Debt burden to grow

Canadian families are following their governments by going deeper into debt.

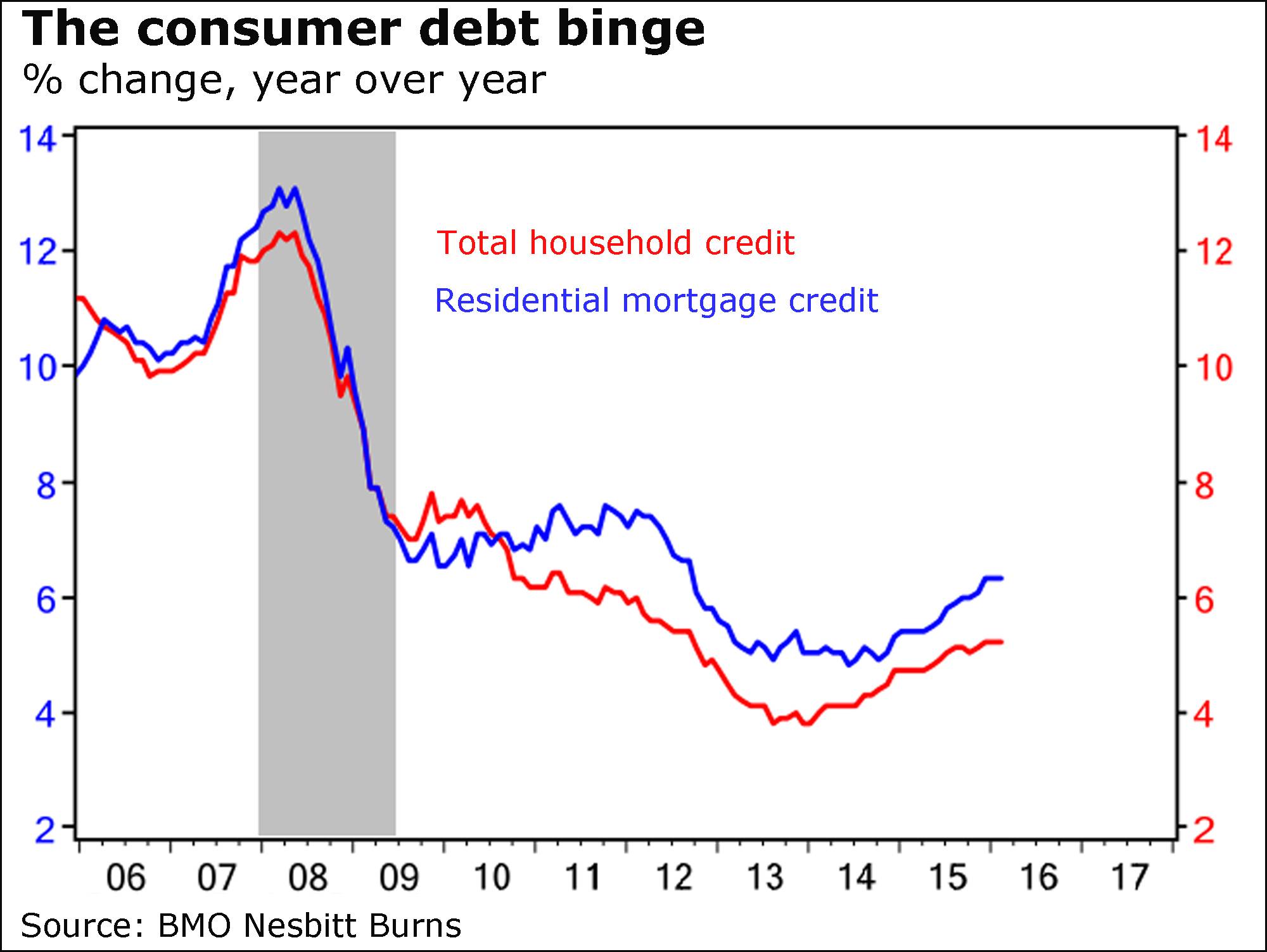

The consumer debt binge had been showing signs of easing, but the latest numbers show it speeding up again, sparked by ultra-low interest rates and rising property values.

“Total Canadian household credit growth remains very healthy - perhaps too healthy,” said BMO Nesbitt Burns chief economist Douglas Porter, citing the latest Bank of Canada statistics that show overall credit up 5.2 per cent in February from a year earlier.

That, Mr. Porter said, matched the January number and outpaced the 4.7 per cent of a year earlier.

“These robust results are being paced mostly by mortgage growth, which has popped 6.3 per cent in the past year, the highest in almost four years,” he added.

“Last year’s BoC rate cuts and the relentless strength in housing markets in two certain cities are driving mortgage growth.”

Those two cities, of course, are Vancouver and Toronto, where home prices are climbing ever higher, raising fears of a frothy market.

It’s not just debt that is growing, but also the debt burden, as measured by the key debt-to-income ratio, which, according to the last reading by Statistics Canada, stood at an elevated 165.4 per cent in the fourth quarter.

That’s because debts are rising faster than disposable income, at a “much milder” annual rate of 3.4 per cent last year, Mr. Porter said.

“In other words, the much-hyped debt/income ratio is poised to keep right on rising in coming quarters,” he added, possibly at an even faster pace that Canada has seen recently.

Word of the day

Wynnefall

The proceeds from pricey dinners in Ontario and B.C.

Yellen lights up markets

Global markets are on the rise so far in the wake of Federal Reserve chair Janet Yellen’s dovish comments yesterday.

“Janet Yellen’s speech has enlivened what threatened to be a dull few days,” said IG senior market analyst Chris Beauchamp.

Tokyo’s Nikkei was the sole loser today, down 1.3 per cent.

Hong Kong’s Hang Seng surged 2.2 per cent, and the Shanghai composite 2.8 per cent.

In Europe, London’s FTSE 100, Germany’s DAX and the Paris CAC 40 rose by between 1.6 and 1.8 per cent.

North American markets also climbed.

“Her speech was taken as notably dovish, cancelling out some of the ‘April hike’ calls from the previous week, with the usual reaction of a falling U.S. dollar and surging equities seen yesterday [afternoon],” Mr. Beauchamp said of Ms. Yellen.

“The good feeling has carried over into Europe, and it may well be that the period of consolidation and modest declines has come to an end.”

The Canadian dollar also climbed as the U.S. currency weakened, topping the 77-cent mark today.

The loonie traded in a range of 76.5 cents U.S. to 77.4 cents by midday.

“The strong dollar gave up the ghost yesterday in the aftermath of Yellen’s fairly dovish speech,” London Capital Group chief analyst Brenda Kelly said of the greenback.

“The use of the word ‘gradual’ and the need to proceed ‘cautiously’ given global risks was construed by the markets as a signal that further monetary tightening was by no means imminent.”

Lululemon gains

Lululemon Athletica Inc. shares surged today after the yoga retailer posted a jump in fourth-quarter profit and boasted that it topped the $2-billion mark in annual sales for the first time.

Quarterly profit climbed to $117.4-million (U.S.), or 85 cents a share, from $110.9-million or 78 cents a year earlier.

Revenue rose to $704.3-million from $602,491.

For the year, profit rose to $266.1-million from $239-million, or $1.90 a share from $1.66, as revenue hit $2.1-billion.

Lululemon also projected first-quarter revenue of between $483-million and $488-million, and diluted earnings-per-share of 28 cents to 30 cents.

For the fiscal year, the company forecast sales of about $2.3-billion and diluted earnings per share of $2.05 to $2.15.