Life Time (NYSE:LTH) Surprises With Q1 Sales, Full-Year Sales Guidance Is Optimistic

Premium fitness club Life Time (NYSE:LTH) reported Q1 CY2024 results topping analysts' expectations, with revenue up 16.8% year on year to $596.7 million. The company's full-year revenue guidance of $2.52 billion at the midpoint also came in 1.4% above analysts' estimates. It made a non-GAAP profit of $0.15 per share, improving from its profit of $0.11 per share in the same quarter last year.

Is now the time to buy Life Time? Find out by accessing our full research report, it's free.

Life Time (LTH) Q1 CY2024 Highlights:

- Revenue: $596.7 million vs analyst estimates of $588.5 million (1.4% beat)

- Adjusted EBITDA: $146 million vs analyst estimates of $144 million (1.1% beat)

- EPS (non-GAAP): $0.15 vs analyst expectations of $0.15 (in line)

- The company lifted its revenue guidance for the full year from $2.48 billion to $2.52 billion at the midpoint, a 1.4% increase (above analyst estimates of $2.48 billion)

- The company lifted its adjusted guidance for the full year from $603 million to $611 million at the midpoint, a 1.3% increase (above analyst estimates of $605 million)

- Free Cash Flow was -$66.39 million compared to -$36.05 million in the previous quarter

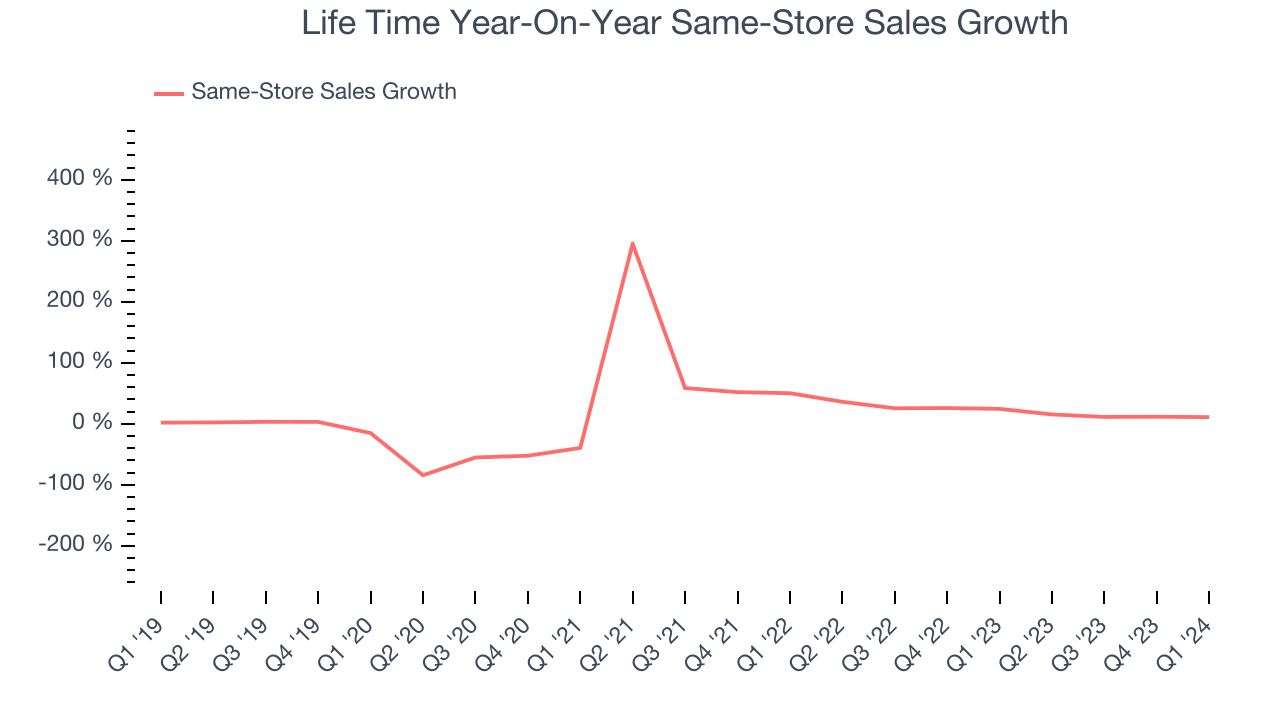

- Same-Store Sales were up 11.1% year on year

- Market Capitalization: $2.69 billion

With over 150 locations and gyms that include saunas and steam rooms, Life Time (NYSE:LTH) is an upscale fitness club emphasizing holistic well-being and fitness.

