DOW Composite [Test](COMP)INDEX/DJ

Dutch Bros (NYSE:BROS) Reports Strong Q1, Stock Soars

Coffee chain Dutch Bros (NYSE:BROS) beat analysts' expectations in Q1 CY2024, with revenue up 39.5% year on year to $275.1 million. The company expects the full year's revenue to be around $1.21 billion, in line with analysts' estimates. It made a non-GAAP profit of $0.09 per share, improving from its loss of $0.02 per share in the same quarter last year.

Is now the time to buy Dutch Bros? Find out by accessing our full research report, it's free.

Dutch Bros (BROS) Q1 CY2024 Highlights:

- Revenue: $275.1 million vs analyst estimates of $255.6 million (7.6% beat)

- Adjusted EBITDA: $52.5 million vs analyst estimates of $31.7 million (large beat)

- EPS (non-GAAP): $0.09 vs analyst estimates of $0.02 ($0.07 beat)

- The company lifted its revenue guidance for the full year from $1.20 billion to $1.21 billion at the midpoint, a 0.8% increase (also lifted its adjusted EBITDA guidance for the full year)

- Gross Margin (GAAP): 26.1%, up from 23.2% in the same quarter last year

- Same-Store Sales were up 10% year on year

- Store Locations: 876 at quarter end, increasing by 160 over the last 12 months

- Market Capitalization: $2.64 billion

Christine Barone, Chief Executive Officer and President of Dutch Bros, stated, “We are pleased with our performance in the first quarter - we delivered exceptional results and witnessed the momentum we saw leaving 2023 continue into Q1. Headlining Q1 performance was 10.0% system same shop sales growth, the strongest single quarter since Q4 2021, and 39% year-over-year growth in revenue to $275 million. These outstanding top-line metrics were underpinned by excellent margin flow through. Given this strong start to 2024, and despite a continued volatile economic backdrop for the consumer, we are comfortable raising our guidance for the year.”

Started in 1992 by two brothers as a single pushcart, Dutch Bros (NYSE:BROS) is a dynamic coffee chain that’s captured the hearts of coffee enthusiasts across the United States.

Traditional Fast Food

Traditional fast-food restaurants are renowned for their speed and convenience, boasting menus filled with familiar and budget-friendly items. Their reputations for on-the-go consumption make them favored destinations for individuals and families needing a quick meal. This class of restaurants, however, is fighting the perception that their meals are unhealthy and made with inferior ingredients, a battle that's especially relevant today given the consumers increasing focus on health and wellness.

Sales Growth

Dutch Bros is larger than most restaurant chains and benefits from economies of scale, giving it an edge over its smaller competitors.

As you can see below, the company's annualized revenue growth rate of 42.3% over the last four years (we compare to 2019 to normalize for COVID-19 impacts) was incredible as it added more dining locations and increased sales at existing, established restaurants.

This quarter, Dutch Bros reported wonderful year-on-year revenue growth of 39.5%, and its $275.1 million in revenue exceeded Wall Street's estimates by 7.6%. Looking ahead, Wall Street expects sales to grow 21% over the next 12 months, a deceleration from this quarter.

Today’s young investors won’t have read the timeless lessons in Gorilla Game: Picking Winners In High Technology because it was written more than 20 years ago when Microsoft and Apple were first establishing their supremacy. But if we apply the same principles, then enterprise software stocks leveraging their own generative AI capabilities may well be the Gorillas of the future. So, in that spirit, we are excited to present our Special Free Report on a profitable, fast-growing enterprise software stock that is already riding the automation wave and looking to catch the generative AI next.

