The Reasons Under $70 per Barrel is a Bargain for Crude Oil

In December 2022, the continuous NYMEX crude oil futures contract established a significant technical support level when the price fell to $70.08 per barrel. In a February 21 Barchart article, I pointed out that the U.S. Strategic Petroleum Reserve was at its lowest level since December 1983. On March 20, it remained at the 371.6-million-barrel level, unchanged over the past weeks.

Meanwhile, nearby NYMEX WTI crude oil prices have declined to the $70 level, with the U.S. administration waiting to replace its SPR. While the price extended below $70 to the mid-$60s, the odds favor a medium-term floor around the current price.

The ProShares Ultra Bloomberg Crude Oil 2X ETF product (UCO) is a short-term leveraged bullish tool that could enhance results if crude oil is at a bottom.

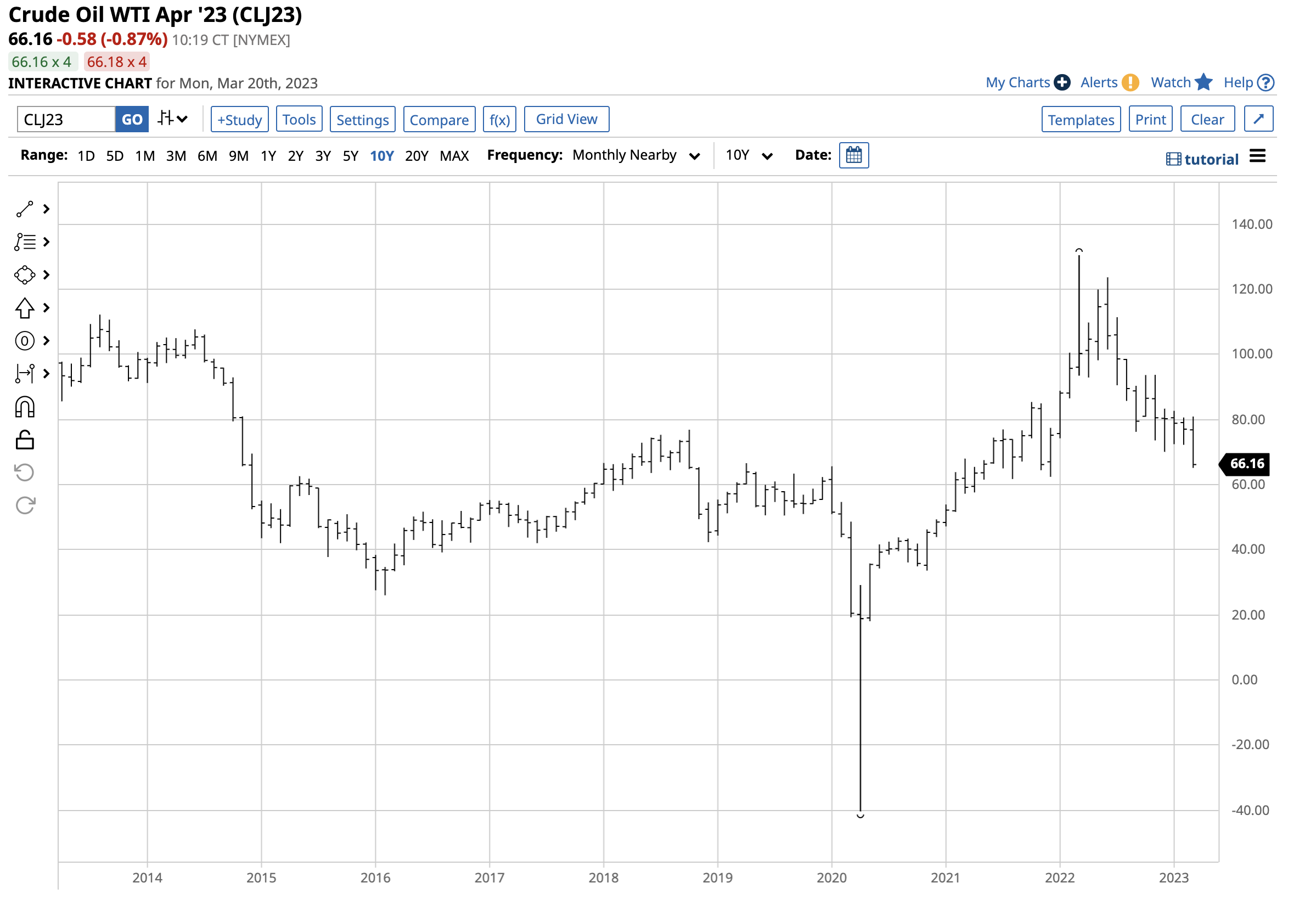

Crude oil falls through the floor level

On March 15, 2023, the nearby NYMEX crude oil futures contract fell through the December 2022 $70.08 low and technical support level.

