SUPPLIED

Human nature is to blame but self-discipline can keep investors on track, says award-winning senior portfolio manager Thane Stenner

The March 2020 pandemic-driven market plunge is still fresh in the minds of many investors. It’s hard to forget the stomach-churning feeling of watching your portfolio value plummet seemingly overnight. It was even tougher to stand by and watch it happen.

Thane Stenner, senior portfolio manager, Stenner Wealth Partners+ of Canaccord Genuity Wealth ManagementSUPPLIED

Not all investors had the courage to sit tight: Some panicked and sold their equities. Those who remained invested were richly rewarded by the relatively quick market rebound.

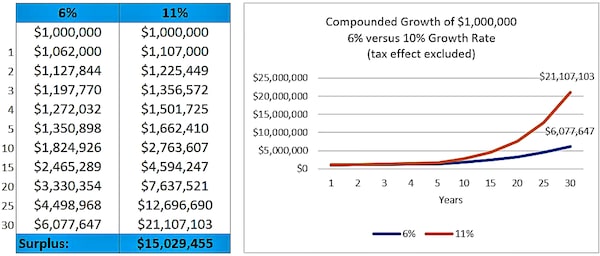

Investing for the long term and not getting spooked by short-term market volatility can pay off. Consider Dalbar’s most recent annual Quantitative Analysis of Investor Behaviour survey that shows the average equity fund investor has seen an annualized return of 6.2 per cent over the past 30 years as of Dec. 31, 2020, compared to a 10.7-per-cent annualized return for the S&P 500 for the same three decades.

Why the big difference? Human nature is to blame for the average investor’s underperformance compared to the index. Behavioural finance teaches us that investors are too often driven by emotion, including buying high and selling low, which can impact their long-term portfolio performance.

SOURCE: Stenner Wealth Partners+ of Canaccord Genuity. www.stennerwealthpartners.com CANACCORD GENUITY WEALTH MANAGEMENT IS A DIVISION OF CANACCORD GENUITY CORP., MEMBER-CANADIAN INVESTOR PROTECTION FUND AND THE INVESTMENT INDUSTRY REGULATORY ORGANIZATION OF CANADA.SUPPLIED

Imagine if you had invested $1-million at the start of those 30 years: With a 6.2-per-cent annualized return, you’d have $6.1-million, but with a 10.7-per-cent annualized return, that number would be around $21.1-million – a difference of more than $15-million.

“It goes to show the value of taking a long-term and disciplined investment approach,” says thane Stenner, a senior portfolio manager and senior investment advisor with Stenner Wealth Partners+ of Canaccord Genuity Wealth Management, who works with ultra-wealthy clients with $25-million+ net worth across Canada and the U.S.

“Investing also requires introspection. You need to know thyself and the risks you’re willing to take,” Mr. Stenner adds.

Data as of December 31, 2020 SOURCE: Dalbar, Quantitative Analysis of Investor Behaviour SurveySUPPLIED

He recommends investors work with an experienced investment advisor to fully understand their risk tolerance and develop a personalized wealth management plan – then stick with it, through good markets and bad.

“A good investment advisor is someone who helps you stay disciplined by going against that natural human instinct to sell low or buy high,” Mr. Stenner says. “The best advisors I know are also behavioural coaches who help you keep a steady hand.”

Looking for more market insights? Listen to Thane’s podcast here: https://stennerwealthpartners.com/bnnbloombergpodcasts

Contact Thane Stenner at SWP@CGF.com or call 1 833 STENNER (783 6637)

Advertising feature produced by Globe Content Studio with Stenner Wealth Partners+ of Canaccord Genuity. The Globe’s editorial department was not involved.