Dow Futures Mini(YMU18)CBOT

Mohawk Industries (NYSE:MHK) Beats Q1 Sales Targets

Flooring manufacturer Mohawk Industries (NYSE:MHK) announced better-than-expected results in Q1 CY2024, with revenue down 4.5% year on year to $2.68 billion. It made a non-GAAP profit of $1.86 per share, improving from its profit of $1.75 per share in the same quarter last year.

Is now the time to buy Mohawk Industries? Find out by accessing our full research report, it's free.

Mohawk Industries (MHK) Q1 CY2024 Highlights:

- Revenue: $2.68 billion vs analyst estimates of $2.64 billion (1.4% beat)

- EPS (non-GAAP): $1.86 vs analyst estimates of $1.68 (11% beat)

- Gross Margin (GAAP): 24.2%, up from 24% in the same quarter last year

- Free Cash Flow of $96.9 million, up 73.2% from the previous quarter

- Market Capitalization: $7.11 billion

Commenting on the Company’s first quarter results, Chairman and CEO Jeff Lorberbaum stated, “Though economic headwinds are impacting industry sales, margins and mix, our first quarter results reflected the positive effect of actions we are taking to enhance our performance. Our earnings per share rose year over year as a result of restructuring, productivity initiatives and benefits from lower cost raw materials and energy, partially offset by weaker pricing and mix.

Established in 1878, Mohawk Industries (NYSE:MHK) is a leading producer of floor-covering products for both residential and commercial applications.

Home Furnishings

A healthy housing market is good for furniture demand as more consumers are buying, renting, moving, and renovating. On the other hand, periods of economic weakness or high interest rates discourage home sales and can squelch demand. In addition, home furnishing companies must contend with shifting consumer preferences such as the growing propensity to buy goods online, including big things like mattresses and sofas that were once thought to be immune from e-commerce competition.

Sales Growth

Examining a company's long-term performance can provide clues about its business quality. Any business can put up a good quarter or two, but the best consistently grow over the long haul. Mohawk Industries's annualized revenue growth rate of 1.9% over the last five years was weak for a consumer discretionary business.  Within consumer discretionary, product cycles are short and revenue can be hit-driven due to rapidly changing trends. That's why we also follow short-term performance. Mohawk Industries's recent history shows a reversal from its already weak five-year trend as its revenue has shown annualized declines of 2.4% over the last two years.

Within consumer discretionary, product cycles are short and revenue can be hit-driven due to rapidly changing trends. That's why we also follow short-term performance. Mohawk Industries's recent history shows a reversal from its already weak five-year trend as its revenue has shown annualized declines of 2.4% over the last two years.

This quarter, Mohawk Industries's revenue fell 4.5% year on year to $2.68 billion but beat Wall Street's estimates by 1.4%. Looking ahead, Wall Street expects revenue to remain flat over the next 12 months.

Today’s young investors won’t have read the timeless lessons in Gorilla Game: Picking Winners In High Technology because it was written more than 20 years ago when Microsoft and Apple were first establishing their supremacy. But if we apply the same principles, then enterprise software stocks leveraging their own generative AI capabilities may well be the Gorillas of the future. So, in that spirit, we are excited to present our Special Free Report on a profitable, fast-growing enterprise software stock that is already riding the automation wave and looking to catch the generative AI next.

Cash Is King

Although earnings are undoubtedly valuable for assessing company performance, we believe cash is king because you can't use accounting profits to pay the bills.

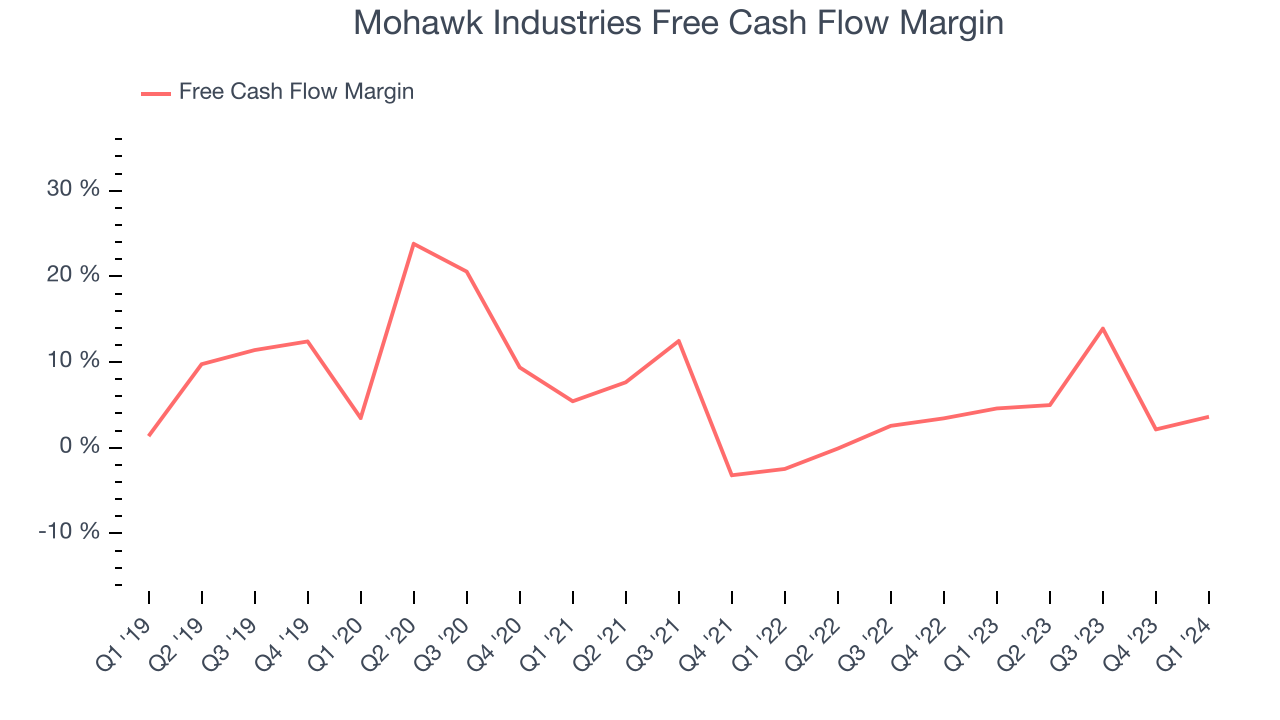

Over the last two years, Mohawk Industries has shown mediocre cash profitability, putting it in a pinch as it gives the company limited opportunities to reinvest, pay down debt, or return capital to shareholders. Its free cash flow margin has averaged 4.3%, subpar for a consumer discretionary business.

Mohawk Industries's free cash flow came in at $96.9 million in Q1, equivalent to a 3.6% margin and down 24.8% year on year. Over the next year, analysts predict Mohawk Industries's cash profitability will improve. Their consensus estimates imply its LTM free cash flow margin of 6.2% will increase to 7.3%.

Key Takeaways from Mohawk Industries's Q1 Results

It was good to see Mohawk Industries beat analysts' revenue and adjusted EPS expectations this quarter. On the other hand, its free cash flow and operating margin missed Wall Street's estimates. Management didn't provide any guidance but noted macroeconomic weakness. Specifically, the demand for residential remodeling is falling as inflation is suppressing discretionary spending. Overall, we think this was still a mixed quarter, and the company's commentary makes us uneasy. The stock is flat after reporting and currently trades at $110.27 per share.

So should you invest in Mohawk Industries right now? When making that decision, it's important to consider its valuation, business qualities, as well as what has happened in the latest quarter. We cover that in our actionable full research report which you can read here, it's free.