Briefing highlights

- Of household debt and home prices

- Oil prices climb on weekend agreement

- Canadian dollar tops 76 cents

Raising hairs

Here are some charts that should raise the hair on the back of your neck.

Or, given how often Canadians have been warned about high levels of household debt and home prices, some eyebrows, at least.

They’re from a quarterly report released over the weekend by the Bank for International Settlements, a global body made up of central banks, which in a previous review already had singled out Canadian consumers for naughty borrowing habits.

They also come during a key week for debt and housing numbers, with reports on tap from Statistics Canada, the Bank of Canada and groups that measure home prices.

Household debt has been a huge issue in Canada, tied to the run-up in home prices, which have cooled in some cities of late.

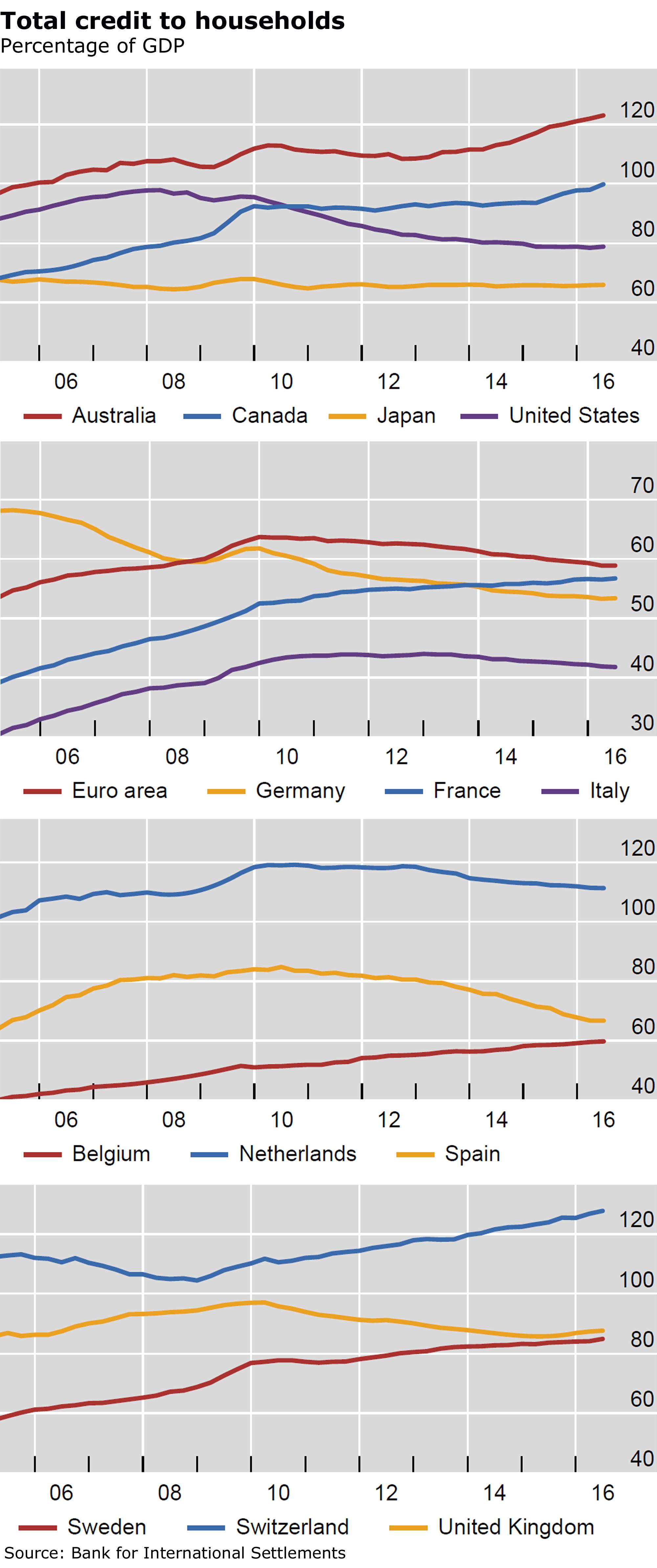

This first chart speaks for itself. Canadian household debt, as a percentage of gross domestic product, certainly isn’t the highest among major developed countries, but it’s way up there.

We’ll get a fresh look on Wednesday, when Statistics Canada releases its quarterly report on debt and wealth.

While we’ve been getting richer as home prices and stock values rise, our debts have been getting that much fatter.

The Wednesday report is the one that includes the key measure of household debt to disposable income. Whether the latest reading is up a bit or down a bit almost doesn’t matter, given the exceptionally high level at which it now stands.

But for the record, Bank of Montreal chief economist Douglas Porter expects to see a fresh record of almost 170 per cent.

“Household debt growth continues to chug along at a 5.2-per-cent year-over-year clip, while disposable income growth labours along at about a percentage point slower,” he said.

Which tells you why what’s happening is happening.

Royal Bank of Canada economists, on the other hand, expect to see a wee dip to 166.9 per cent in the third quarter from the 167.6 per cent of the previous three-month period, because the federal government’s child benefit cheques, which were sent in July, are helping us out.

