400 members joined in a month when the facility opened in November 2018. But growth had slowed by the end of 2019.Fred Lum/The Globe and Mail

Artscape’s closeness with the development sector, which led to the creation of Launchpad, fundamentally transformed the non-profit. It became more widely recognized as a developer for arts facilities than as a support non-profit for artists. “It was no longer an arts organization,” said Davies, the former Toronto Arts Council executive director who co-founded Artscape. She is now chair of the Ontario Arts Council. (She spoke with The Globe only in her capacity as Artscape co-founder.)

From Artscape’s perspective, Launchpad was a natural extension of the non-profit’s long-time mission.

Fresh grads from art and design programs need business skills if they want to strike out on their own, and they rarely have money to build their own studios right away – especially if they need expensive equipment for projects that require recording, editing or manufacturing. By the early 2010s, Artscape staff began realizing that, by providing these tools, the organization could cement itself as a long-term provider of services to artists, avoiding the past plague of temporary leases. So, to launch artists’ careers, Artscape created Launchpad.

The vision of making space for artists had by this time attracted corporate luminaries deeply familiar with the worlds of financing, real estate and fundraising to Artscape’s board – luminaries who, with Launchpad, signed off on a project with a vastly different business model than Artscape was accustomed to.

Directors from this era included chair Robert Foster, founder of the investment banking firm Canada Capital Ltd., who has also chaired other arts boards, including TO Live and the Canadian Arts Summit; his successor as chair, Susan Pigott, a former vice-president of community engagement for the Centre for Addiction and Mental Health and vice-president of fundraising for the United Way of Greater Toronto; secretary Paul Morassutti, a CBRE Ltd. executive vice-president; Richard Simm, a managing director with KPMG Corporate Finance; and Judith McKay, chief client officer at McCarthy Tétrault LLP.

Artscape’s treasurer prior to 2019 was Colin Mowatt, a senior partner with PwC Canada’s tax division. When he reached his term limit, he became treasurer of the Artscape Foundation, an affiliated organization tasked with fundraising for the non-profit. He declined to comment for this story. Artscape’s current board treasurer, Geoff Rush, KPMG Canada’s national financial services leader, deferred to Artscape executives for comment.

Artscape itself provided a response on behalf of the majority of directors from this time whom The Globe contacted for this story. The non-profit cited the board’s unanimous approval of Launchpad and significant due diligence that had led to that approval, including feasibility studies, market reviews and a risk analysis by the board’s finance and audit committee. (Artscape declined to provide The Globe with any of the research that led to Launchpad being approved.) The statement also cited “the need to support the creative community in the entrepreneurial space.”

“Taking all available information into account, the organization pressed ahead with full stakeholder support for Launchpad,” it added.

Initial funding for Launchpad was formally announced in April, 2017: $21.4-million would go toward building and programming costs for a 30,000-square-foot facility nestled in a new waterfront complex built by Daniels. But there were a few devils in the details. Artscape had actually raised only $14-million for the facility’s development and launch costs, $3.5-million of which came from the federal Heritage Department, and $3-million of which was from the Ontario Ministry of Research, Innovation and Science. Another $4.5-million came from “community bonds,” or loans from supporters, which would need to be repaid.

At the time of the announcement, Artscape said the capital costs would be $27.3-million, making Launchpad easily the most ambitious project in its three-decade existence. Despite having a dedicated fundraising arm, the organization had raised only roughly half of what it needed in order to finish building.

Launchpad’s development costs would eventually grow to $31-million. Lee Reynolds, the current Artscape CEO, said that this “could be viewed as moderate, but manageable risk with strong program execution,” but she noted that she and other current managers were not present for these decisions. “The pandemic and economic changes have altered conditions necessary for Artscape’s success,” she said.

Overall, the organization had by then become very comfortable with debt: borrowings of $9.4-million at the end of 2010 increased gradually to $17.6-million in 2017.

But Artscape had little financial wiggle room. Starting in 2016, it continually had negative operating cash flow, meaning its normal, day-to-day business used up more money than it generated.

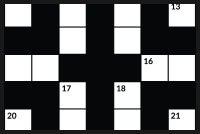

Interest in Launchpad was strong at the start. About 400 members joined in a month when the facility opened in November, 2018. But growth had slowed by the end of 2019: 14 months after Launchpad’s debut, it reported having 1,030 members – an undisclosed number of whom were supported by bursaries raised by Artscape’s foundation. As Artscape tried to draw attention to Launchpad, hosting events with the likes of Margaret Atwood and briefly partnering with HXOUSE, the Weeknd’s creative accelerator, its staff and directors began having tough conversations about the risk they had undertaken.

