Peruvian Nuevo Sol/U.S. Dollar(PENUSD)FOREX

Rates & Commodities

Typically, rising U.S. interest rates weigh on raw material prices for two reasons. Higher rates increase the cost of carrying inventories, causing consumers to avoid stockpiling by purchasing requirements hand-to-mouth. Since the dollar is the world’s reserve currency and the benchmark pricing mechanism for most commodities, a rising dollar causing commodity prices to increase in other currency terms causes global requirements to decline because of the price elasticity of demand. Commodities are global assets and essentials highly sensitive to currency and interest rate markets.

Over the past year, the rise in rates and the dollar’s value has been explosive. The trend is always your best friend in markets, and it remains higher for the dollar and lower for bonds in March 2023, which threatens to push commodity prices lower. While that is a commonsense approach based on historical price action, the current environment includes atypical variables.

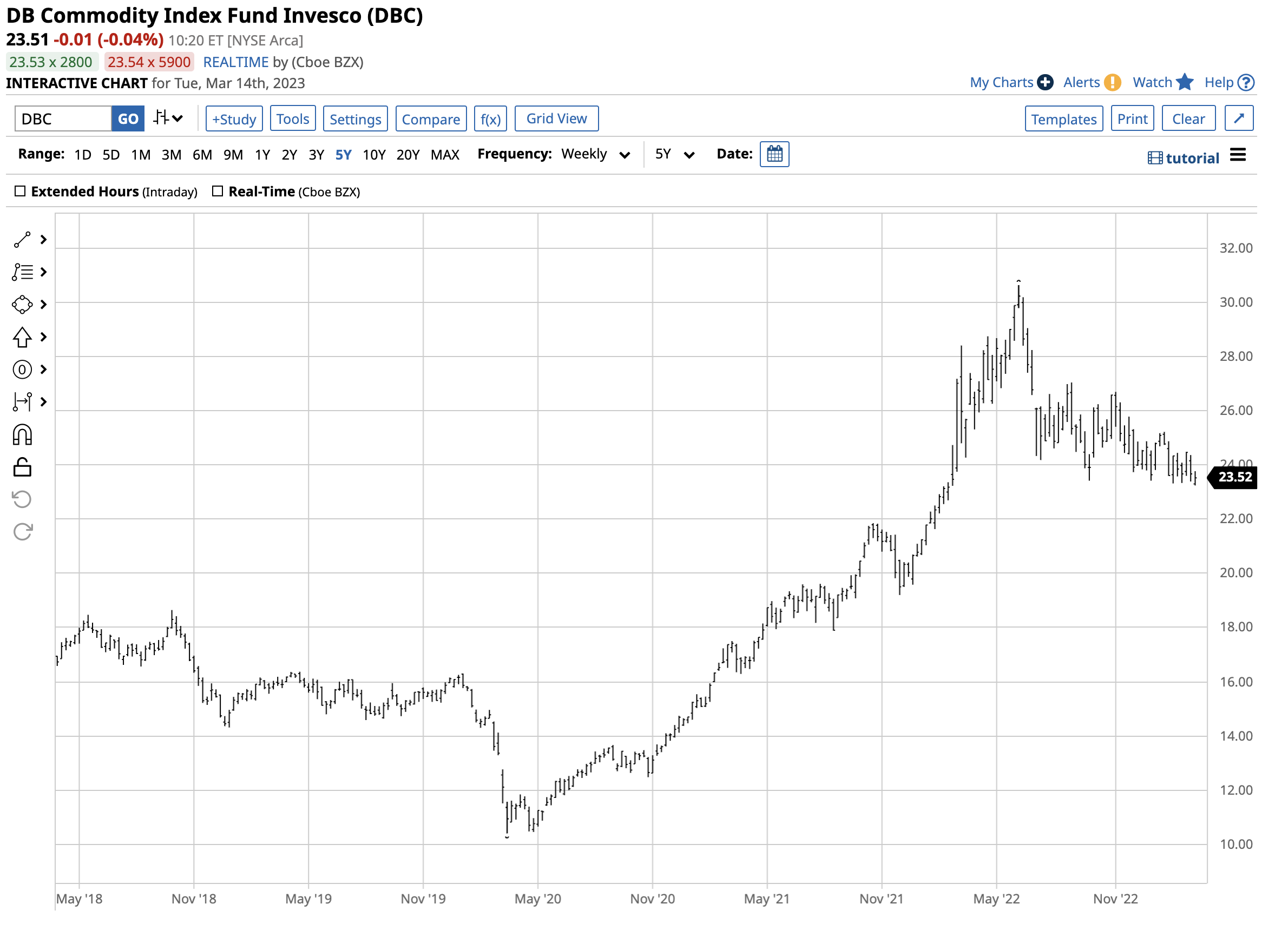

The Invesco DB Commodity Fund (DBC) is a liquid diversified commodity investment tool weighted to energy.