“Growth in assets and net worth should also have outpaced the increase in debt outstanding in the quarter,” they added.

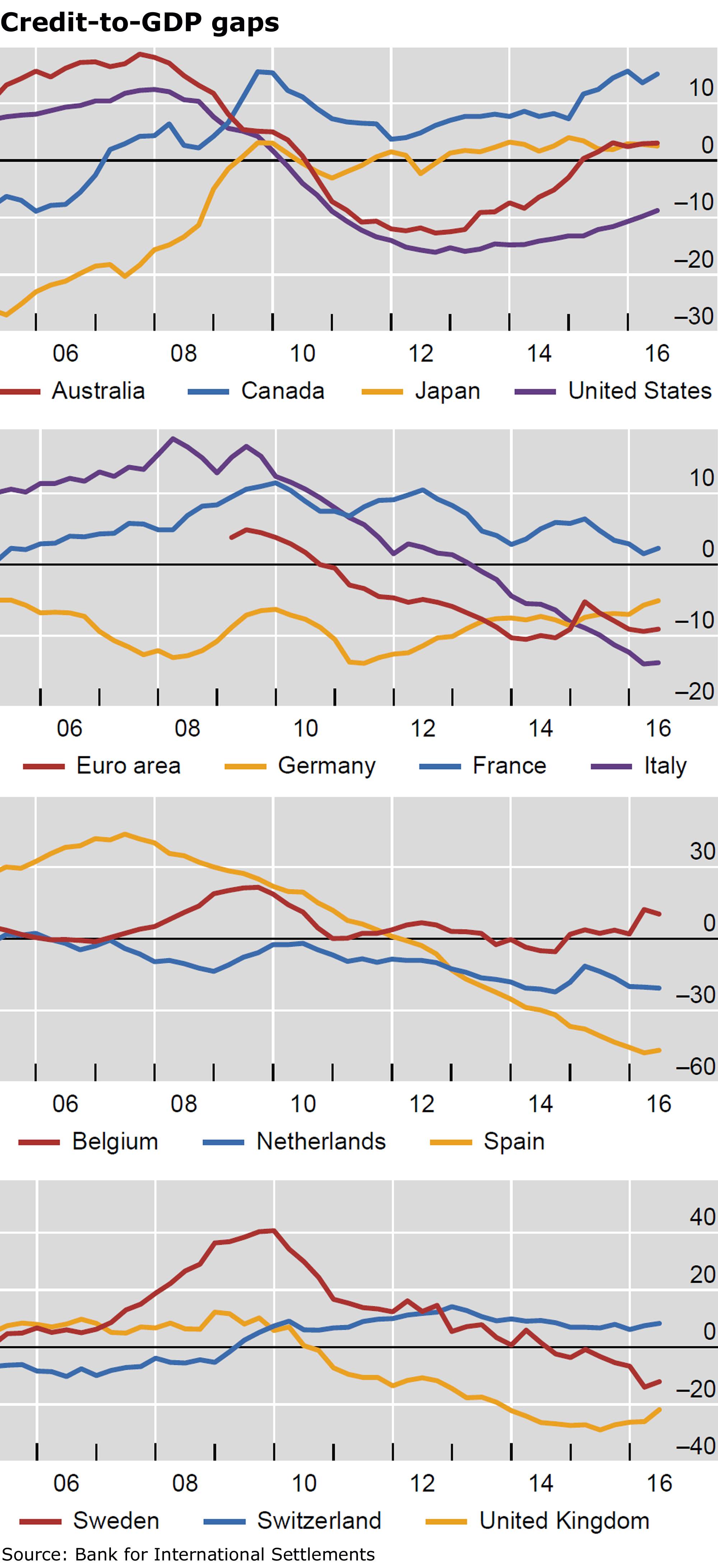

In a previous report, the BIS red-flagged Canada, warning of likely stress on the banking system because of the credit surge.

It noted an elevated credit-to-GDP “gap,” the difference between credit-to-GDP and its long-term trend. That takes in all credit to the non-financial sector, including loans and other instruments such as debt securities.

Here’s where that stands now:

Many economists believe that Canadian families are generally in okay shape, despite the debt burden and absent a shock such as a spike in unemployment or a sudden rapid rise in borrowing costs.

Remember, too, that Ottawa recently brought in new mortgage and tax measures aimed at cooling our credit appetite and heading off a popped housing bubble.

“We have consistently been in the ‘sky-is-not-falling’ camp on this issue, and would point out that the household savings rate has quietly hit its highest level since 2000 (5.8 per cent in Q3),” Mr. Porter said.

Looking ahead, economists believe the housing market will cool further. Sales are already slumping in Vancouver, in the wake of a separate provincial tax on foreign buyers of Vancouver area properties, and the pace of growth in Toronto is expected to ease as people are increasingly priced out of the market.

“The housing market started to slow in Q3, but debt burdens continued to build faster than income gains,” said Mr. Porter’s colleague, BMO senior economist Benjamin Reitzes.

“The new mortgage restrictions should restrain housing activity (and in turn borrowing) in 2017, suggesting the debt ratio could start to flatten out somewhat next year.”

