Dow Jones U.S. Index Total Return(DJUT)INDEX/DJ

Health Catalyst (NASDAQ:HCAT) Posts Q1 Sales In Line With Estimates But Quarterly Guidance Underwhelms

Healthcare software provider Health Catalyst (NASDAQ:HCAT) reported results in line with analysts' expectations in Q1 CY2024, with revenue up 1.2% year on year to $74.72 million. On the other hand, the company expects next quarter's revenue to be around $75 million, slightly below analysts' estimates. It made a non-GAAP profit of $0.05 per share, down from its profit of $0.05 per share in the same quarter last year.

Is now the time to buy Health Catalyst? Find out by accessing our full research report, it's free.

Health Catalyst (HCAT) Q1 CY2024 Highlights:

- Revenue: $74.72 million vs analyst estimates of $74.81 million (small miss)

- Adjusted EBITDA: $3.37 million vs analyst estimates of $2.89 million (beat)

- EPS (non-GAAP): $0.05 vs analyst estimates of $0.03 (45.3% beat)

- Revenue Guidance for Q2 CY2024 is $75 million at the midpoint, below analyst estimates of $75.61 million

- The company reconfirmed its revenue guidance for the full year of $308 million at the midpoint (slight miss)

- Gross Margin (GAAP): 48.5%, down from 49% in the same quarter last year

- Free Cash Flow of $7.53 million is up from -$21.92 million in the previous quarter

- Market Capitalization: $392.6 million

“For the first quarter of 2024, I am pleased by our strong financial results, including total revenue of $74.7 million and Adjusted EBITDA of $3.4 million, with these results beating the mid-point of our quarterly guidance on each metric. This financial performance demonstrates our ability to continue to scale our business as we drive toward our long-term profitability goals. We are reiterating our full year 2024 total revenue and Adjusted EBITDA guidance ranges and also reiterating both of our bookings metrics, inclusive of dollar-based retention rate and net new DOS Subscription client additions,” said Dan Burton, CEO of Health Catalyst.

Founded by healthcare professionals Tom Burton and Steve Barlow in 2008, Health Catalyst (NASDAQ:HCAT) provides data and analytics technology to healthcare organizations, enabling them to improve care and lower costs.

Data Analytics

Organizations generate a lot of data that is stored in silos, often in incompatible formats, making it slow and costly to extract actionable insights, which in turn drives demand for modern cloud-based data analysis platforms that can efficiently analyze the siloed data.

Sales Growth

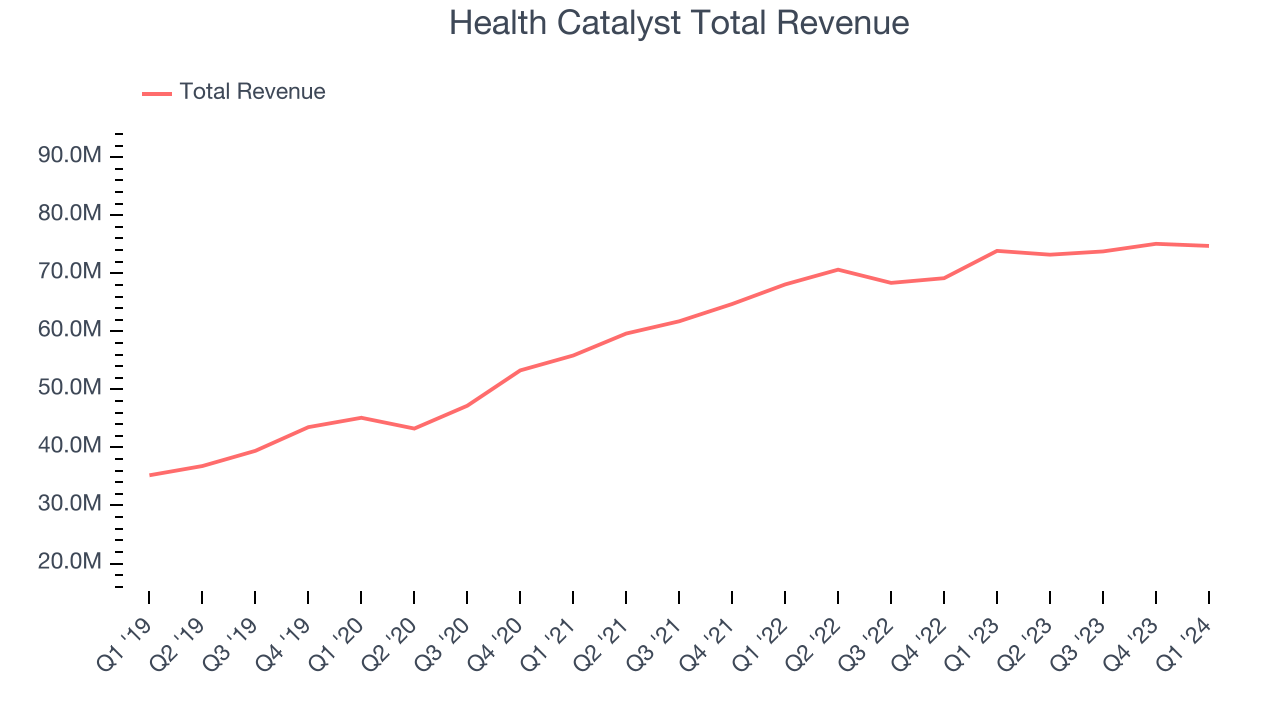

As you can see below, Health Catalyst's revenue growth has been mediocre over the last three years, growing from $55.85 million in Q1 2021 to $74.72 million this quarter.

Health Catalyst's quarterly revenue was only up 1.2% year on year, which might disappoint some shareholders. On top of that, the company's revenue actually decreased by $361,000 in Q1 compared to the $1.31 million increase in Q4 CY2023. While we'd like to see revenue increase each quarter, management is guiding for growth to rebound in the next quarter and a one-off fluctuation is usually not concerning.

Next quarter's guidance suggests that Health Catalyst is expecting revenue to grow 2.4% year on year to $75 million, slowing down from the 3.7% year-on-year increase it recorded in the same quarter last year. Looking ahead, analysts covering the company were expecting sales to grow 6.9% over the next 12 months before the earnings results announcement.

When a company has more cash than it knows what to do with, buying back its own shares can make a lot of sense–as long as the price is right. Luckily, we’ve found one, a low-priced stock that is gushing free cash flow AND buying back shares. Click here to claim your Special Free Report on a fallen angel growth story that is already recovering from a setback.

Cash Is King

If you've followed StockStory for a while, you know that we emphasize free cash flow. Why, you ask? We believe that in the end, cash is king, and you can't use accounting profits to pay the bills. Health Catalyst's free cash flow came in at $7.53 million in Q1, turning positive over the last year.

Health Catalyst has burned through $29.88 million of cash over the last 12 months, resulting in a negative 10.1% free cash flow margin. This low FCF margin stems from Health Catalyst's constant need to reinvest in its business to stay competitive.

Key Takeaways from Health Catalyst's Q1 Results

We were impressed by Health Catalyst's strong gross margin improvement this quarter and its adjusted EBITDA beat. On the other hand, its revenue guidance for next quarter missed analysts' expectations and its full-year revenue guidance slightly missed Wall Street's estimates. Overall, this was a mixed quarter for Health Catalyst. The company is down 1% on the results and currently trades at $6.6 per share.

Health Catalyst may have had a tough quarter, but does that actually create an opportunity to invest right now? When making that decision, it's important to consider its valuation, business qualities, as well as what has happened in the latest quarter. We cover that in our actionable full research report which you can read here, it's free.