Leisure Facilities

Leisure facilities companies often sell experiences rather than tangible products, and in the last decade-plus, consumers have slowly shifted their spending from "things" to "experiences". Leisure facilities seek to benefit but must innovate to do so because of the industry's high competition and capital intensity.

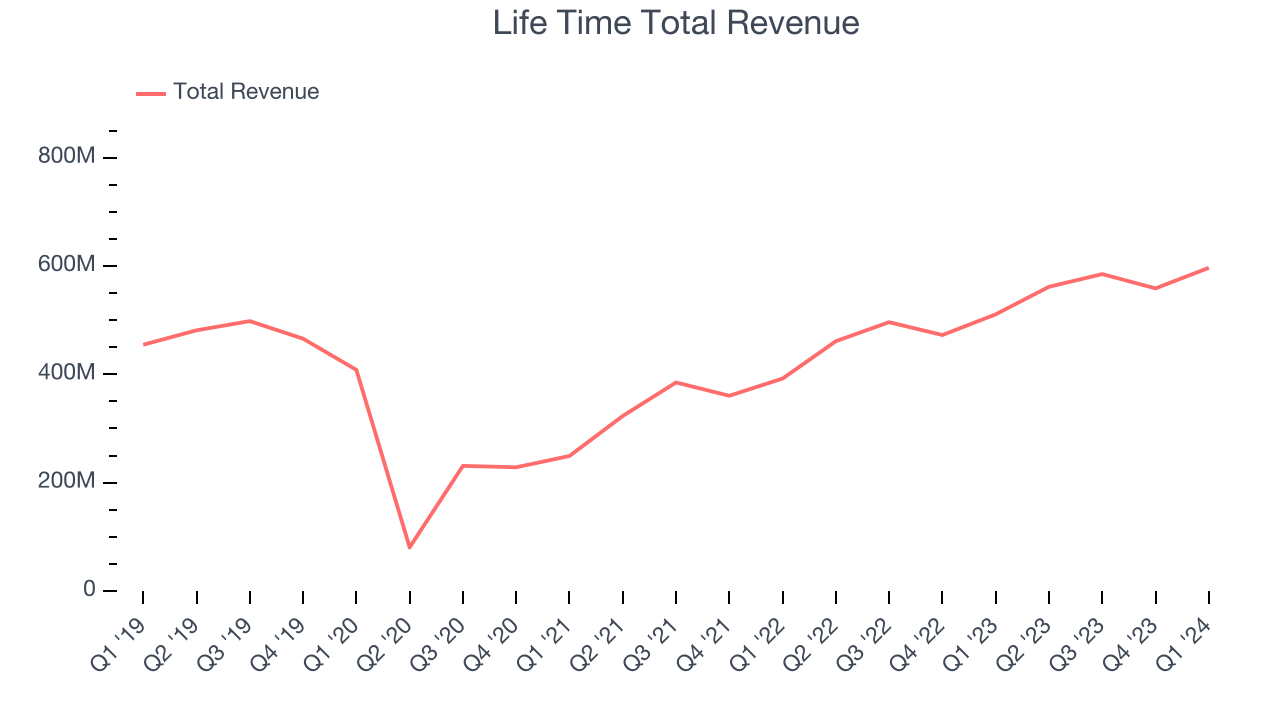

Sales Growth

A company’s long-term performance can give signals about its business quality. Even a bad business can shine for one or two quarters, but a top-tier one may grow for years. Life Time's annualized revenue growth rate of 5.6% over the last four years was weak for a consumer discretionary business.  Within consumer discretionary, product cycles are short and revenue can be hit-driven due to rapidly changing trends. That's why we also follow short-term performance. Life Time's annualized revenue growth of 25.5% over the last two years is above its four-year trend, suggesting some bright spots.

Within consumer discretionary, product cycles are short and revenue can be hit-driven due to rapidly changing trends. That's why we also follow short-term performance. Life Time's annualized revenue growth of 25.5% over the last two years is above its four-year trend, suggesting some bright spots.

We can dig even further into the company's revenue dynamics by analyzing its same-store sales, which show how much revenue its established locations generate. Over the last two years, Life Time's same-store sales averaged 20.3% year-on-year growth. Because this number is lower than its revenue growth, we can see the opening of new locations is boosting the company's top-line performance.

This quarter, Life Time reported robust year-on-year revenue growth of 16.8%, and its $596.7 million of revenue exceeded Wall Street's estimates by 1.4%. Looking ahead, Wall Street expects sales to grow 10.4% over the next 12 months, a deceleration from this quarter.