A Globe and Mail analysis, which included an examination of a decade of Artscape’s finances, found that Launchpad was the primary reason for the non-profit’s financial collapse.Christie Vuong/The Globe and Mail

In two years, Artscape’s borrowings – leases, lines of credit, loans and debt – more than doubled, from $17.6-million at the end of 2017 to $30.2-million by the end of 2018, and $37.5-million by the end of 2019.

Of that debt, $15.6-million was tied to Launchpad. In 2020, a year in which Artscape had to pay interest on the debt in place at the end of 2019, the non-profit reported annual interest expenses of $1.56-million, a 173-per-cent increase from 2017 levels.

But revenue across the organization didn’t keep up. From 2017 to 2019 – the last full year before the pandemic – revenue increased 32 per cent, to just over $14-million. That is a much slower rate of growth than the rate at which Artscape was accumulating debt and associated interest costs. (Artscape noted in a statement that it opened two other projects in 2019 beyond Launchpad, including an event and below-market rental facility in Toronto’s Weston neighbourhood, and a residential building on the city’s waterfront.)

Jones said there is little to be learned by comparing the rate of revenue growth to the increase in debt, describing it in his statement as “not a meaningful statistic.” He continued: “What matters is whether sufficient resources are generated to service the debt, something that Artscape continued to do in these years. This is the story that the financial statements tell.”

Bahen, the charity-analysis expert who reviewed Artscape’s financial statements at The Globe’s request, disagreed with this analysis. “This was obviously a situation where vision and ambition had no grounding in reality,” she said. “When you have this much leverage, you’ve got no margin for error. As Warren Buffett would say: They risked what they had, to double down.”

Four people with knowledge of Artscape’s operations around this time said that its board and staff were increasingly worried, in the pre-pandemic months after Launchpad opened, about whether membership growth would catch up to the debt the non-profit had undertaken. The Globe is not naming the sources because they were not authorized to discuss the matter publicly.

“This references a period that precedes our tenure at Artscape,” Lee Reynolds said on behalf of the non-profit’s leadership when asked about these discussions. “However, we can say that in our experience stabilizing any new operation has risk and we believe the team made informed business decisions for that time and context.”

City of Toronto officials saw Artscape’s financial distress and, even though they were growing more concerned as the pandemic began, continued supporting the organization. “While we weren’t invested in Launchpad itself, we were more invested in how they were going to manage the debt load created through the acquisition of Launchpad,” said Patrick Tobin, Toronto’s general manager for economic development and culture.

Launchpad was made up of 12 separate condominium units, and the commercial real-estate market was on fire. It seemed at the time that in a worst-case scenario Artscape could always sell some if it needed to scale back its ambition. And Launchpad was still new enough that directors felt they had time to refine the business model.

This kind of optimism fuelled big bets at many organizations at the end of the 2010s – a decade of cheap money and few macroeconomic disasters, masking the massive risk that had historically been tied to massive debt. Then the pandemic struck, and the consequences of these kinds of management decisions began to trickle down to everyday people the world over, including the artists Artscape was founded to help.

“Non-profits supporting community service are not set up to withstand sustained economic disruptions – like the pandemic,” Lee Reynolds said. “Artscape did not have reserves to sustain operations at a loss and the arts sector was hit hard.”

When the pandemic began, event-space rentals immediately collapsed, depriving Artscape of about a quarter of its expected annual revenue. Jones announced he was leaving the organization just months into the pandemic, and Lee Reynolds, a former MaRS Discovery District executive, soon took over. She was thrust into managing what, in hindsight, appears to have been a significant decline in the organization’s financial health. Board chair Susan Pigott stepped down during the pandemic as well. Asked to comment for this story, Pigott deferred to Artscape.

The non-profit’s 2021 financial statements show that its earned income – a revenue figure that excludes government grants, such as COVID-19 assistance – was $6.1-million, up 6.7 per cent from the year before. Government grants, meanwhile, were Artscape’s single biggest revenue source in 2020 and 2021. Its debt, while down from 2019 levels, was $33.2-million, nearly double the 2017 amount.

In November, 2021, Artscape consolidated much of the debt tied to Launchpad, including what had grown to $6-million in community bonds, and two debt instruments totalling nearly $8.4-million from Vancity Community Investment Bank, into a $14.4-million mortgage with a lower, fixed rate from Toronto-Dominion Bank.

The TD mortgage required monthly interest-and-principal payments of $70,384.