U.S. Rates have exploded over the past year

Over the past year, U.S. short-term interest rates increased from 0.125% to 4.625%, with significant consequences for individuals and businesses. The Fed’s quantitative tightening program at $95 billion monthly has pushed debt security rates for deferred maturity higher.

The bearish trend in the iShares 20+ Year Treasury Bond ETF (TLT) illustrates the trajectory of interest rates that rise when bonds decline.

A conventional fixed-rate 30-year mortgage moved from under 3% in late 2021 to over 7% in March 2023. A borrower now faces an over $1,300 higher monthly mortgage payment on a $400,000 loan. Rising rates have also put upward pressure on consumer goods and essentials.

The recent failures of Silvergate Capital, Signature Bank, and Silicon Valley Bank sent shockwaves through markets.

Many startup tech companies have depended on Silicon Valley Bank for funding. The outflow of deposits forced both to sell assets at a loss. Banks invest in U.S. government debt securities that are safe assets if held to maturity. However, rising interest rates have caused them to lose mark-to-market value, and sales before maturity result in losses. The bottom line is the failure of two financial institutions threatens other banks with systemic risks. SVB’s failure is the second biggest of all time; with over $200 billion in assets, it was second only to Washington Mutual’s bankruptcy.

When it comes to commodities, rising rates increase production costs and the cost of carrying inventories. The trajectory of financing costs threatens output and demand as consumers shun stockpiling and purchase requirements hand-to-mouth. An increasing interest rate environment tends to be bearish for raw material prices.

The dollar index has been in a bull market since early 2021

The U.S. dollar index measures the U.S. currency against other world reserve currencies, with the most significant 57.6% exposure to the euro. The index’s composition also includes the Japanese yen, British pound, Canadian dollar, Swedish krona, and Swiss franc.

The dollar index soared in 2022 for two reasons. Since interest rates are a primary factor determining the path of least resistance of one currency versus another, increasing U.S. rates put upward pressure on the U.S. dollar. Meanwhile, the first major war on European soil and Western Europe’s doorstep put downward pressure on the euro, pushing the euro below parity against the dollar for the first time since 2002.

The long-term dollar index chart highlights the May 2022 break above the March 2020 103.96 high and critical technical resistance level. The index exploded to 114.745 in September 2022 before pulling back to 100.68 in February. At the 103.360 level, the index is just bleow the 104-pivot point on March 14.

Since the U.S. dollar is the world’s reserve currency, it is the pricing mechanism for most commodities. Historically, a stronger dollar tends to weigh on commodity prices as it causes them to rise in other currency terms. The elasticity of demand causes consumers to purchase less at higher prices. Therefore, raw material prices tend to fall when the dollar rises.

The chart shows the dollar index rose 28.7% from the January 2021 89.165 low to the September 2022 114.745 two-decade peak. The rise in the dollar and increasing interest rates should be a toxic bearish cocktail for commodity prices, but the last time a composite of the 29 most liquidly-trades commodity futures fell was in 2018. Over the past years, the composite turned in the following results:

- 2022- +3.83%

- 2021- +26.79%

- 2020- +9.89%

- 2019- +10.98%

- 2018- -6.82%

The diversified composite includes six sectors, precious metals, base metals, energy, grains, animal proteins, and soft commodities. While the dollar and rates have been bearish, commodity prices have increased as rising inflationary pressure has trumped the economic landscape.

The Fed is committed, but the record is dubious

The Fed and the U.S. government have yet to take responsibility for planting inflationary seeds in 2020. As the pandemic gripped the world in early 2020, the Fed unleashed a liquidity tidal wave and the government a stimulus tsunami. In late 2020 and most of 2021, Fed and government economists blamed rising prices on “transitory” pandemic-related supply chain issues. The bottom line is the central bank waited far too long to tighten credit, with the first Fed Funds Rate hike coming in March 2022 and quantitative tightening following liftoff from a zero percent rate environment.

