KBW Property & Casualty Index(KPX)INDEX/NASDAQ

Palantir (NYSE:PLTR) Beats Q1 Sales Targets But Stock Drops

Data-mining and analytics company Palantir (NYSE:PLTR) reported Q1 CY2024 results exceeding Wall Street analysts' expectations, with revenue up 20.8% year on year to $634.3 million. Guidance for next quarter's revenue was also better than expected at $651 million at the midpoint, 1.2% above analysts' estimates. It made a non-GAAP profit of $0.08 per share, improving from its profit of $0.05 per share in the same quarter last year.

Is now the time to buy Palantir? Find out by accessing our full research report, it's free.

Palantir (PLTR) Q1 CY2024 Highlights:

- Revenue: $634.3 million vs analyst estimates of $617.6 million (2.7% beat)

- Billings: $619.5 million vs analyst estimates of $637.0 million (2.7% miss)

- EPS (non-GAAP): $0.08 vs analyst expectations of $0.08 (in line)

- Revenue Guidance for Q2 CY2024 is $651 million at the midpoint, above analyst estimates of $643.4 million

- The company lifted its revenue guidance for the full year from $2.66 billion to $2.68 billion at the midpoint, a 0.9% increase

- Gross Margin (GAAP): 81.7%, up from 79.5% in the same quarter last year

- Free Cash Flow of $126.9 million, down 58.4% from the previous quarter

- Market Capitalization: $51.96 billion

Started by Peter Thiel after seeing US defence agencies struggle in the aftermath of the 2001 terrorist attacks, Palantir (NYSE:PLTR) offers software as a service platform that helps government agencies and large enterprises use data to make better decisions.

Data Analytics

Organizations generate a lot of data that is stored in silos, often in incompatible formats, making it slow and costly to extract actionable insights, which in turn drives demand for modern cloud-based data analysis platforms that can efficiently analyze the siloed data.

Sales Growth

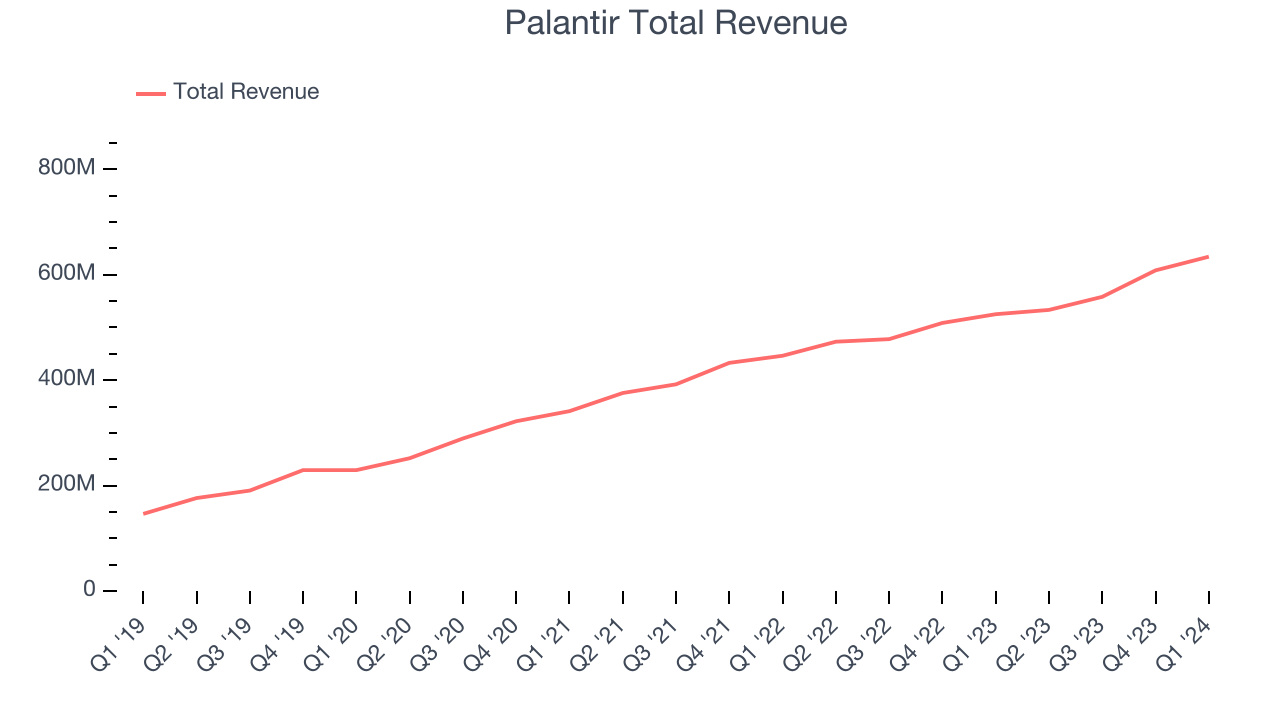

As you can see below, Palantir's revenue growth has been strong over the last three years, growing from $341.2 million in Q1 2021 to $634.3 million this quarter.

This quarter, Palantir's quarterly revenue was once again up a very solid 20.8% year on year. However, its growth did slow down compared to last quarter as the company's revenue increased by just $25.99 million in Q1 compared to $50.19 million in Q4 CY2023. While we'd like to see revenue increase by a greater amount each quarter, a one-off fluctuation is usually not concerning.

Next quarter's guidance suggests that Palantir is expecting revenue to grow 22.1% year on year to $651 million, improving on the 12.7% year-on-year increase it recorded in the same quarter last year. Looking ahead, analysts covering the company were expecting sales to grow 20.5% over the next 12 months before the earnings results announcement.

Today’s young investors won’t have read the timeless lessons in Gorilla Game: Picking Winners In High Technology because it was written more than 20 years ago when Microsoft and Apple were first establishing their supremacy. But if we apply the same principles, then enterprise software stocks leveraging their own generative AI capabilities may well be the Gorillas of the future. So, in that spirit, we are excited to present our Special Free Report on a profitable, fast-growing enterprise software stock that is already riding the automation wave and looking to catch the generative AI next.

Cash Is King

If you've followed StockStory for a while, you know that we emphasize free cash flow. Why, you ask? We believe that in the end, cash is king, and you can't use accounting profits to pay the bills. Palantir's free cash flow came in at $126.9 million in Q1, down 32.8% year on year.

Palantir has generated $668.5 million in free cash flow over the last 12 months, an eye-popping 28.6% of revenue. This robust FCF margin stems from its asset-lite business model, scale advantages, and strong competitive positioning, giving it the option to return capital to shareholders or reinvest in its business while maintaining a healthy cash balance.

Key Takeaways from Palantir's Q1 Results

It was good to see Palantir beat analysts' revenue expectations this quarter. We were also glad next quarter's revenue guidance came in higher than Wall Street's estimates. On the other hand, its billings unfortunately missed analysts' expectations. Overall, the results could have been better. The company is down 6.1% on the results and currently trades at $23.68 per share.

Palantir may have had a tough quarter, but does that actually create an opportunity to invest right now? When making that decision, it's important to consider its valuation, business qualities, as well as what has happened in the latest quarter. We cover that in our actionable full research report which you can read here, it's free.