Same-Store Sales

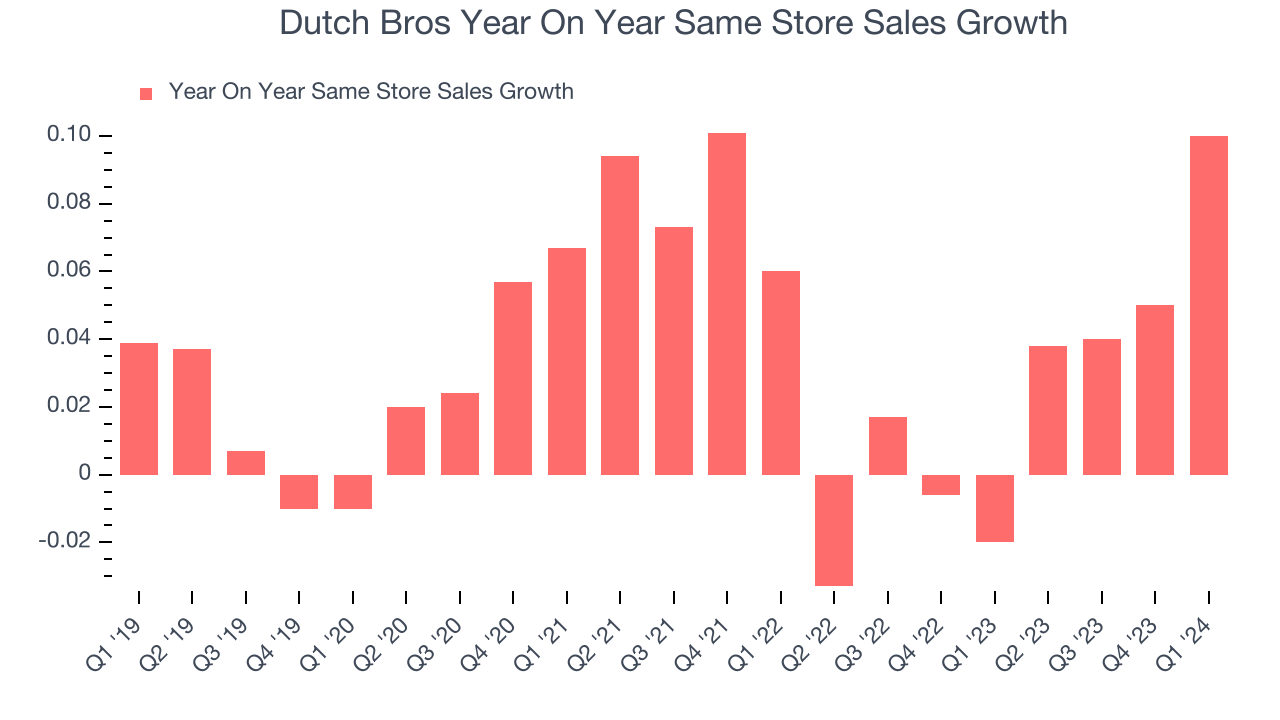

A company's same-store sales growth shows the year-on-year change in sales for its restaurants that have been open for at least a year, give or take. This is a key performance indicator because it measures organic growth and demand.

Dutch Bros's demand within its existing restaurants has been relatively stable over the last eight quarters but fallen behind the broader sector. On average, the company's same-store sales have grown by 2.3% year on year. With positive same-store sales growth amid an increasing number of restaurants, Dutch Bros is reaching more diners and growing sales.

In the latest quarter, Dutch Bros's same-store sales rose 10% year on year. This growth was a well-appreciated turnaround from the 2% year-on-year decline it posted 12 months ago, showing the business is regaining momentum.

Key Takeaways from Dutch Bros's Q1 Results

This was a 'beat and raise' quarter. We were impressed by how significantly Dutch Bros blew past analysts' adjusted EBITDA and EPS expectations this quarter. We were also excited its full year guidance was raised. Zooming out, we think this was an impressive quarter that should delight shareholders. The stock is up 8.7% after reporting and currently trades at $30.9 per share.

Dutch Bros may have had a good quarter, but does that mean you should invest right now? When making that decision, it's important to consider its valuation, business qualities, as well as what has happened in the latest quarter. We cover that in our actionable full research report which you can read here, it's free.