Briefing highlights

- Analysts believe Bank of Canada won't act

- What to expect on debt, home prices this week

- Video: Why rudeness at work is contagious

Hot markets

Analysts don’t believe the Bank of Canada will move to cool the Vancouver and Toronto housing markets and curb runaway consumer debt, as former governor Mark Carney threatened to do.

They also believe, as does current Governor Stephen Poloz, that the first attack against bloated mortgage debt should be via government policy, rather than monetary policy.

“While moves to boost housing supply and control foreign demand may be helpful, the first line of defence is tried and true macroprudential rules tightening, similar to what we’ve already seen,” said Emanuella Enenajor, the North America economist at Bank of America Merrill Lynch.

Ms. Enenajor cited several government moves in Canada over the past several years, including reducing maximum amortization and capping loan-to-value ratios in refinancings. There have been other moves, as well.

“Research by the [International Monetary Fund] suggests that the major moves to tighten mortgage rules were effective in slowing mortgage credit growth,” Ms. Enenajor said in a report titled “How do you solve a problem like a housing bubble?”

Like other analysts, Toronto-Dominion Bank economist Diana Petramala believes Mr. Poloz will leave the housing market to governments, and thus won’t raise his benchmark interest rate until 2018.

And like others, she noted the strength of the job markets in both Ontario and British Columbia, which, bodes well for housing.

“Regardless of the source of the sharp acceleration in home prices, the one undeniable implication is the rising risks related to the surging amount of debt households have to take on to make these expensive purchases,” Ms. Petramala said.

“The Bank of Canada highlighted a concern over the rising share of households carrying debt loads of more than 450 per cent of income in both Toronto and Vancouver and increasingly relying on 30-year amortizations to make their debt payments more affordable,” she added.

“Households are now taking on more and tying themselves to it for even longer.”

Having said that, economists such as Ms. Petramala don’t fear a crash unless the economy dives or interest rates suddenly spike, and that’s not in the forecast.

And on that note

We’ll see just what Ms. Enenajor and Ms. Petramala are talking about this week when Statistics Canada reports on consumer debt and two groups release fresh readings of the housing markets.

