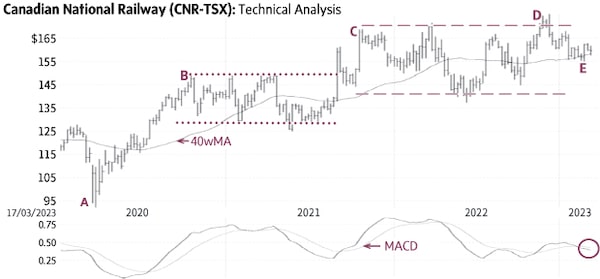

Canadian National Railway rallied from $92.01 to $149.11 in 2020 (A-B), stayed in a horizontal trading range mostly between $130 and $150 (dotted lines) and, after a rise to $168.66 in 2021 (C), settled in another range mostly between $140 and $170 (dashed lines).

The recent move above this range suggests a breakout and the start of an uptrend toward higher targets (D) ; a sustained rise above $172 would confirm it.

CNR pulled back toward support near $155 recently, for a good entry level (E). A rise above $163-164 would suggest the stock is ready to resume the uptrend. Only a sustained decline below $155 would cancel the current upside potential.

A rise above $172 would signal Point & Figure targets of $195 and $210. The large trading ranges (dotted and dashed lines) support potentially higher targets.

stock

Monica Rizk is the Senior Technical Analyst of the Phases & Cycles publication (www.capitalightresearch.com). Chart source: www.decisionplus.com

Be smart with your money. Get the latest investing insights delivered right to your inbox three times a week, with the Globe Investor newsletter. Sign up today.

Monica Rizk

Monica Rizk