iStockPhoto / Getty Images

We’ve all heard the saying that the only guarantees in life are death and taxes. Another certainty is that taxes will be going up as governments look to pay down debt and deficits that have ballooned since the onset of the COVID-19 pandemic.

Thane Stenner, senior portfolio manager, Stenner Wealth Partners+ of Canaccord Genuity Wealth ManagementSUPPLIED

The rising costs from the effects of climate change on our land and infrastructure – as seen with the recent flooding in B.C. and on the East Coast – and the impact of an aging population on our health care system, are also expected to lead to even higher taxes in the future.

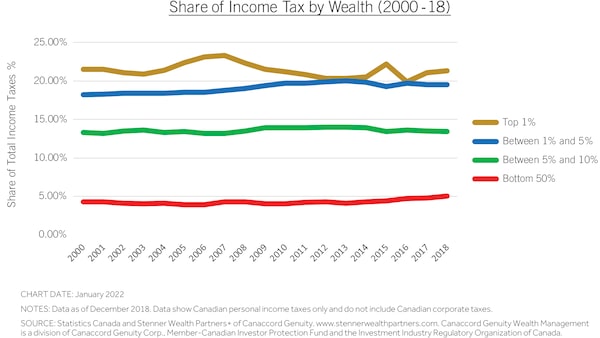

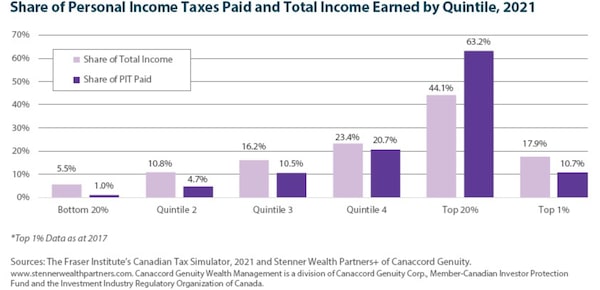

Some say the wealthy should pay more taxes – which they arguably already do. Canadian top-income earners pay nearly two-thirds of the country’s personal income taxes, while the top 1 per cent pay more than 20 per cent (see chart). These numbers compare to the bottom 50 per cent of income earners, who pay just 5 per cent in aggregate.

SUPPLIED

What do these numbers tell us? High-net-worth (HNW) and ultra-high-net-worth (UHNW) Canadians should expect to continue to pay more than their share of tax in the years to come.

That already higher portion could even grow if the government increases the percentage of tax wealthy Canadians pay, which is being proposed in other countries like the U.S.

“There’s little doubt that those who generate the most income should expect to see their tax rate increase in 2022 and beyond,” says Thane Stenner, an investment advisor and senior portfolio manager with Stenner Wealth Partners+ of Canaccord Genuity Wealth Management, who works with ultra-wealthy clients with $25-million+ net worth across Canada and the U.S.

SUPPLIED

Mr. Stenner says HNW and UHNW investors may need to reposition their portfolios to account for additional taxes – and the time is now.

“Tax-advantaged investments are going to become even more important than ever,” he says. “You need to make sure that your portfolio is well-positioned.”

Looking for more wealth insights? Listen to Thane’s podcast here: https://stennerwealthpartners.com/bnnbloombergpodcasts.

Advertising feature produced by Globe Content Studio with Stenner Wealth Partners+ of Canaccord Genuity. The Globe’s editorial department was not involved.