This week also brings the Bank of Canada’s financial system review, which no doubt will again highlight the debt surge and high home prices as points of vulnerability.

“The BoC has been supportive of recent macro-prudential measures ... but remains likely to see elevated household debt as a key vulnerability to the system,” said the RBC economists.

“Indeed, while Vancouver has shown signs of moderation, Toronto-area home prices have continued to rise,” they added.

“As well, the recent jump in long-term interest rates, which received a mention in the [Bank of Canada’s] short December rate statement, should get some attention from a financial-conditions perspective.”

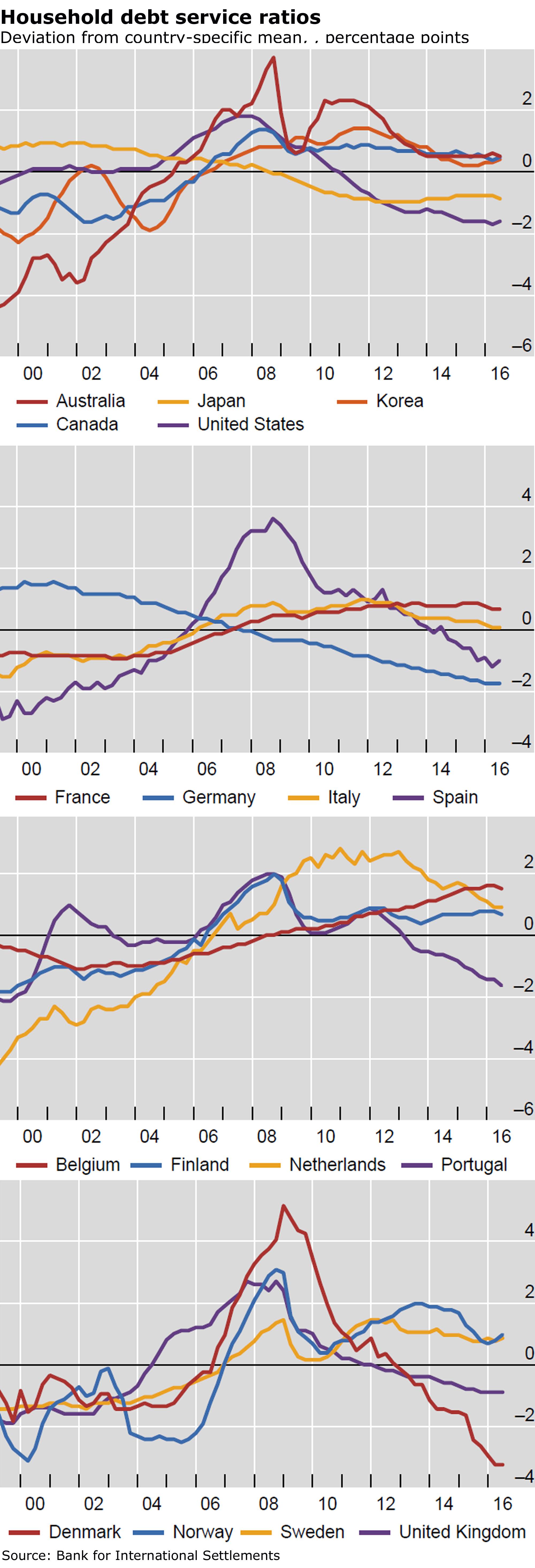

Note how the blue line pokes its head just above the others in this chart, below.

Two housing reports this week may also show markets cooling, but for Toronto. We’ll see both the Teranet-National Bank home price index and the Canadian Real Estate Association’s monthly look at sales and prices.

The latter, said BMO’s Mr. Reitzes, is likely to show sales flat compared to a year ago.

“The new mortgage rules took effect in the second half of October, weighing on activity mostly in higher-priced markets,” he said.

“Vancouver continues to to be hid hard by the foreign buyers tax and now the mortgage rules, driving sales down nearly 40 per cent year over year,” he added.

“Contrast that with Toronto, where sales remained red hot, surging over 15 per cent year over year.”

Expect to see average price increases stay “relatively healthy” at about 6 per cent, compared to a year earlier, and the MLS home price index, which is deemed a better measure, up by about 14.5 per cent.

Oil prices climb

Oil prices are surging after the weekend production cut deal between OPEC and non-OPEC producers, and the Canadian dollar is above 76 cents U.S.

“Nevertheless, as the price of a barrel rises, an increasing number of oil producers are expected to reach the breakeven point and return to the market,” said London Capital Group senior market analyst Ipek Ozkardeskaya.

“At around $70/barrel, we expect many producers ... will restart producing. Therefore, the depth in the supply side could rapidly jeopardize the recovery in the mid-term.”

Investors, of course, are also waiting for the big event of the week, Wednesday’s decision by the Federal Reserve, which is expected to raise its benchmark rate.

“There should be no surprises around this meeting, though the press conference will take on an even greater significance in the context of the signalling of Fed intentions in 2017, as regards further rate rises,” said CMC Markets chief analyst Michael Hewson.