Artwork is displayed at Artscape Youngplace in Aug. 2023. When the pandemic began, event-space rentals immediately collapsed, depriving Artscape of about a quarter of its expected annual revenue.Galit Rodan/The Globe and Mail

It is difficult to know how much this impacted Artscape’s cash flow through 2022, because the company didn’t complete financial statements for that year. But the non-profit told The Globe in a statement that it had an operating deficit in 2022, and that its long-term debt was consistent that year with 2021. Its actions in 2023 show that it was under serious financial pressure.

This past summer, Artscape began to restructure to reckon with its debt payments. Executives took pay cuts, staff were laid off and those that remained tried to cut costs further. The organization considered selling off its real estate assets to free up funds and build up capital reserves.

It listed the Launchpad space in the Daniels building for sale at a price of $22.5-million – about $8.5-million less than it said it had spent on the waterfront facility. The lower asking price was a result of the continuing commercial real-estate slump.

In July, Artscape asked the City of Toronto to guarantee a $1.5-million extension to another TD loan so it could keep paying bills as it tried to complete the sale.

In a letter to city council’s executive committee, Toronto city controller Andrew Flynn, and Tobin, the city’s general manager for economic development and culture, recommended the city guarantee the credit extension. Artscape was struggling to repay its debt, they wrote, and risked running out of money by mid-August. They said the way forward for Artscape was to return to what it had been before Launchpad spun its finances out of control, with a “core mandate of providing affordable live, work and presentation space for artists.”

Councillors agreed to guarantee the loan extension. But it wasn’t enough for TD. On Aug. 28, Artscape announced that it expected to enter receivership, which would put its assets under the control of a court, or a privately appointed officer, to ensure its creditors were paid back.

Artscape’s portfolio by then tallied 14 projects, 265 affordable rental and ownership spaces, and 125 spaces for commercial tenants. More than a year and a half after most restrictive pandemic lockdowns had ended, Launchpad had 500 members – just a hundred more members than it had a month after opening.

The federal and provincial governments have begun circling Artscape and waiting for a Launchpad sale, to determine whether they can or should recoup the nearly $10-million they sunk into Launchpad together.

The federal Heritage Department had topped up its Launchpad commitment to a total of $6.5-million, through the Canada Cultural Spaces Fund. The commitment contained an “assets disposal clause” obliging the non-profit to maintain Launchpad for a decade for its original purpose, Heritage spokesperson Caroline Czajkowski said in an e-mail. Ontario spokesperson Sumita Kanga said the province is “monitoring the situation and exploring all options, including assessing the potential for recovery of funds.”

Artscape is in the midst of dividing itself up. In early November, the non-profit said Launchpad and the handful of other facilities it owns, including Triangle Lofts, off Queen Street West, would be included in the receivership process. But chief operating officer Kelly Rintoul said in a letter to tenants that Artscape’s many operations and management contracts would be transferred to other non-profits to ensure continuity for tenants and their surrounding communities.

Artscape’s associated housing non-profit, Artscape Non-Profit Homes Inc., is slated to take over operations of all of the rental sites it didn’t already run, including the Parkdale Arts and Cultural Centre. A new non-profit called ArtHubs Toronto Inc., meanwhile, will take over operations at several facilities, including Artscape Gibraltar Point, on the Toronto Islands; Daniels Spectrum, in Regent Park; and Wychwood Barns.

In her statement, Lee Reynolds offered more detail on what Artscape’s soon-to-be-former assets and programs might look like once the process is complete: “With the potential operating partnerships, a renewed vision for the residential properties and community hubs can be realized, debt-free, with refocused operations and a stronger foundation in place.”

For all the effort Artscape’s remaining staff have put into continuity, the people who served the organization, and the people it served, still have little closure. Former rank-and-file employees are trying to figure out their severance terms after doing everything they could to keep Artscape alive in the aftermath of its former executives’ and directors’ expensive decisions.

Meanwhile, artists in affordable rental apartments, whose homes are now about to go to a receiver, are writing to city councillors to express concern that whoever takes over won’t keep their rents affordable. At least one tenant in Triangle Lofts isn’t even sure it’s healthy to live there anymore.

Molina, the sound engineer, said on Friday that her heat was still not working, even after weeks of piling blankets atop her young son so he could sleep. She still doesn’t know when her walls will be rebuilt, either, nearly three months after the flood. Artscape’s financial and management paralysis has left her torn.

“If it wasn’t for them, I wouldn’t be able to maintain my independence the way I do,” she said. “It’s hard – to be disrespected by something I trusted with my life, and my family’s health and safety.”

Editor’s note: A previous version of this story said the heat in sound engineer Angela Molina's apartment had been restored; it was still off as of Friday, Nov. 10.

Josh O’Kane

Josh O’Kane David Milstead

David Milstead Greg Mercer

Greg Mercer