The continuous contract highlights the support breach that took the April contract to a $64.12 low on March 20. Crude oil fell after U.S. bank failures and UBS’s takeover of troubled Credit Suisse, a leading European financial institution, and the energy commodity fell to its lowest price since December 2021.

Markets can extend on the up and downside

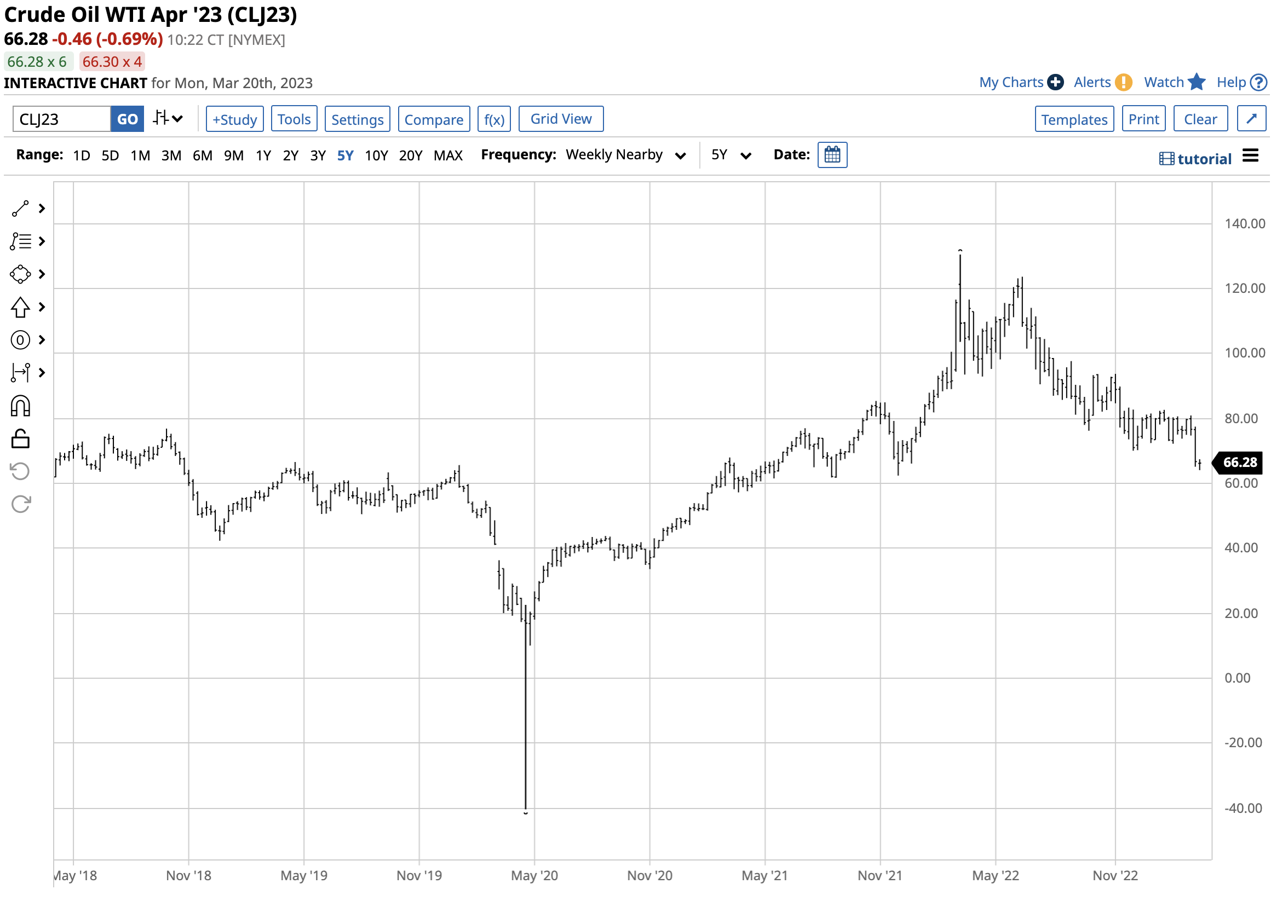

Commodity futures can be highly volatile and often extend to prices that defy supply and demand fundamentals on the up and downside.