Today’s young investors won’t have read the timeless lessons in Gorilla Game: Picking Winners In High Technology because it was written more than 20 years ago when Microsoft and Apple were first establishing their supremacy. But if we apply the same principles, then enterprise software stocks leveraging their own generative AI capabilities may well be the Gorillas of the future. So, in that spirit, we are excited to present our Special Free Report on a profitable, fast-growing enterprise software stock that is already riding the automation wave and looking to catch the generative AI next.

Cash Is King

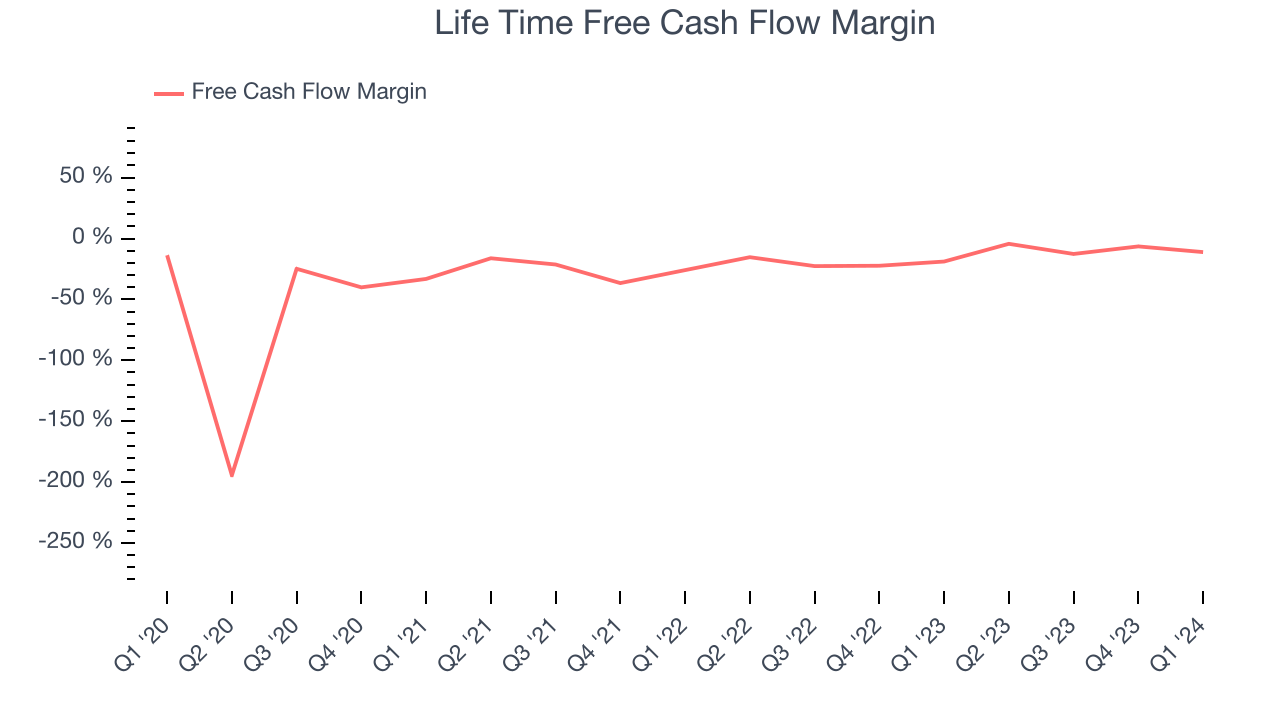

If you've followed StockStory for a while, you know we emphasize free cash flow. Why, you ask? We believe that in the end, cash is king, and you can't use accounting profits to pay the bills.

Over the last two years, Life Time's demanding reinvestments to stay relevant with consumers have drained company resources. Its free cash flow margin has been among the worst in the consumer discretionary sector, averaging negative 13.8%.

Life Time burned through $66.39 million of cash in Q1, equivalent to a negative 11.1% margin, increasing its cash burn by 31.2% year on year.

Key Takeaways from Life Time's Q1 Results

This was one of those 'beat and raise' quarters that the market cheers. The company exceeded expectations for revenue and adjusted EBITDA and raised its full year guidance for both metrics, showing that the demand environment is now stronger than what Life Time saw just about three months ago when it gave its previous guidance. The stock is flat after reporting and currently trades at $13.66 per share.

So should you invest in Life Time right now? When making that decision, it's important to consider its valuation, business qualities, as well as what has happened in the latest quarter. We cover that in our actionable full research report which you can read here, it's free.