Briefing highlights

- Seniors face housing woes

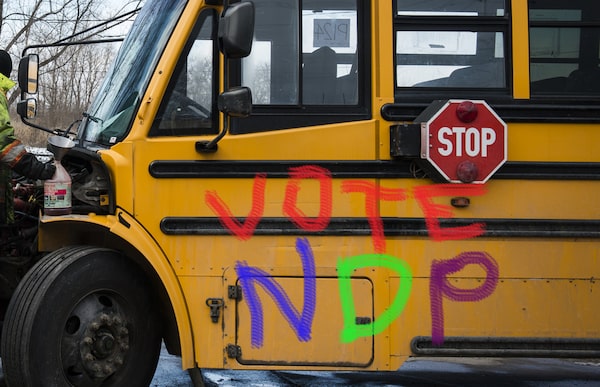

- An NDP scene I’d love to see

- Canada’s jobs market stalls

- But growth in wages perks up

- Markets at a glance

- Thomson Reuters beats estimates

Gimme shelter

The fortunes of so many baby boomers are a-changin’ again.

Anything seemed possible back then, when those Dylan lyrics were our anthem. Now, we wonder if we can pay the rent.

There’s a housing crisis in Canada, rating agency DBRS Ltd. warns, and it spells particular trouble for seniors.

Our baby boomers face “a severe housing shortage” amid low vacancy and supply of shelter, along with surging rental rates, Stephanie Hughes, Karen Gu and Erin Stafford of DBRS warned in a study.

“Housing is a national crisis that generally affects all Canadians regardless of age,” Ms. Hughes, Ms. Gu and Ms. Stafford said.

“However, it is especially a problem for seniors who tend to have specific housing needs,” they added.

“Affordable housing is becoming increasingly out of reach for those who rely on a fixed income, but the market’s investment prospects may change the tide of this issue, providing a greater unit supply for the ever-aging population.”

The focus among policy makers and the media is more on the national picture than on shelter for seniors, Ms. Gu added in an interview.

Using Canada Mortgage and Housing Corp. numbers, Ms. Hughes, Ms. Gu and Ms. Stafford tracked general 2017 rental rates across the provinces, from Quebec’s low of $1,678 a month to Ontario’s high of $3,526.

“Between 2013 and 2017, the national average rental rate increase was 4.7 per cent, year over year,” they said.

“Assuming this percentage increase persists, national average rent rates could reach just over $4,000 a month by 2025. Keeping up with this rate will become increasingly difficult, especially for those on a fixed income.”

Then there are retirement homes, which DBRS rates from a credit perspective and which I’m sure most of us couldn’t envision when we were singing about my generation.

Rates here range from about $1,000 a month for standard units to almost $5,000 for something more luxurious.

(And we can’t just camp out anymore.)

“Vacancy is a well-observed issue among the properties, with an average occupancy rate of 95.1 per cent,” the researchers said.

“With an average rent of DBRS-rated senior homes is around $3,552, which is more than double the $1,206 national rent rate for regular housing.”

DBRS, they said, has inspected luxury properties through the years and found them “well stocked with features and services.”

Indeed, they “seem more like a full community” than just apartments, with everything from piano lounges and libraries to spas and chapels.

(Well, there’s an answer to that last one if you can’t get in: And no religion, too.)

Added to this is the fact that we’re living longer (which I’m thankful for now), with the over-80 set expected to top 3.3 million people by 2036. Those older than 100 could top 20,000 by then.

(Remember that whole thing about people over 30 being old?)

“The growing senior population is putting a strain on the availability of current supply,” said Ms. Hughes, Ms. Gu and Ms. Stafford.

“More senior housing units are being developed nationally each year in an attempt to match this growth. However, the issue is that the rate of supply growth is not enough to match the senior population incline.”

You can’t just fix the problem by “laying out construction plans,” given the regulatory standards.

“This can make it more complicated for investors to be approved to develop and manage properties designed for seniors,” the researchers said.

Read more

- Matt Lundy: How much can you spend on a home? It may have changed drastically

- Rob Carrick: Is your bank shafting you on rates for mortgages, lines of credit?

- Ugh, it’s getting tougher to be debt-free, particularly for seniors

A scene I’d love to see

Photo illustration

Read more

Jobs market stalls, wages up

Canada’s jobs market stalled in April, with unemployment holding steady at 5.8 per cent.

On net, the economy lost 1,100 positions, Statistics Canada said today.

Employment is now up 1.5 per cent, or by 278,000 positions, from a year earlier. Full-time employment is up by 378,000, or 2.6 per cent, and part-time work down by 100,000 or 2.8 per cent.

Wage growth, so key to the Bank of Canada, sped up to 3.6 per cent on an annual basis.

Of course, “that is being flattered by the impact of minimum wage increases earlier in the year,” said Andrew Grantham of CIBC World Markets.

“In whole, while the numbers disappointed on the headline, the detail was fairly solid, and there shouldn’t be much impact in markets today,” Mr. Grantham added.

“However, we noted prior to the release that, in our view, it would take a standout figure for the BoC to hike later this month. We didn’t get that, and, as such, maintain our call for a July hike.”