The five-year chart highlights nearby NYMEX crude oil’s plunge to negative $40.32 in April 2020 and the rally to a $130.50 per barrel high in March 2022. The low occurred as those holding long positions had to sell at any price as storage capacity disappeared in April 2020. The highest price since 2008 was because Russia invaded of Ukraine, causing supply worldwide concerns.

The price action that followed the 2020 low and 2022 high demonstrated that the energy commodity overextended its price moves on the downside and the upside. Given crude oil’s current fundamentals, the move below $70 per barrel could be a buying opportunity.

The odds favor that oil is in the buy zone

The following factors favor higher crude oil prices and recovery from below the $70 per barrel level on the nearby NYMEX futures contract:

- In 2022, the Biden administration sold over 200 million crude oil barrels from the U.S. Strategic Petroleum Reserves to stem the high prices. The average sale is around the $96 per barrel level, and the administration had stated it would repurchase those barrels at the $70 per barrel level or lower. The U.S. could be a significant buyer at the current price level, putting upward pressure on prices.

- The oil market is now entering the spring and summer driving season, where gasoline demand tends to rise. As drivers put more miles on their cars, gasoline usage increases, and crude oil is the primary ingredient in the fuel.

- China is emerging from its COVID-19 lockdowns, and the world’s most populous country and second-leading economy will likely consume more crude oil over the coming months. Increasing Chinese demand puts upside pressure on worldwide prices.

- OPEC is now the dominant force in the oil market, and the cartel’s mission is fundamental balance at the highest possible price. U.S. energy executives see slower future shale growth, putting OPEC “back in control of the oil market.”

As the war in Ukraine continues and Russia is the most powerful OPEC non-member, the cartel will likely follow production policies that lift the price over the coming months. The bifurcation of the world’s nuclear powers means Russia will likely continue to use crude oil as an economic weapon against “unfriendly” countries supporting Ukraine. Moreover, the Russians need oil revenues to continue funding their war effort.

UCO is a leveraged ETF

The most direct route for a risk position in crude oil is via the WTI futures on the CME’s NYMEX division or the Brent futures on the Intercontinental Exchange. The U.S. Oil Fund (USO) and the U.S. Brent Oil Fund (BNO) ETFs track the short-term WTI and Brent prices. The Ultra Bloomberg Crude Oil 2X ETF product (UCO) is a short-term tool, providing double leverage for WTI crude oil.

At $21.50 on March 20, UCO had $578.836 million in assets under management. UCO trades an average of over 3.8 million shares daily and charges a 0.95% management fee.

The last significant short-term rally in April WTI crude oil futures took the price from $73.80 on February 22 to $80.94 on March 7, a 9.67% rise.

The chart illustrates UCO rose from $25.72 to $30.05 per share over the same period, a 16.84% increase. UCO only trades during hours when the U.S. stock market operates, and crude oil trades around the clock. Therefore, UCO can miss highs or lows during European or Asian trading hours.

Leverage requires time, and price stops

Leverage can enhance trading results, but it comes at a price. Products like UCO that magnify upside moves do the same on the downside. Meanwhile, time decay erodes the ETFs’ value, when crude oil moves into a narrow trading range, resulting in losses.

When trading with leveraged ETF or ETN products, price and time stops are necessary to protect capital. UCO and other leveraged tools are useful but come with additional risks that need careful attention.

I believe crude oil fell to the buy zone last week, but picking bottoms or tops is always a dangerous game, as we learned in April 2020 when the WTI oil market fell below zero for the first time, or in March 2022 when it rose to over $130 per barrel for the first time since 2008. While the odds favor the upside, the risk of another extension that defies the fundamentals is always possible.

More Energy News from Barchart

- Nat-Gas Prices Sink on the Outlook for Milder U.S. Temps

- Crude Oil Prices Retreat on Concern Bank Turmoil Will Spark Recession

- Crude Prices Slump on Concern Bank Turmoil Will Spark Recession

- Nat-Gas Prices Climb on Forecasts for Colder U.S. Weather

On the date of publication, Andrew Hecht did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.