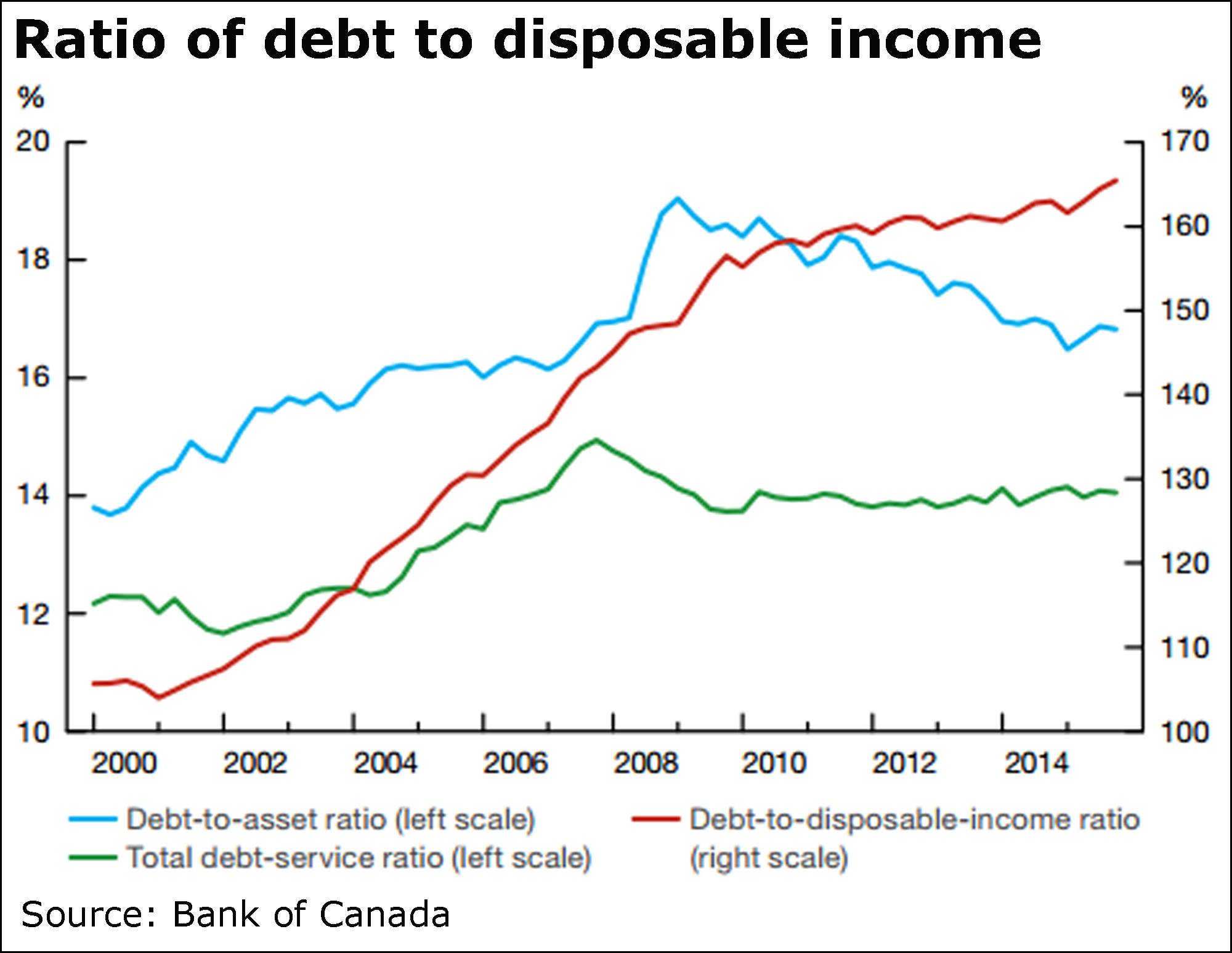

The federal agency releases its quarterly look at wealth and debt tomorrow morning, which may show another rise in the key debt-to-income ratio. That measure, which has been climbing relentlessly as growth in the former outpaces that of the latter, stood at bloated 165 per cent last year.

“Fortunately, income growth improved slightly (the debt-to-income ratio uses a four-quarter moving average), which should help limit the increase in the debt ratio,” said BMO Nesbitt Burns senior economist Benjamin Reitzes, noting that tomorrow’s report also includes the latest peek at the assets of Canadian families.

“After rising to just shy of a record high ... net worth as a share of disposable income likely breached that barrier as home prices continue to rise sharply and a weaker loonie boosts foreign asset values,” he added.

“Over all, debt loads may be significant, but interest rates are low and unlikely to rise soon, leaving Canadian balance sheets in decent shape.”

This week also brings the Teranet-National Bank home price index, and the monthly report from the Canadian Real Estate Association, which Mr. Reitzes forecast will show a rise of 9.5 per cent in sales, from a year earlier,and 15 per cent in prices in May.

“With mortgage rates likely to stay low for some time, as long as job growth holds up, housing looks to maintain decent momentum this year,” Mr. Reitzes said.

Microsoft to buy LinkedIn

Microsoft Corp. is getting awfully social, striking a $26.2-billion (U.S.) deal today for LinkedIn Corp.

Microsoft is offering $196 a share, sending LinkedIn’s shares surging.

The tech giant said it will be issuing new debt to fund the deal

“Today is a re-founding moment for LinkedIn,” Reid Hoffman, the social network’s chairman and controlling shareholder, said in a statement.

Penn West climbs

Penn West Petroleum Ltd. shares surged nearly 50 per cent today after the oil producer agreed to sell one of its main producing areas to ease a crushing debt burden, The Globe and Mail’s Jeffrey Jones reports.

Penn West said late Friday it will sell its Viking Dodsland property in Saskatchewan to privately held Teine Energy Ltd. for $975-million. It will jettison production of nearly 14,000 barrels a day.

It struck another deal to sell Alberta assets for $140-million.