In 2022 and early 2023, the now hawkish Fed is hell-bent on pushing inflation to its 2% target rate, an arbitrary level central bank economists believe is appropriate for a balanced economy. Economic reactions tend to lag monetary policy shifts. Still, the dramatic trajectory of rate hikes and quantitative tightening could be coming home to roost with the latest bank failures and potential for systemic risks. Moreover, monetary policy tends to impact demand. The ongoing war in Ukraine and the bifurcation between the world’s nuclear powers are impacting the supply-side, particularly in food and energy prices. The central banks like to exclude food and energy because of the volatility in those markets, but food and energy are staples that impact all prices and economic trends. Ukraine and Russia are Europe’s breadbasket, and Russia is an influential producer and exporter of energy and many other raw materials. Therefore, a hawkish monetary policy may not be enough to push inflation lower in the current environment.

The Fed and regulators are reactive, relying on data points and market events, and they tend to be behind real-time economic trends. We may look back at March 2023 as 2021, when inflation was rising. The trajectory of interest rate hikes could be a shock to the system that caused the recent bank failures, push the economy into a recession, stagflation, or worse.

The dollar index is a mirage in the current environment

The dollar index was useful when the U.S. dollar dominated world trade. Meanwhile, the “no-limits” alliance between China and Russia and the U.S. and Western Europe’s support for Ukraine have caused a bifurcation of the world’s nuclear powers.

Markets reflect the economic and geopolitical landscapes. In March 2023, China, the world’s second-leading economy, and Russia, a significant commodity-producing country and influential non-member of the international oil cartel, have been moving towards non-dollar assets for cross-border payments and other transactions. As the dollar’s global position declines, the value of the dollar index recedes. Dramatic moves in the dollar index have become less critical as countries shift to other currencies or financial assets. Over the past years, central banks worldwide have increased their gold reserves, an alternative to the U.S. currency and a challenge to the reserve currency status.

The decline of the dollar’s role in the worldwide economy makes commodity prices less sensitive to the U.S. currency.

The four reasons commodities could rally with rising rates and a strong U.S. dollar

At least four factors could support commodity prices even if U.S. rates continue to rise and the dollar index moves higher over the coming months and years:

- Geopolitics- The bifurcation of the world’s nuclear powers will impact trade and create barriers. We will likely see commodity surpluses develop in some regions and shortages in others, leading to increased price volatility.

- Inflation- The highest inflation in decades increases production costs. Rising interest rates and credit tightening make less capital available for new commodity production projects, creating shortages.

- U.S. domestic economic issues- The U.S. national debt is $31.5 trillion, and the current short-term interest rate environment causes a $1.5 trillion annual price tag to service that debt. Congress wants to negotiate terms for increasing the debt ceiling, but the administration has refused. If the two sides cannot agree, the U.S. could default on its obligations, causing havoc in markets across all asset classes. Meanwhile, the latest bank failures and rising potential for systemic risks could lead the central bank to curb its enthusiasm for rate hikes and adjust its inflationary target to a more realistic level in the current environment. A pause in rate hikes or any moves to shift monetary policy to a more dovish path could cause explosive rallies in raw material markets.

- Demographics- the worldwide population is now at eight billion. China is the world’s most populous country and second-leading economy. Population growth puts upward pressure on the demand side of many commodities. China has spent decades securing commodity flows, and the world will need to compete for finite supplies in an environment of ever-increasing demand. The war and geopolitical tensions only exacerbate the tight commodity balance sheets in metals, agricultural products, energy, and financial commodities.

The bottom line is higher U.S. interest rates that pushed the U.S. dollar higher may have a different impact than in the past. The geopolitical landscape has changed, making historical assumptions a leap of faith.

The Invesco DB Commodity Fund (DBC) is a liquid commodity ETF with a weighting towards traditional energy products. At $23.51 on March 14, DBC had $2.408 billion in assets under management. DBC trades an average of over 1.270 million shares daily and charges a 0.87% management fee.

The chart highlights DBC’s rally from the March 2020 low to the June 2022 high. DBC corrected as even the most aggressive bull markets rarely move in straight lines, and a strong dollar and rising rates have weighed on commodity prices. However, DBC has been consolidating between $23 and $27 per share since July 2022. While DBC sits near the bottom of its range, the geopolitical landscape favors higher prices over the coming months and years. A short-term spike lower could present a golden buying opportunity for the diversified commodity ETF product.

More Forex News from Barchart

- Dollar Falls Back on Reduced Rate Hike Expectations

- Stocks Higher as a Plunge in Bond Yields Supports the Broader Market

- Dollar Retreats on Turmoil in the U.S. Banking Sector

- Stocks Weighed Down by Bank Jitters

On the date of publication, Andrew Hecht did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.